What is rollover?

Rollover is the interest paid or earned for holding a currency position overnight.

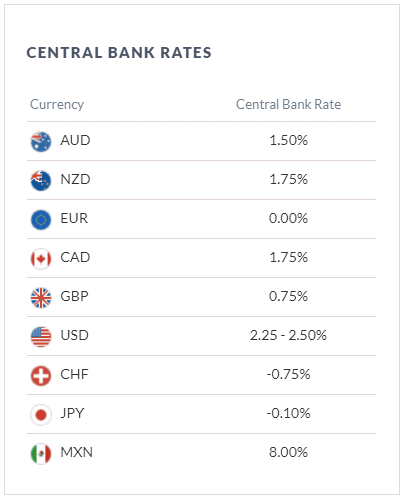

Each currency has an overnight interbank rate associated with it, and since the currency is traded in pairs, each trade involves not only two different currencies but also two different rates.

Rollover refers to the interest rate that is either charged or applied to a trader’s account for positions held “overnight”, meaning after 17:00 ET.

Now we know what rollover means, let’s find out how it works in forex.

How does a rollover work in the foreign exchange market?

When a forex position is open, the position earns or pays the difference in interest rate for the two currencies.

These are called forex rollover rates or currency rollover rates.

The position will make money if the long currency’s rate is higher than the short currency’s rate.

Similarly, the position will cost money if the long currency rate is lower than the short currency rate.

For example, consider a long position on EUR/USD and the EUR overnight rate is lower than the USD overnight rate, you will pay the difference.

For traders planning to trade overnight, it is important to keep an eye on the interest rate for this rollover.

During a normal market environment, exchange rates tend to be stable.

If the interbank market becomes stressed due to increased credit risk, it is possible to see interest rates fluctuate drastically from day to day.

Some types of strategies that focus on interest rate differentials, such as carry trades, try to take advantage of positive interest rate differentials by taking a long position in the high interest rate currency and going short in the low interest rate currency.

Rollovers are only applied to positions held open at 5pm ET, so traders can avoid the risk of paying a negative rollover by closing their positions before 5pm ET.

Changes in interest rates can lead to large fluctuations in the rollover, so it’s worth keeping up to date with the central bank’s calendar to monitor when these events occur.

Calculating the interest rate for a rollover

To calculate the interest rate for a rollover, or the notional amount, forex traders need to know three things:

1. position size

2. The currency pair

3. the interest rate for each currency With this information, it is possible to make a calculation that tends to give a general idea of what the cost of a rollover would be.

However, the actual cost will differ slightly because central bank rates are target rates and the rollover is a tradable market based on market conditions that carry a spread.

Let’s look at an example of how we estimate the daily transfer cost (AUD/USD 0.72):

1. position size of 10,000 lots

2. AUD/USD currency pair long

3. 1.5% annual AUD, 2.5% annual USD Thus, the position makes money in one leg, AUD 10,000 X 1.5% = AUD 150 annually.

150/365 AUD = 0.4109 AUD at rollover.

The position thus costs money in the other leg, USD 7 200 X 2.5% = USD 180 annually.

180/365 = 0.4932 USD Convert AUD 0.41095 interest to dollars.

0.41095 * 0.72 = USD 0.2960 Subtract the amount earned from the amount paid = USD 0.2960-0.4932 = USD -0.1972 (the cost of a rollover) The estimate of rollover interest would simply be the long currency interest rate minus the short currency interest rate.

In the example above, the trader would have paid a cost to keep that position open each night.

There are forex strategies built around earning daily interest and they are called carry trades.

Here is an example of a trader earning a positive roll.

The forex trader wanted to buy AUD because he felt that the Australian dollar would appreciate.

Instead of trading AUD against USD, the trader decides to trade AUD against EUR.

Here is an example of short 10k (EUR/AUD 1,6)

1. position size of 10,000 lots

2. Currency pair EUR/AUD short

3. 1.5% annual AUD rate, 0% annual USD rate Thus, the position makes money in one leg, 10,000 X 1.6 = AUD 16,000 X 1.5% = AUD 240 annually.

AUD 240/365 = AUD 0.65 at rollover.

The second leg of the position usually costs interest, but this is zero in this example.

The trader then pays 10,000 X 0% = 0 EUR annually.

Convert 0.65 AUD of interest earned to euros.

0.65/1.6 = 0.41 EUR Subtract amount earned from amount paid = 0.41-0 = 0.41 EUR (profit on rollover)

When is the rollover booked?

The transfer is booked at 17:00 ET.

A position that opens at

16.59 will be subject to rollover at

17.00.

A position opened at 17:01 will only be subject to rollover if it has not been closed by 17:00 the next day.

If you are in America, the rollover takes place at

17.00.

If you are in the UK, the rollover takes place at 22:00 (GMT).

If you are in Australia, rollover takes place at 9:00.

How does it work over the weekends?

Most banks worldwide are closed on Saturdays and Sundays, so there is no rollover on these days, but banks still apply interest on these days.

To account for that, the forex market books three-day rollovers on Wednesdays.

Using the AUDUSD example above, a forex trader holding the position above on Wednesday at 5pm ET would incur a cost of -1972 x 3 = 0.59

How does it work on red days?

There is no rollover on public holidays, but an extra day’s rollover usually occurs two working days before the red day.

Usually this happens if any of the currencies in the pair have a major holiday.

So for Independence Day in the US (July 4), when US banks are closed, an extra day is added for the rollover until 5pm on July 1 for all US dollar pairs.

If the day the rollover is to be applied is on a weekend, it is pushed to that Wednesday, which could mean 4 or 5 days of interest.

Three tips to use the rollover to your advantage A few basic tips can help traders take advantage of interest rates for currencies.

Here are three tips that can help you incorporate rollovers into your strategy:

1. close positions before 5pm ET if you know the rollover is likely to be hugely negative.

This would be applicable when trading FX crosses or emerging market currencies.

2. Leave positions open if you know the rollover is likely to be positive and you want to keep your position open.

3. Keep an eye on the central bank calendar to monitor when the rollover may vary drastically.

About the Vikingen

With the Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs. Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)