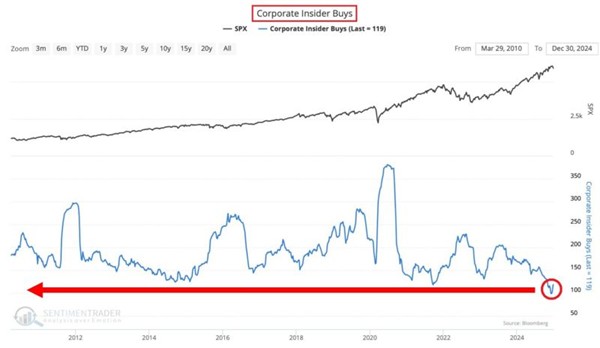

US insider buying has rarely been this low

US executives’ purchases of their own companies’ shares, known as insider buying, have fallen to near all-time lows. This coincides with insiders selling the most shares ever. Does this mean that US stocks are expensive? It is usually said that there are a hundred reasons for an insider sale while there is only one reason for insider buying. However, whether this is true is up to you as an investor to decide.

Source: Sentimentrader and Bloomberg data via Global Markets Investor

Source: Sentimentrader and Bloomberg data via Global Markets Investor

Viking offers price data on US stocks

Want to follow and analyze some of the biggest companies in the world? Here you can analyze the giants like Berkshire, Apple, Microsoft, JP Morgan and Google. You can do this by adding the extensions Nasdaq and NYSE, the New York Stock Exchange, from as little as $58 per month.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)