What strategies work best for forex trading?

One of the most common questions we get about forex trading is which strategies work best for forex trading? In this article, we take a closer look at some proven strategies for Forex.

Do you feel lost when trying to figure out which Forex trading strategies to use? Will you be a day trader, swing trader, position trader, news trader, scalper or a combination of different forex trading strategies? This can be frustrating, as you have seen traders make money with different currency trading strategies. But when you try, you fail. Don’t worry about it. In today’s post, we share five types of Forex trading strategies that work. We tell you how to find the right strategy for you.

Position trading

Position trading is a long-term trading method where you can trade for weeks or even months. The time frames you trade on are usually daily or weekly.

As a position trader, you mainly rely on fundamental analysis in your trading (such as NFP, GDP, retail sales and so on) to provide a bias. You can also use technical analysis to better control when to buy and sell.

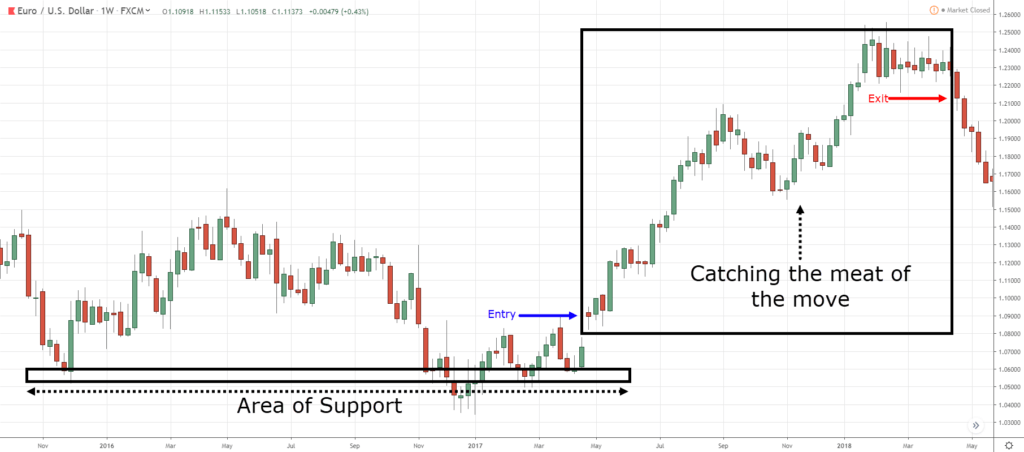

You analyze the fundamentals of the EUR/USD currency pair and determine that it is bullish. But you don’t want to go far at any price. So you wait for the EUR/USD to get to the support line before taking your position. If your analysis is correct, you can get into the beginning of a new trend earlier than anyone else.

For example

Let’s look at the pros and cons of position trading

– No need to spend so much time on your trading because your trades are longer.

– Less stress in your trading as you are not concerned about the short-term price fluctuations

– a favorable risk to reward for your trades (possibly 1 to 5 or more)

The disadvantages

– Requires a strong understanding of the fundamentals that drive the market.

– Need a larger capital base as your stop loss is larger

– May not make a profit every year due to the low number of transactions

There is a trading strategy called Trend Following (similar to position trading). The only difference is that Trend Following is purely a technical approach that does not use any fundamental data.

Swing trading

Swing trading is a medium-term trading strategy where you can keep a position open for days or even weeks. The time frames you trade on are usually one or four hours of data. As a swing trader, your interest is in capturing “a movement” in the market (otherwise known as a swing).

So you are likely to:

– Buying on aid

– Sell on resistance

– Trading on outbreaks

– Trading on downturns

– Trade when the currency pair breaks through the moving average.

Therefore, it is important to learn technical concepts such as support and resistance, candlestick patterns and moving averages.

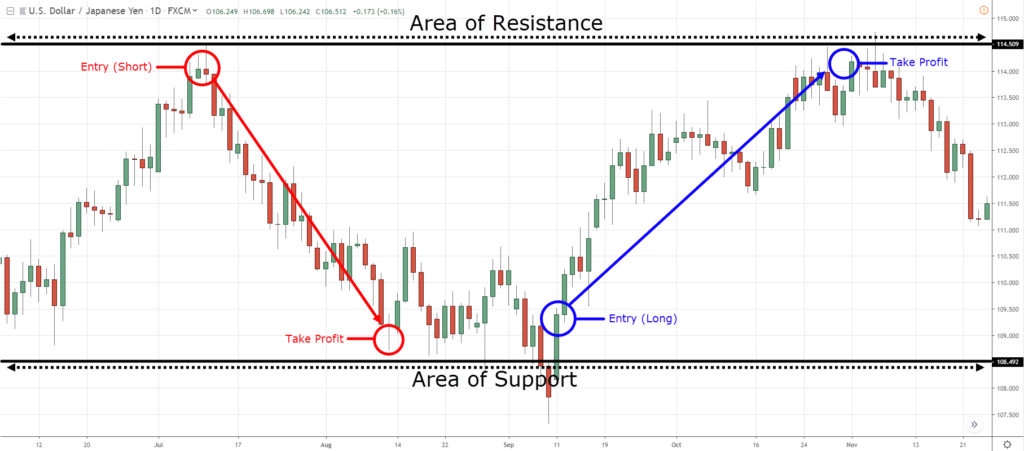

Here is an example of swing trading in the USD/JPY currency pair:

Let’s look at the pros and cons of position trading

Advantages

– No need to stop working full-time to become a swing trader

– It is possible to be profitable every year because you have more trading opportunities

The disadvantages

– Won’t be able to ride the big trends

– You take risk overnight

Day trading

Day trading is a short-term trading strategy where you will hold your trades for minutes or even hours (it is similar to swing trading but at a ‘faster’ pace). The time frames you trade on are usually 5 minutes or 15 minutes. As a day trader, your interest is in capturing intraday volatility.

That means you need to act during the instrument’s most volatile session because that’s where the money is made.

So you are likely to:

– Buying on aid

– Sell on resistance

– Trading on outbreaks

– Trading on downturns

– Trade when the currency pair breaks through the moving average.

If you are a day trader, you will not worry about the fundamentals of the economy or the long-term trend because it is irrelevant. Instead, you identify your bias for the day (be it long or short) and act in that direction for the session.

For example

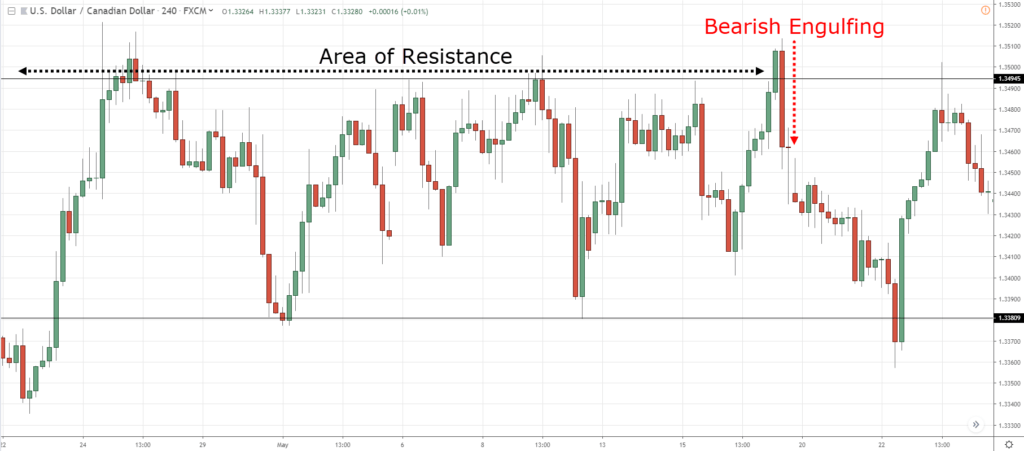

Below is the chart of USDCAD (4-hour time frame) at the 1.2900 resistance. If the price cannot break above that resistance, chances are that today will be a day of downward price action.

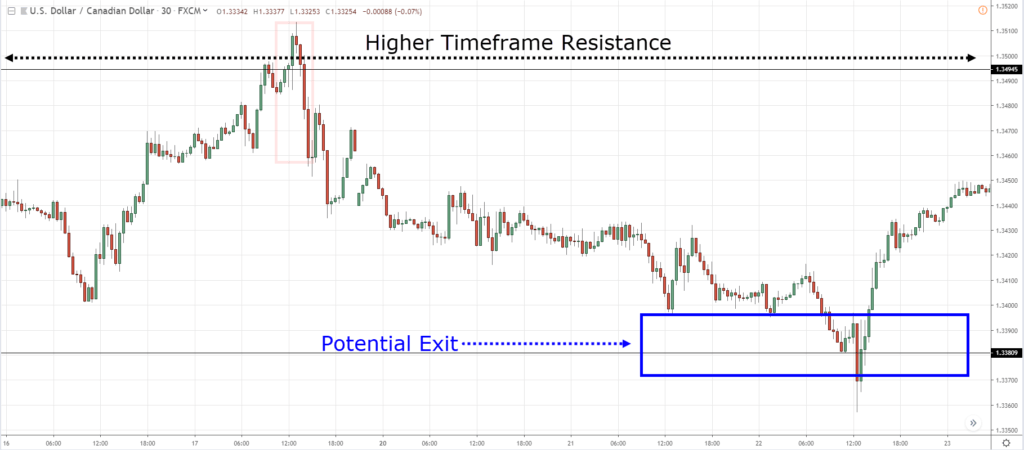

On the fifteen-minute chart, you noticed that a Shooting Star has formed, signaling selling pressure. You can make a short sale with possible target profit on the support (blue box).

On the fifteen-minute chart, you noticed that a Shooting Star has formed, signaling selling pressure. You can make a short sale with possible target profit on the support (blue box).

Let’s look at the advantages and disadvantages of day trading

Let’s look at the advantages and disadvantages of day trading

Advantages

– If you are good, you can make money in most months.

– No overnight risk as you close your positions at the end of the day

Disadvantages

– It is stressful when you have to follow the markets all the time.

– Can lose much more than intended if you suffer from massive slippage, for example from Black Swan events)

– Huge opportunity costs as you can earn full-time wages elsewhere

If day trading is still too ‘slow’ for you, the next forex trading strategy might suit you…

Scalping

Warning: I do not recommend that regular traders work with scalping as the transaction cost eats up most of the profits. You are slower than the machines, which puts you at a big disadvantage. Scalping is a very short-term strategy where you can trade minutes or even seconds.

As a scalper, your concern is with what the market is doing now and how you can profit from it. The main tool you use to trade is the order flow (which shows buy and sell orders in the market). An example:

Let’s look at the advantages and disadvantages of scalping

Let’s look at the advantages and disadvantages of scalping

Advantages

– Can make a good income from this type of currency trading

Disadvantages

– High financial cost (paying for your software, news feed, connection, etc.)

– You are locked to the screen for many hours a day

– It is a very stressful strategy

Transition trading

You’ve probably never heard of Transition trading before. The idea is to enter a trade on the lower time frame, and if the market moves in your favor, you can increase your target profit or raise your stop loss on the higher time frame. Here is an example:

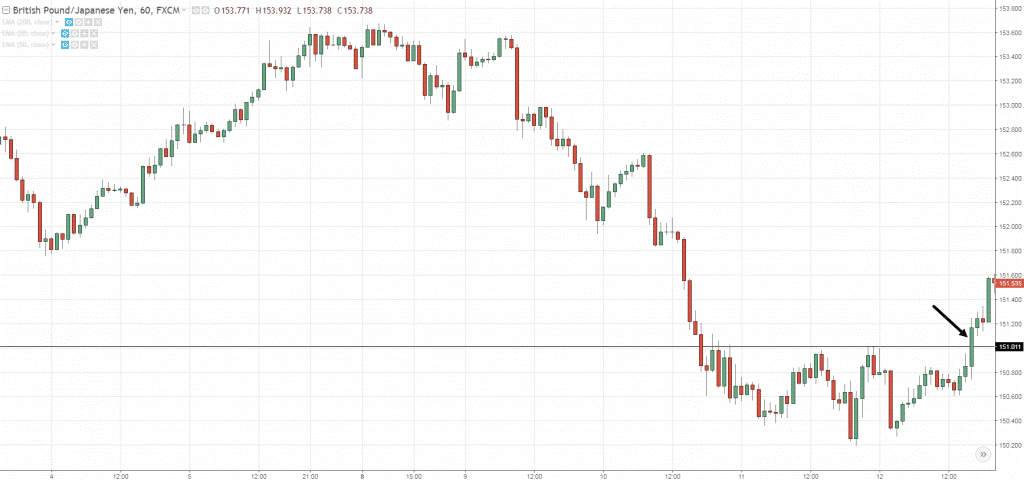

Let’s say you traded the breakout on GBP/JPY in the one-hour chart and the price quickly moved in your favor.

Let’s say you traded the breakout on GBP/JPY in the one-hour chart and the price quickly moved in your favor.

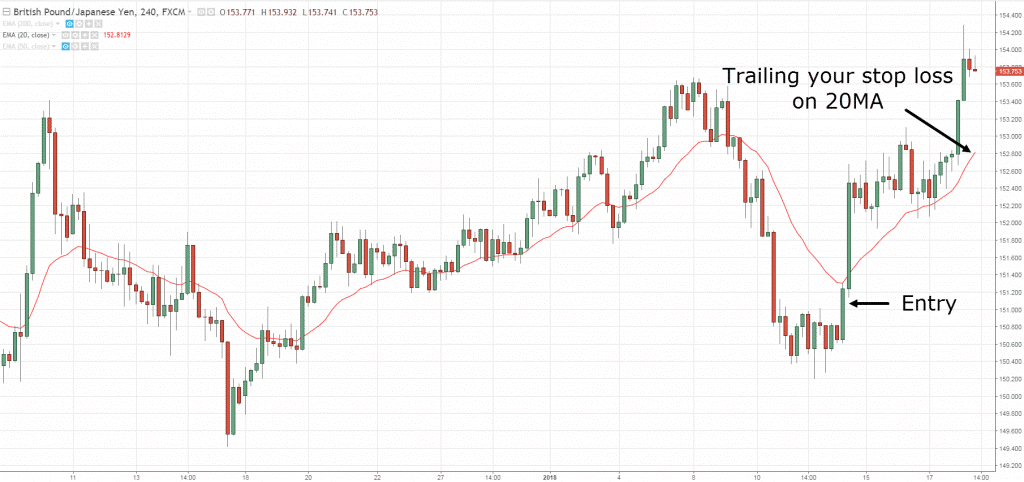

You note the 4-hour time frame that shows 20MA. So instead of taking profits, you raise your stop loss by 20MA in the hope of riding out a bigger wave. If you are wrong, you will exit your trade when the price closes below the 20MA.

Now, there are variations of Transition trading, but the main idea is this:

Now, there are variations of Transition trading, but the main idea is this:

1. Find an entry on the lower timeframe

2. If the price develops in your favor, consider scheduling your sales on the higher time frame.

Now let’s discuss the pros and cons of Transition trading.

Advantages

– Can get a good risk reward (possibly 1 to 10 or even more)

– Can lower your risk as your trading is done on a longer-term basis

Disadvantages

– Only a handful of your trades lead to really big profits

– Must understand multiple timeframes really well

Now that you have an idea of a few different forex trading strategies. The next question is which forex trading strategies suit you best?

So before you try to trade for any of these forex trading strategies, you need to consider these three questions…

1. Do you want to increase the value of your wealth or make money from trading?

Let us first define what is income and wealth.

Income = Earn X dollars per month

Wealth = Grow X% per year

For income

If you are looking to make money from trading, you need to find more trading opportunities in a shorter period of time (for the law of large numbers to work). This means you have to change the lower time frames and spend more hours in front of the screen.

The forex trading strategies you can use are scalping, day trading or short-term swing trading.

For wealth

If you want to increase your wealth through trading, you can afford to have fewer trading opportunities. This means you can set higher time frames and spend fewer hours in front of the screen. The trading strategies you can use are swing trading or position trading.

How much time can you devote to trading?

This is a no-brainer, but it is an often overlooked issue. Here’s how it works. If you have a full-time job, or if you don’t have time to spend 12 hours a day in front of your computer, don’t try scalping or day trading. Instead, you should engage in swing trading or position trading. But if you have all the time in the world and like short-term trading, go ahead.

Does this Forex trading strategy suit you?

Here is the breakdown:

Most trading strategies will fall into one of two categories:

1. a high level of profit with low rewards

2. A low level of profit with high rewards

So, which approach is better?

In terms of profitability, both methods can work as it depends on your profit level and risk-to-reward ratio.

So a better question would be

“Which approach are you more comfortable with?”

If you prefer a higher profit level but smaller profits, you should engage in swing trading.

If you prefer a lower profit level but bigger profits, you should engage in position trading.

Forex trading strategies for beginners, how to get started …

Now if you are new to forex trading, you may be overwhelmed by the sheer number of trading strategies out there. You’ll read about things like trading indicators, chart patterns, Elliot Waves, etc. Where do you start?

My suggestion is to start by mastering support and resistance because the price of a currency only does one of two things:

1. it reverses support and resistance; or

2. It breaks support and resistance

This means that if you understand support and resistance, you have the ability to be a trend trader, breakout trader or even a position trader.

The best part is that it is easy

It works on different timeframes whether you are working on day trading, swing trading or even position trading.

How to get started …

1. learn how to draw support and resistance

2. Learn how price reacts to support and resistance (SR)

When price breaks SR, ask yourself: What is the pattern that occurred before the breakout?

When the price reverses at SR, ask yourself: What is the pattern that occurred before the reversal?

After studying thousands of charts, you get a sense of whether the price is likely to cross or reverse at these trend lines.

3. Define your trading timeframe

Next, you commit to a time frame that you can trade comfortably. For example, if you have a full-time job, it doesn’t make sense to trade the 5mins timeframe because you don’t have the time for it. Instead, you are better off trading the higher time frames (like 4 hours and more) as it requires less screen time. So be honest with yourself and choose a timeframe that suits you best.

4. develop a trade plan

Once you know your trading strategy and timeframe, you can develop a trading plan for it.

Different forex trading strategies that work

Position trading: A wealth-building strategy for those who can’t spend all day in front of the screen.

Swing trading: A wealth or income building strategy for those who can spend a few hours each day.

Day trading and scalping: An income-generating strategy for those who can spend all day in front of the screen.

And finally…

Before learning any forex trading strategies, you need to consider …

1. Your trade objectives

2. Your time available

3. Whether the strategy fits your personality

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)