What is the Dow Jones Industrial Average?

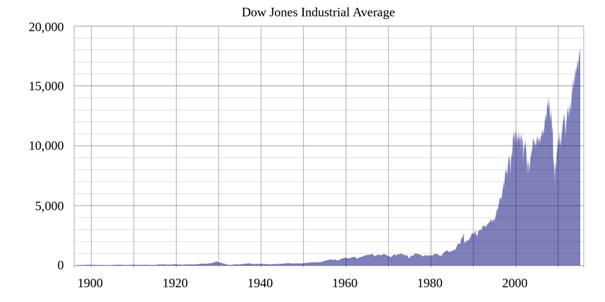

The Dow Jones Industrial Average, more commonly known as the Dow or Dow Jones, is a stock market index made up of 30 of the largest companies based in the United States. It is a price-weighted index which means that the price of the index is an average of the price of the 30 stocks that make it up. Although it is price weighted, it does not mean that every time there is a split the index changes completely, as they have factors to keep the value of the index consistent.

The Dow Jones Industrial Average was first calculated on May 26, 1896 by Charles Dow and one of his business partners, statistician Edward Jones. It is the second oldest US market index, although the content of the index has changed several times. Its purpose was as straightforward as it was revolutionary. Back then, anyone who wanted to know how the stock market was doing had to filter through a lot of newspapers, magazines and hearsay, which was a huge amount of information that was very difficult to process. The Dow and Jones built the averages as a market thermometer, so a casual observer could see whether the markets as a whole were moving up or down on any given day. The average is not a simple average of the prices of all its components; rather, it is a weighted average that takes into account the differences in share prices of all the companies it tracks, and measures the change of the group as a whole. By selecting the largest and most stable companies within each of the main industrial sectors, the average serves as a stable indicator of how the markets as a whole are performing. Although there are not many companies in the Dow, it is made up of some very large and very stable Blue Chip stocks. Because these companies have proven their value over time, the ups and downs of the Dow can be a very strong indicator of investor sentiment across the economy.

The Dow Jones Industrial Average was first calculated on May 26, 1896 by Charles Dow and one of his business partners, statistician Edward Jones. It is the second oldest US market index, although the content of the index has changed several times. Its purpose was as straightforward as it was revolutionary. Back then, anyone who wanted to know how the stock market was doing had to filter through a lot of newspapers, magazines and hearsay, which was a huge amount of information that was very difficult to process. The Dow and Jones built the averages as a market thermometer, so a casual observer could see whether the markets as a whole were moving up or down on any given day. The average is not a simple average of the prices of all its components; rather, it is a weighted average that takes into account the differences in share prices of all the companies it tracks, and measures the change of the group as a whole. By selecting the largest and most stable companies within each of the main industrial sectors, the average serves as a stable indicator of how the markets as a whole are performing. Although there are not many companies in the Dow, it is made up of some very large and very stable Blue Chip stocks. Because these companies have proven their value over time, the ups and downs of the Dow can be a very strong indicator of investor sentiment across the economy.

Current companies in the Dow Jones Industrial Average

| Short name | Name |

| AMZN | Amazon.com Inc |

| AXP | American Express Co |

| AMGN | Amgen Inc |

| AAPL | Apple Inc |

| BA | Boeing Co |

| CAT | Caterpillar Inc |

| CSCO | Cisco Systems Inc |

| CVX | Chevron Corp |

| GS | Goldman Sachs Group Inc |

| HD | The Home Depot Inc |

| HON | Honeywell International Inc |

| IBM | International Business Machines Corp |

| INTC | Intel Corp |

| JNJ | Johnson & Johnson |

| KO | Coca-Cola Co |

| JPM | JPMorgan Chase and Co |

| MCD | McDonald’s Corp |

| MMM | 3M Co |

| MRK | Merck & Co Inc |

| MSFT | Microsoft Corp |

| NKE | Nike Inc |

| PG | Procter & Gamble Co |

| TRV | Travelers Companies Inc |

| UNH | UnitedHealth Group Inc |

| CRM | Salesforce Inc |

| V | Visa Inc |

| VZ | Verizon Communications Inc |

| DIS | Walt Disney Co |

| WMT | Wal Mart Stores Inc |

| DOW | Dow Inc |

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)