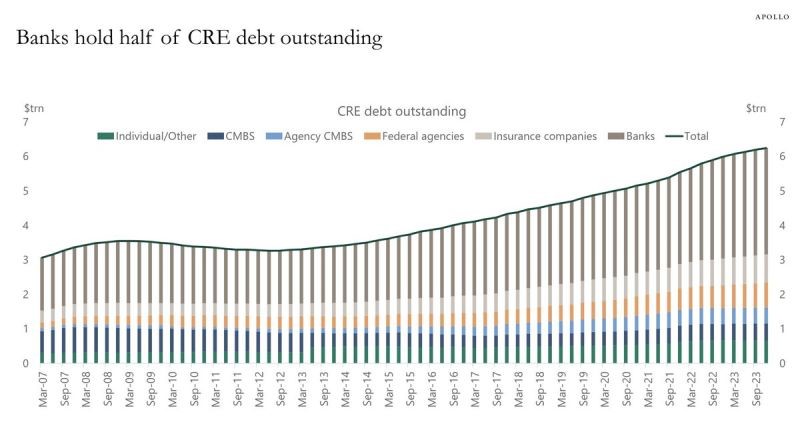

US banks are sitting on huge real estate debt

Currently, there is approximately $6 trillion in commercial real estate (CRE) debt in the United States. US banks hold a whopping three trillion dollars, or 50%, of this outstanding debt. This year, ~929 billion dollars, or one sixth of this debt, will be refinanced, according to Goldman Sachs.

Interest rates on these loans are set to double or even triple since they were taken. All while many of these CRE projects are bankrupt or cash flow negative.

Can these banks weather the storm?

Source: Apollo, The Kobeissi Letter

Source: Apollo, The Kobeissi Letter

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)