What affects the price of platinum?

Let’s look at the demand for platinum, and let’s delve into why it’s arguable that the price of this precious metal will accelerate “significantly” within the next five years as global environmental “climate change” pressures gain traction coupled with ever-tightening emissions standards. In this respect, the market balance around platinum supply and demand is likely to lead to a deficit. It is important to note that the global “continuity” of platinum supply is not without risk, as supply is heavily dependent on the South African PGM industry, which supplies approximately 73, 37 and 82 percent of global platinum, palladium and rhodium respectively (Johnson Matthey JM). In these circumstances, there is reason to believe that an environment of ever-increasing demand coupled with downside supply risk going forward will inevitably lead to upward pressure on the price of platinum.

Reducing harmful emissions

It is important to look at both the use of and demand for platinum (palladium, rhodium). Today, this precious metal is used as a catalyst for the reduction of harmful tailpipe emissions.

In response to the introduction of vehicle regulation and standards for the control of exhaust emissions of harmful gases (US Clean Air Act of 1970), vehicle manufacturers introduced catalytic conversion technology to meet these standards by using platinum, palladium and rhodium (PGMs) in various ratios to catalyze (neutralize) harmful gases such as carbon monoxide and nitrogen oxides.

Vehicle emission standards have been gradually tightened through regulation worldwide since 1970. In response, vehicle manufacturers have been forced to increase the content (loading and unloading ratios) of palladium, platinum and rhodium (PGMs) in autocatalysts to meet the stricter limits. The market expects autocatalyst loads to increase in all regions to comply with stricter vehicle emissions and testing standards. The stricter heavy-duty emission rules and testing standards are being phased in (2019 and 2024). These standards will apply in major vehicle markets.

It is important to note that a palladium and rhodium metal mixture is used in gasoline catalysts, while a platinum, palladium and rhodium metal mixture is used in diesel catalysts. Of note is that the first gasoline catalysts initially used platinum as the primary metal in the mixture and over time platinum was replaced with palladium. Platinum is the dominant PGM in the metal mixture in diesel autocatalysis. It should also be noted that diesel engines are “lean-burn”, meaning they use less fuel and more air to achieve the same performance as gasoline engines. In addition, they emit around 20% less greenhouse gas emissions, especially carbon dioxide (CO₂).

As part of the EU’s response to the Kyoto Protocol in 1997 to reduce greenhouse gas emissions, particularly CO2, the EU published legislation in 2009 stating that it will impose significant penalties on those EU vehicle manufacturers that fail to meet Euro 6 emissions standards from January 2021. For each passenger vehicle they sell, EU car manufacturers will be charged €95 for every gram of CO₂ above 95g they emit per km.

The platinum market and the platinum price

There have been important changes in catalyst technology since its inception, as indicated above. In this respect, the PGM mix in the converter has changed significantly; for example, in gasoline converters platinum has been replaced by palladium over time. In diesel converters, platinum has been partly replaced by palladium. It should be noted that the price differential between the higher price of platinum versus the significantly lower price of palladium played a role in motivating this change. The net result of the reallocation was a decrease in net demand for platinum, which was partly offset by an increase in demand for platinum from the growing market share of diesel engines, including heavy-duty diesel vehicles. As a result, platinum prices have generally declined since 2011, while palladium prices have shown a continuous upward trend since 2011. This trend accelerated significantly in 2017, causing the palladium price to rush through $2,000 per troy ounce in early January 2020 due to increased demand.

The relationship between platinum and palladium

It is interesting to note that the price ratio between palladium and platinum reached 1.0 in October 2017: since then, the ratio has increased significantly, implying a palladium price premium over platinum of around USD 1,400/troy ounce in September 2020). In these circumstances, vehicle manufacturers are stepping up research into the potential for palladium to replace platinum in gasoline applications. However, there are many technical obstacles to overcome. There are some reports that say these hurdles have been overcome and if proven correct, the replacement could happen in as little as two years. This development will be positive for platinum demand.

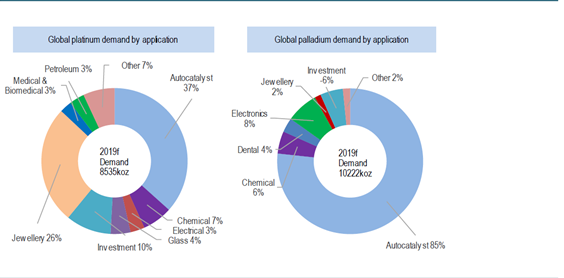

It is important to realize that there is a significant difference between the sectors and the quantity of demand associated with the application of platinum and palladium. The figure below illustrates these differences by application and demand. For platinum, autocatalysts, jewelry and investments are at about 37, 26 and 10 percent, respectively, of demand.

For palladium, the same figure for autocatalysts, electronics and investments is 85%, 8% and -6% respectively. It is clear that platinum demand is also influenced by jewelry demand and is therefore subject to the vagaries of choice and socio-economic factors. However, investment in both platinum and palladium is a significant factor in demand, especially for platinum.

Global demand areas for platinum and palladium

Source: Johnson Matthey

Source: Johnson Matthey

Investments

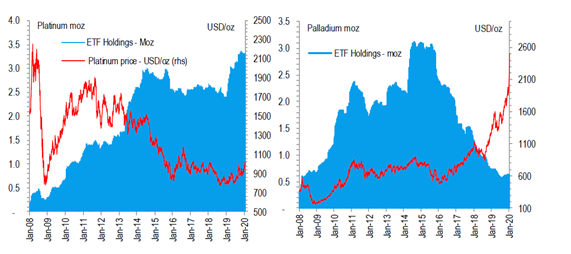

Continued investment demand for platinum bullion or other investment platforms, such as exchange-traded funds (ETFs), is a strong indicator that some investors consider platinum to be undervalued and have a positive fundamental view. Investor demand for platinum-backed ETFs was significantly renewed, by around 900,000 troy ounces in 2019, to a total of around 3,300,000 troy ounces by year-end. After the turn of the year, the inehaven has increased further as many investors have chosen to buy platinum as they hope for a similar price increase as for silver and gold.

Platinum and palladium holdings of exchange-traded funds

Source Bloomberg

Source Bloomberg

The image above illustrates ETF holdings of platinum and palladium since 2008. It is interesting to note that the comparison between the general movement in platinum and palladium ETF holdings is different over time and is at different ends of the scale. In terms of investor sentiment around platinum, investors are buying at low prices on expectations of a positive change in demand. In the case of palladium, investors have taken profits as the price of palladium has risen.

The global supply

The global supply of platinum (and PGMs) depends heavily on the South African PGM industry. South Africa supplies about 73, 37 and 82 of all global platinum, palladium and rhodium respectively. The market considers that there is an increasing risk of reduced supply from South African PGM mines as veins and mines reach the end of their life and/or have become economically unviable.

In addition, the industry has faced many challenges in the past caused mainly by the combined effects of prolonged industrial action and electricity shortages, increased costs, a significant reduction in investment and a negative legal and political environment. The industry is currently experiencing daily and prolonged power outages, which have a negative impact on the primary supply of PGMs.

There is no indication that these risks will diminish in the next five years. In this respect, the negative impact on supply will put upward pressure on PGM prices.

The demand

In conclusion, it is likely to assume that demand for PGMs has been and will continue to be driven by progressively more stringent vehicle standards through regulation worldwide. In response, vehicle manufacturers have had to increase the content (loading and unloading conditions) of palladium, platinum and rhodium (PGMs) in autocatalysts to meet the more stringent requirements, thereby gradually increasing demand. Vehicle manufacturers have shifted significantly to the introduction of electrification, hybrids and FCEVs in an effort to comply with stricter emission standards.

However, the increase in demand for platinum was curtailed “twice” in the intervening period. Firstly, by replacing platinum with palladium in gasoline autocatalysts and partial substitution of platinum with palladium in diesel autocatalysts. Second, by Dieselgate, which resulted in a loss of diesel market share from 2016, which in turn affected platinum demand. In this respect, the demand for autocatalyst decreased by – 2,3% (CAGR) between 2007 and 2019f (JM). In comparison, demand for palladium autocatalyst grew by 6.7% (CAGR) over the same period.

Greenhouse gas (CO₂) regulations are likely to accelerate PGM demand, especially for platinum. Hybrid diesel vehicles, which contain platinum as the primary metal in their autocatalysts, emit less CO2 and are more fuel efficient than gasoline hybrid vehicles. In addition, hybrid vehicles, gasoline and diesel, require additional loads of palladium and platinum.

However, it is inevitable that internal combustion engines (gasoline and diesel internal combustion engines) are likely to be phased out faster than generally expected and will be replaced by BEVs and FCEVs and a combination of hybrid vehicles.

Market balance

The supply and demand fundamentals for platinum are difficult to ignore compared to supply and demand for palladium. At the long-term macro level, platinum has shown an average annual net current account deficit of around 110,000 oz and a total deficit of around 1,450,000 oz between 2007 and 2019.

Between 2013 and 2016, significant deficits were recorded. In 2013, the market deficit increased to around 800,000 oz, mainly due to an increase in investment and demand for platinum. In 2014, a deficit of around c700 000 oz was recorded mainly due to a reduced supply of over 1 300 000 oz of platinum production following a five-month strike at major South African mines. In 2015, the market deficit decreased to around 40,000 kg, mainly due to growth in autocatalyst and investment demand. As mentioned above, Dieselgate provoked a backlash against diesel resulting in a loss of diesel market share, which in turn affected platinum demand.

Both platinum and palladium have reflected annual deficits, suggesting that both metals exhibit supply imbalances, but the price of palladium has risen sharply and the price of platinum has been in free fall. This situation is clearly incompatible and contrary to all financial standards. Financial markets are unlikely to price these metals ceteris paribus.

It can be seen from the figure above that the majority of the platinum market balance deficits have a large component of investment demand, which has acted as a swing factor in the calculation of the market balance. It is likely that this situation is likely to change with the rapid introduction of FCEVs and hybrid vehicles. In this respect, the platinum market balance is likely to show a deficit in 2022/2023 without investment demand. With this, the deficit should be even higher. Sibanye-Stillwater forecasts a market balance surplus until 2022 and then reverts to a continuous deficit that becomes significant from 2025.

What do these trends mean and how will they affect the price of platinum

The upcoming price movement is likely to be supported by the combination of a number of market indicators characterized by strong consumer demand and tight physical availability, combined with a continuous deficit in the balance and supply market after 2022, accelerating from 2025. However, the price is likely to move upwards, with some volatility, before 2022. This is supported by the following factors

Primary supply from South Africa is declining.

The continuity of South African production is not assured: currently there are almost daily power cuts in South Africa. These outages are likely to continue for at least five years and will affect platinum production.

Demand for platinum will accelerate “considerably” within the next five years as global environmental pressures “climate change” gain traction combined with ever-tightening vehicle emission standards. Vehicle manufacturers have had to increase the levels of palladium, platinum and rhodium (PGMs) in autocatalysts to meet the stricter limits.

It is inevitable that gasoline and diesel internal combustion engines (ICEs) will be phased out faster than generally accepted and replaced by BE vehicles and FCEVs and a combination of hybrid vehicles. Hybrid diesel requires an increase in autocatalyst platinum.

The palladium price premium over platinum has increased significantly to around USD 1 400 per troy ounce. In these circumstances, vehicle manufacturers are seeking to replace palladium with platinum in gasoline applications. Substitution may well happen in as little as two years. This development will be positive for platinum demand.

Investment in platinum has increased significantly, with exchange-traded funds buying 900,000 troy ounces in 2019 alone.

This increased demand means that investors see the low price and positive fundamental outlook for platinum.

What can drive the price of platinum

Car companies used to use platinum in all autocatalysts but switched over to palladium in gasoline cars more than a decade ago because it was cheaper. For example, diesel vehicles once accounted for almost 50% of Europe’s car sales. However, the current environment of lower palladium supplies and higher prices has given some in the platinum industry hope that the automotive industry will switch back to platinum.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)