What the US credit rating downgrade means

Fitch Ratings recently lowered its credit rating on US debt to AA+ – one notch below the agency’s highest rating of AAA. The decision by Fitch seems to have more to do with Washington than it does with Wall Street. “The repeated debt limit political standoffs and last-minute resolutions have eroded confidence in Treasury management,” the ratings firm said in a press release.

In a vacuum, the announcement combined with the decline in share prices should raise alarm bells for investors. In historical context, however, this week’s downgrade is less of a big deal than it seems, experts say.

“The average investor shouldn’t worry here,” said Ryan Detrick, market strategist at Carson Group. “This happened in 2011, so it’s not nearly the same shock as it was then.”

Here is everything you need to know about the downgrade.

What is Fitch?

When companies or governments issue bonds, investors turn to three major credit rating agencies – Fitch, Moody’s and Standard & Poor’s – to determine how likely it is that these companies or governments will be able to pay their debts.

Bonds that receive higher ratings from these agencies are considered “investment grade” and are unlikely to default. These bonds usually pay lower interest rates than riskier debt, but are considered much safer. The AAA rating is the best of the best and represents a virtual guarantee that an issuer will never run out of money to pay its debts.

Bonds with ratings below investment grade are called high-yield bonds, junk bonds or junk bonds. In exchange for the increased risk of default, these liabilities offer higher returns to attract investors. US debt is miles away from that territory – Fitch’s downgrade represents a fall from the very top of creditworthiness to a notch below.

Has Fitch done this before?

No, but S&P has. In August 2011, after a period of partisan bickering about raising, the rating agency lowered the US government’s once perfect credit rating. On August 5, the first trading day after the announcement, the S&P 500 fell by almost 7%.

“This time the reaction was much more muted,” says Jon Maier, chief investment officer at Global X ETFs. “The market is mostly shrugging its shoulders.”

It makes sense on at least one front: S&P has not restored the AAA rating that the US relinquished in 2011. In other words, Fitch put its rating in line with where S&P already was.

“In some ways, the S&P downgrade mirrors the current Fitch downgrade,” Sam Millette, interest rate strategist for Commonwealth Financial Network, wrote in a recent commentary. “Both rating agencies cited rising political dysfunction as a primary reason for their downgrades following contentious debt ceiling standoffs. In both cases, the conflicts were resolved, and the federal government did not default.”

So nothing terrible? No standard? No recession?

Although a notch in the US credit rating means Fitch believes it is more likely than before that the US will default, it remains an extremely unlikely scenario, experts say. Even after the downgrade, US government bonds are likely to retain their status among the safest investments in the world, says Detrick.

“There may be 11 countries with higher-rated debt than us, but we still like our chances that we have the world’s reserve currency and favored debt,” he says.

In the case of a recession, a credit downgrade will likely have a slowing effect on the economy, but is not in and of itself enough to tip the economy into recession or push the market into bear territory,” Maier said.

Whether the Fed will be able to slow the economy while avoiding a recession remains to be seen, but downgrade or not, much of this economic data is still strong,” he says. “The GDP figures came in stronger than expected. And some economists say, because consumer and labor markets are strong, this could be more of a “soft landing” scenario.

Small numbers

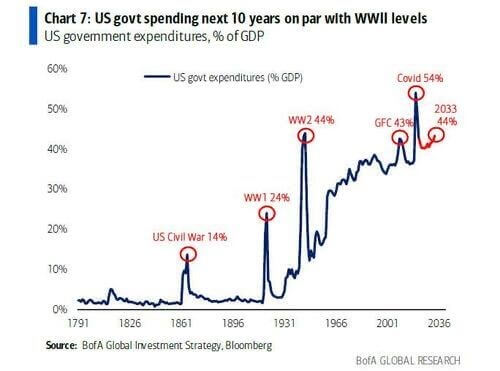

The US now spends 44% of its Gross Domestic Product (GDP) per year, which is the same level as the Second World War. The only time this figure was higher was during COVID-19 when it rose to 54%.

While an additional $1.5 trillion has been added to the debt, tax revenues have increased by less than 3%/year since 2015. So the US has more spending and less revenue than before.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)