What is a pip in forex trading

If you’re new to the world of forex trading, you might be wondering what a pip is. Short for ‘points in percent’, pips are the smallest incremental movement a currency pair can make. ‘Pips’, ‘spreads’ and ‘pipettes’ are all common forex terms that new aspiring forex traders need to wrap their heads around. In this guide, we will explain how a pip works, how to calculate a pip and what is the difference between a pip and a pipette. Keep reading and take your time with this information, it is crucial knowledge for any new trader entering the market to know exactly how forex trading works.

What is a pip in forex?

A pip is the standardized unit that measures a change (both gains and losses) of a currency pair in the forex market. It is the smallest increase in the value of an exchange rate between a currency pair. A pip, also known as a ‘point’ in forex trading, is worth 1/100 of a cent on most exchanges. Forex traders typically use pips to calculate profits and losses when handling currency trading transactions.

What does pip stand for?

‘Pip’ can stand for ‘percent in points’ in the foreign exchange market.

How do pips work?

A pip measures the size of the change in the exchange rate of a currency pair, calculated to its fourth decimal place (in JPY pairs it is calculated to the second decimal place). It is important to note that pips do not represent any real cash value – it depends on the position size of the trade, which would affect the pip value.

Example of a pip with a major currency pair

In the EUR/USD currency pair, the pip movement from 1.1080 to 1.1081 is an increase of 1 pip. A trader who will buy EUR/USD will profit if the euro increases in value against the US dollar. If the trade was entered at 1.1081 and closed at 1.1126, they would have made: 1.1126 – 1.1081 = 45 pips But if the trade went the opposite way, the trader would have suffered a loss.

Example of a beep with Japanese yen pairs

In the USD/JPY currency pair, the pip movement from 10.44 to 10.43 is a decrease of 1 pip. A trader who will buy USD/JPY will profit if the dollar increases in value against the Japanese yen. If the trade was entered at 10.43 and closed at 10.96, they would have made: 10.96 – 10.43 = 53 pips If the market went the opposite way, the forex trader would have seen a loss.

What is a pipette in forex?

Pipettes are fractional pips. It is 1/10 of a pip, usually calculated with the fifth decimal place (in JPY pairs it is calculated with the third decimal place).

Example of a pipette using a major currency pair

In the EUR/USD currency pair, a movement from 1.10811 to 1.10812 is an increase of 1 pipette. Example of a pipette using a Japanese Yen currency pair In the USD/JPY currency pair, a movement from 10.433 to 10.432 is a decrease of 1 pipette.

What is the pip value?

A pip value is defined by the currency pair being traded, the exchange rate of the pair and the size of the trade. The pip value is usually referred to when referencing the performance of a position to attribute price to forex trading, whether it is a loss or profit.

How to calculate the value of a pip?

To calculate the value of a pip, you must first multiply one pip (0.0001) by the lot or contract size. The standard lot is 100,000 units of the base currency, while a mini lot is 10,000 units. If you use EUR/USD again as our example, a pip movement with a standard lot will be equal to $10 (0.0001 x 100,000). Pip value = 100,000 (standard lot) x 0.0001 (one pip) Pip value – $10 With every pip movement in favor of the trade, this translates into a $10 profit, while every one pip movement going against the trade becomes a $10 loss.

Due to the variation in exchange rates, the value of a pip will be different between currency pairs.

What is a spread in forex?

A spread is defined as the difference between the bid and ask price of a currency pair. Spreads are not unique to forex as many other markets use this term to calculate the difference between the bid and ask price, including indices, commodities and cryptocurrency to name a few.

How to calculate spreads in forex?

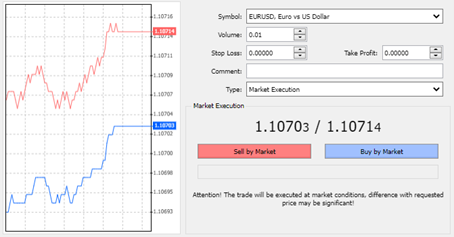

Before looking at any spread, a beginner trader must understand the concept of bid and ask price. ” The ‘Bid’ is the price at which you can sell the base currency, while the ‘Ask’ is the price at which you can buy the base currency. The bid and ask prices are available on the MetaTrader 4 trading platform.

As shown in the chart above EUR/USD has a bid price of 1.10703 and a ask price of 1.10714. Given that 1 pip in a EUR/USD pair is at the fourth decimal place (0.0001), this would mean that this EUR/USD rate has a 1-pips spread.

What is the difference between a spout and a pipette?

A pip relates to motion at the fourth decimal place while a pipette is used to measure motion at the fifth decimal place. A pipette is a “fractional pip” because it corresponds to one tenth of a pip. When looking at the difference between pip and pipettes in currency pairs involving Japanese yen, pip relates to the second decimal place and pipette is the third decimal place.

How many pips a day do forex traders make?

There is no set amount of pips you can make daily and will depend on your technical analysis, fundamental analysis, forex trading strategy and ultimately how the market moves. All traders want every day to be profitable but in the real world that doesn’t exist because forex trading is very much a high-risk game. Stick to your trading plan, test and innovate new strategies and practice proper risk management techniques.

What are ticks and points?

A ‘tick ‘ is similar to a beep, but it may not measure each step equally. For example, a tick on one instrument may be measured in increments of 0.0001 while another instrument may be measured in increments of 0.25. A tick is simply the smallest increment a particular instrument can move in, and the terminology is typically used when trading securities or indices. A point or dot is another unit of measurement, used when there is a change in the dollar amount. For example, if a stock price went from $25 to $30, traders would say it has moved by five points. This term is also used in forex in place of ‘pipette’, to refer to the movement of the fifth decimal place.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)