What does head-shoulder mean in technical analysis?

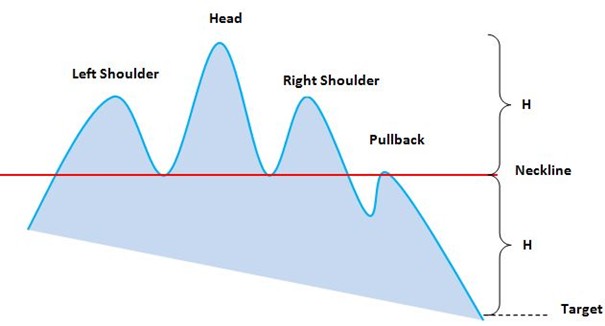

The head and shoulders pattern is one of the most popular chart patterns in technical analysis. Its popularity is mainly because it is easier to spot than other patterns. The name comes from the way the pattern looks: One head and two shoulders (and a neckline). The pattern indicates that a reversal is likely to occur after the pattern is completed. the head-shoulder pattern comes in two forms, top and bottom. The bottom head and shoulders pattern is very similar to the double bottom pattern or the triple bottom pattern and is similar in many ways. If we look at a graphical representation of the upper head-shoulder pattern, we can see that the pattern consists of two shoulders, a head and a neckline:

The pattern does not have to look exactly like this, but it must follow a couple of guidelines: 1. The pattern must start with an upward trend and have a head that is higher than the two shoulders. 2. The shoulder heights should also be about the same height, although the troughs can be different heights (upward trending troughs are more desirable, that is, the second trough is higher than the first trough). In this graph, H stands for height and in general we can set our target price (to exit the position) at about the same height between the difference between the neckline and the top of the head. The downward trend is likely to hit the target price for the same difference H between the neck and the target. This is a good place to put a stop loss order. Another thing to note is that the pullback is not necessarily always part of the pattern, it only happens about half the time. It doesn’t have to go across the neckline, (it’s even preferable that it doesn’t) and shouldn’t be there for long, or cross the neckline by a large amount. Top patterns are quite reliable and take an exit downwards (past the neckline) in about 90% of cases. Here is also an example of a head-shoulder without pullback.

The pattern does not have to look exactly like this, but it must follow a couple of guidelines: 1. The pattern must start with an upward trend and have a head that is higher than the two shoulders. 2. The shoulder heights should also be about the same height, although the troughs can be different heights (upward trending troughs are more desirable, that is, the second trough is higher than the first trough). In this graph, H stands for height and in general we can set our target price (to exit the position) at about the same height between the difference between the neckline and the top of the head. The downward trend is likely to hit the target price for the same difference H between the neck and the target. This is a good place to put a stop loss order. Another thing to note is that the pullback is not necessarily always part of the pattern, it only happens about half the time. It doesn’t have to go across the neckline, (it’s even preferable that it doesn’t) and shouldn’t be there for long, or cross the neckline by a large amount. Top patterns are quite reliable and take an exit downwards (past the neckline) in about 90% of cases. Here is also an example of a head-shoulder without pullback.

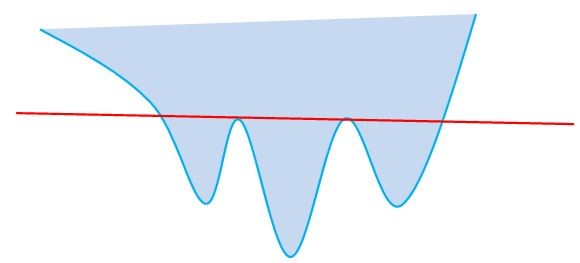

This chart is almost identical to the top and the main axis and follows the same rules but inverted.

This chart is almost identical to the top and the main axis and follows the same rules but inverted.

Volume

The underlying volume is a key indicator to successfully trade this pattern. Without volume, the pattern is considered weak at best and is much more risky to trade.

Above we can see that when the stock first crosses the line at the first bubble, many people would be tempted to trade the stock because it fulfills the pattern. It may have been very risky as it could have simply been a temporary decline without much strength. The much safer and more important time to trade is when the stock continues with its support and trades down with significant volume. This is a much stronger indication of the trend. In conclusion, head-shoulders are one of the first patterns students learn in technical analysis. It is important to not only look at the pattern but to have strong volume when breaking through the neckline or various support and resistance.

Above we can see that when the stock first crosses the line at the first bubble, many people would be tempted to trade the stock because it fulfills the pattern. It may have been very risky as it could have simply been a temporary decline without much strength. The much safer and more important time to trade is when the stock continues with its support and trades down with significant volume. This is a much stronger indication of the trend. In conclusion, head-shoulders are one of the first patterns students learn in technical analysis. It is important to not only look at the pattern but to have strong volume when breaking through the neckline or various support and resistance.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)