What is the Sharpe Ratio?

The Sharpe Ratio is an important tool for evaluating a stock, or a portfolio, based on how risky it is to get a higher return. You can use the Sharpe ratio risk measure to determine how consistent the returns of a stock or portfolio are, allowing you to determine whether the returns stem more from wise investments or getting lucky.

Example

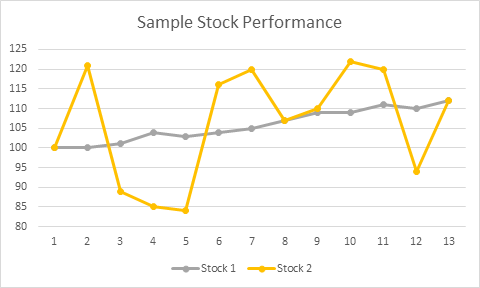

Look at the performance of these two stocks:

On the first day we track and the last day, these two investments have the same value. However, stock 1 is very consistent in its returns, while stock 2 has a very wide range of variation. In this example, if an investor holds both of these stocks for 13 days, their returns would be the same for both. However, imagine if the investor sold both shares on day 11. The return for share 2 would be much higher! But if they waited just one more day, on day 12, share 2’s value crashed, so share 1 looks like a better choice.

On the first day we track and the last day, these two investments have the same value. However, stock 1 is very consistent in its returns, while stock 2 has a very wide range of variation. In this example, if an investor holds both of these stocks for 13 days, their returns would be the same for both. However, imagine if the investor sold both shares on day 11. The return for share 2 would be much higher! But if they waited just one more day, on day 12, share 2’s value crashed, so share 1 looks like a better choice.

How to use the Sharpe ratio when investing

When saving and investing, the goal should always be consistent returns and capital preservation; you don’t want to make risky moves that could wipe out any savings you put in. A wise investor would always prefer stock A, as they don’t have to worry about timing the market, instead they can focus on building a strong long term portfolio, instead of focusing on when to buy and sell some hot stocks at the best prices. In this example, stock A would have a much higher Sharpe ratio than stock B, because it has much less variance for the same return at the end of the period we looked at. You can extend this concept to an entire portfolio; if your portfolio value fluctuates up and down a lot, but you end up with a higher value, you will have a much lower Sharpe Ratio than someone else who may have a lower final return, but their portfolio value grew at a more consistent rate throughout the trading period.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)