What is a trade diary?

This article explains what a trading journal is, why it is an important tool for traders, how to create one, what to record and how often to review your entries. We will also provide a free sample trading journal that you can download and use. A trading log, or even a trading diary, can help you keep track of your trades in a structured way. Recording all your trades in a trading diary after each trading day can be invaluable for any aspiring trader looking to improve their performance. Being prepared is one of the most important factors for success, whether you are an investor or a trader. A trading diary is an absolute must, but we are quite convinced that very few traders keep one. Thus, to succeed in short-term trading, which is very much a zero-sum game, you gain an advantage over your competitors just by having a trading journal! First, let’s define what a trading diary is:

What is a trade journal?

A trading journal is a log (normally a spreadsheet or software) that you use to record your trades. Let’s call it a database of all your trades. You can later reflect on past trades and thus evaluate yourself. It’s a great tool for creating a good feedback loop – a prerequisite for successful trading. Feedback is the key to improvement! We see a sample trading journal as one of the most important factors in becoming a successful trader. If you take trading seriously, you will find this to be an invaluable tool later on:

Why trade journals are useful – why use it

We have emphasized many times the importance of a trading journal, and we can assure you that it will be practical and useful at a later date. Perhaps the main reason a trading log is useful is that it forces you to have a trading plan. It can force you to test what you actually trade! Additionally, you’ll need to share some thoughts on risk management, drawdowns, and trading psychology. Other things that are useful with a trading journal: – You get statistics on your win ratio and consistency. Do you have a positive expectancy? – You can compare backtests with live trading (to find out slippage) – It keeps you accountable – You can find patterns in your habits that you weren’t aware of – You can find which strategies you perform best on – You create a feedback loop – Get ideas for trading advantages (what is a trading advantage?) The last point is often overlooked. A trading journal is a great tool to get inspiration and new trading ideas, and keeping a trading journal is one of our most important trading lessons.

Trade plan

A trading plan is not the same as a trading journal. While a journal records all your trades in a log, a trading plan is the work you put in before you make the log. The plan is how and why you trade. You need to be systematic to have a trading plan. This means having clear trading rules and settings for each strategy or asset you trade. Remember, we recommend that you have many trading strategies that have an internal low or negative correlation. Ideally, the strategies should complement each other.

Trade plan and mechanical trade

The more you quantify, the more you can automate. Automation is power! If you can automate your strategies, that means more strategies to trade. There are virtually no limits to how many strategies you can trade – except your imagination to test and find new trading strategies.

Do professional traders use a trading plan?

Yes, professional traders use a trading plan. Jim Simons, the man behind the Medallion Fund, is a perfect example of how far you can get with a backtested trading plan. It’s probably the most successful hedge fund on this planet. Only one thing stops you from having a trading plan and diary: laziness. You need a trading diary to avoid second guessing Let’s give you an example from live trading on why you should have a trading diary to improve confidence in your trading:

Why you need a trading diary

Why you need a trading diary

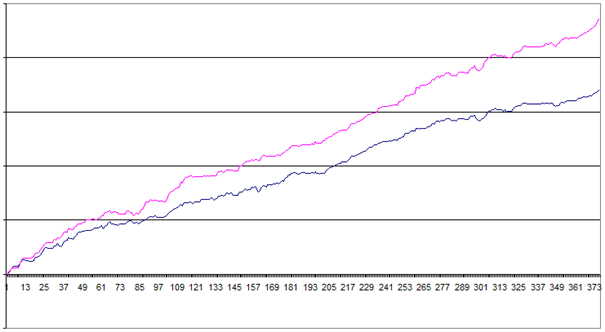

The pink line shows the mechanical results, while the blue line shows our live trading. The difference is huge, both in relative and monetary terms, and it all comes down to a few decisions that went against the rules. Our simple conclusion is that it’s better to walk the dog, go to the pub or chase girls. The more we stare at the screen, the more stupid mistakes we make!

How to create and write a trading diary

Creating a trading diary is easy. You need a spreadsheet and you need to tailor the spreadsheet to your own needs, but this is done by trial and error. There are no hard and fast rules on what you need to record, but we’ll give you an example further down the article. You can create a journal in 1-2 hours. The best advice is simply to start. As you go, you may find other variables that you want to record. The longer you continue to trade, the more you will want to put into your trading log.

When to keep records in a trade journal spreadsheet

At the end of the trading day, you’ll want to manually write down all your trades in your trading spreadsheet. It may not be the neatest job in the world, but our best advice is to put it on file while it’s still fresh in your mind, although it may be more tempting to order champagne after a good day’s trading. We emphasize the importance of keeping a manual log. We’re sure copying and pasting is tempting, but you’ll miss details if you don’t do it manually. We have always done our trading log manually. At the height of our day trading back in 2008, we were doing hundreds of trades per day, but we still entered the trades manually. By doing it manually, we managed to adjust our strategies all the time. The devil is in the details! If you keep records for a long time, the more data you have, the more interesting it becomes. You can look back at past performance and find out where you went wrong or what you can do to improve performance. The devil is often in the details. If you have a long trading diary, you have a great tool to create a feedback loop.

What should be in a trade diary?

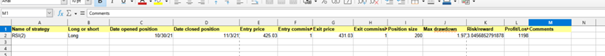

Certain items should be an absolute minimum to have in your trading journal. An example of what you can have in your trading journal is the following: – Name of strategy – Long or short direction – Date position opened – Date position closed – Entry price – Exit price – Position size – Max drawdown – Risk/reward – Profit/loss – Arguments (red flags) about when to stop trading a strategy – written down BEFORE you start trading it As you can see, this is no rocket science – it’s more about discipline and taking the time and effort to do this exercise consistently. You can also have a section in your journal where you write down your feelings. As you move forward, you will likely expand the variables in the journal and log. You will need to find out through trial and error what works best for you. As mentioned above, the best way to do trial and error is to do it manually.

When to review and reflect on the trading journal

A trading diary is a tool that you should at least look at every month, but it depends on your volume of trades. The more data you have in your database, the better the tool! Below is a screenshot of a simple trading diary:

Online and automated trading journals

There are apps and software that can track your trades automatically. It has its pros and cons. We won’t delve into it, but we do want to mention that you lose a lot of information if you automate it. We write our trades manually, and there’s a reason for that: you get to see patterns that you won’t see if you automate the process. It can be time-consuming and tedious, but we believe it is time well spent. Alternatively, you can make a compromise and do both.

Also in the trading journal: list arguments for when to stop trading

One of the most difficult tasks in trading is to decide when to stop trading a specific strategy. This is why your diary should keep notes, arguments or red flags for when you should consider stopping trading a strategy. This needs to be put down BEFORE you start trading live. For example, you could write down that the strategy should be halved in size after x% drawdown, and stopped completely if it reaches 2x% drawdown. Alternatively, you can put in demo mode if the returns are lower than x% over a 12-month period. The most important thing is that you try to quantify most of the rules.

Trade diary

A trading journal serves as a personal narrative of a trader’s journey through the financial markets, documenting not only the technical aspects of each trade but also the emotional and psychological factors that come into play. It is a tool for introspection and self-reflection, offering invaluable insights into one’s trading habits, strengths and weaknesses. By diligently recording each trade, along with accompanying thoughts and feelings, traders can identify patterns, refine strategies and cultivate discipline. Regular review of the trading journal promotes a continuous feedback loop, guiding traders toward constant improvement and greater success in the dynamic world of trading. A trading diary goes beyond technical records by delving into the emotional and psychological side of trading. This narrative-style record captures the trader’s thoughts, feelings and motives behind each trade. By consistently documenting emotional reactions to profits, losses and market volatility, a trading journal helps traders recognize emotional triggers, patterns of exuberance or hesitation. Reflecting on these entries reveals psychological habits that can affect trading performance, promoting a higher level of self-awareness and resilience. Over time, a trading journal can become an invaluable tool for building mental discipline, leading to better decision-making and improved trading performance.

Trade log: A tool for accurate record keeping

A trading log is a structured record of each trade, capturing important details such as entry and exit prices, position sizes and performance. Unlike a temporary list, a trading log is systematic and accurate, designed to give traders a clear overview of their trades’ performance and help assess the effectiveness of risk management. Keeping a detailed log can reveal trends, success rates and areas for improvement, serving as a foundation for disciplined trading. Data collected in a trading log helps traders analyze the technical aspects of their strategies, enabling data-driven improvements to enhance performance.

Summary

This article gives you an example of free trading diary (spreadsheet). The benefits are more obvious the longer you trade and the more experience you gain. Make sure you have a trading diary! When you start trading, you should make sure you have a trading diary as soon as possible. You will soon discover what you are doing right or where you are going wrong! And if you also update your journal manually, you will see details that you otherwise wouldn’t if you cut and paste.

Frequently asked questions:

What should be included in a trade journal?

A trading diary should at least include details such as the name of the strategy, direction (long or short), dates of opened and closed positions, entry and exit prices, position size, maximum drawdown, risk/reward ratio and profit/loss. Additional sections to record emotions are also proposed.

Do professional traders use a trading plan?

Yes, professional traders use trading plans. Having a systematic approach with clear rules and settings for each strategy or asset is crucial. Automation, where possible, is recommended as it allows trading multiple strategies efficiently.

How do I use a trading diary to improve my trading?

A trading journal helps identify areas for improvement by providing insights into trading patterns, strategies and emotional aspects. By regularly reviewing the journal, traders can refine their approach and maintain a continuous feedback loop.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)