Why invest in shares?

Put simply, when you have money to invest over a longer period of time (such as 20 years or more), the stock market has historically provided the greatest returns. In other words, investing in shares has paid off best over time. However, there is no guarantee that this will be the case in the future. When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if you have 1,000 in your savings account and the bank pays you 3% interest, at the end of a year you will have about 1,030. As the savings balance grows, many people hope to earn more than the bank pays in interest, so they invest in real estate, stocks, bonds and/or gold.

Historical return on investment

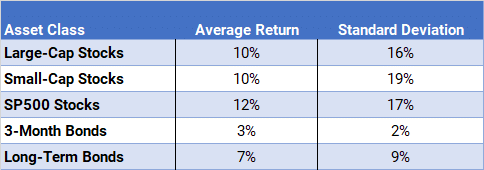

While no one knows for sure what will happen in the future, a look at historical returns shows how these different investments have performed over time. Finally, this chart looks at average returns from 198 to 2018 and shows that the S&P 500 stocks were the best performers, with an average annual return of 12% – beating out both the large-cap stocks in the Dow Jones Industrial Average and the small-cap stocks in the Russell 2000 index.

In this table, you also need to note the Standard Deviation column which measures the variance or volatility of returns. It shows that small cap stocks also have the highest variance. That’s why we say “over time” stocks have the highest returns. If you looked at just one year or even five years, you might not see the same results because stocks are so volatile, but the longer the time period you have to keep the money invested, the better it is to invest in stocks.

In this table, you also need to note the Standard Deviation column which measures the variance or volatility of returns. It shows that small cap stocks also have the highest variance. That’s why we say “over time” stocks have the highest returns. If you looked at just one year or even five years, you might not see the same results because stocks are so volatile, but the longer the time period you have to keep the money invested, the better it is to invest in stocks.

Summary

Simply put, if you want to maximize your personal net worth, if you want to get rich, if you want to become a millionaire, if you want to retire early – you need to start saving and investing TODAY. The earlier you get started, the more time your money has to grow. And the more time it has to grow, the bigger it will be. Understanding how the stock market works and how to invest is so important because it determines how much your net worth will be when you retire. Should you leave your money in your savings account at the bank all your life and earn an average of 3%? Or should you invest it in the stock market and try to earn 11%?

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)