What is a naked call option?

A naked call option is a written call option where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call. This type of option is also known as naked calls and is the opposite of covered calls. This option strategy is one of the riskiest option strategies you can take because there is unlimited risk.

Explanation of a naked call option

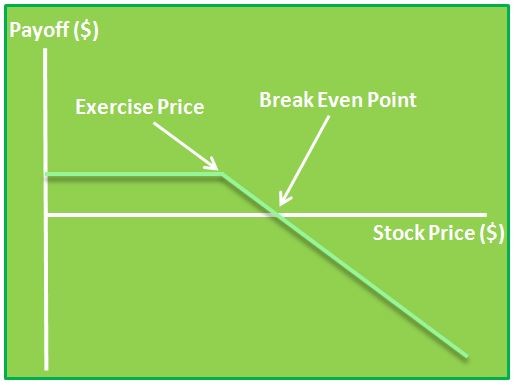

A naked call option is usually created by issuing a call option without owning the underlying stock. Covered calls, where the writer of the option also owns the stock and thus protects himself against large price increases, are protected against large losses. Using naked options, on the other hand, can have unlimited losses when the price of the stock rises. Here is the option payout chart associated with this strategy:

As you can see above, as the share price increases (towards the right), the loss can continue indefinitely.

As you can see above, as the share price increases (towards the right), the loss can continue indefinitely.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)