Up or down for Nordic currencies

Will Nordic currencies go up or down? If one currency goes down in a currency pair, it is of course the opposite for the other currency, so it should always be possible to make money from currency trading. But you don’t, because it’s hard not to shop, even when things are at a standstill.

If you buy a foreign share, it is important to keep an eye on the exchange rate. There may be an additional gain or loss. In Vikingen Börs/Trading/Maxi, there are currencies to look at and see which ones have up or down signals. There is also a model that converts the share price into your own Nordic currency. In the investment school, we have bought NVIDIA, which is quoted in USD and with the model “VALUTA” it is possible to see the price development in Danish/Norwegian/Swedish kroner or in Euro.

Up or down for the Swedish currency, SEK

A constant question is whether Nordic currencies are up or down. We start with SEK.

This is what the TESLA share price looks like in USD on the left and in SEK on the right. In the chart on the right, you can see that the exchange rate has moved much more because the Swedish krona has fluctuated more than the USD, but they have followed each other, which is good.

Up or down for the Danish currency, DKK

DKK/NOK

Comparing the Danish krone with the Norwegian krone, we see that the Danish krone is trending downwards and is now at the support level of 1.52 DKK/NOK. That is, for 1 Danish krone you get 1.52 Norwegian kroner. If the Danish krone falls through 1.52, the next support is already at 1.50. But if it also goes below 1.50, the price could go down quite a bit to 1.42. What does it mean for a Dane? A difference of 1.42/1.52 = 6.6% difference.

Yes, if the Dane buys a Norwegian share today, there is a risk that the share will fall in value by -6.6% without the price having moved. If the exchange rate also falls, the loss is compounded. The Dane gets less Danish kroner back from a sale simply because the currency has depreciated, even if the exchange rate has remained stable.

Up or down for the Finnish currency, EURO

Exchange rates are also available at the Riksbank

Here are the official exchange rates: https://www.riksbank.se/sv/statistik/rantor-och-valutakurser/sok-rantor-och-valutakurser/

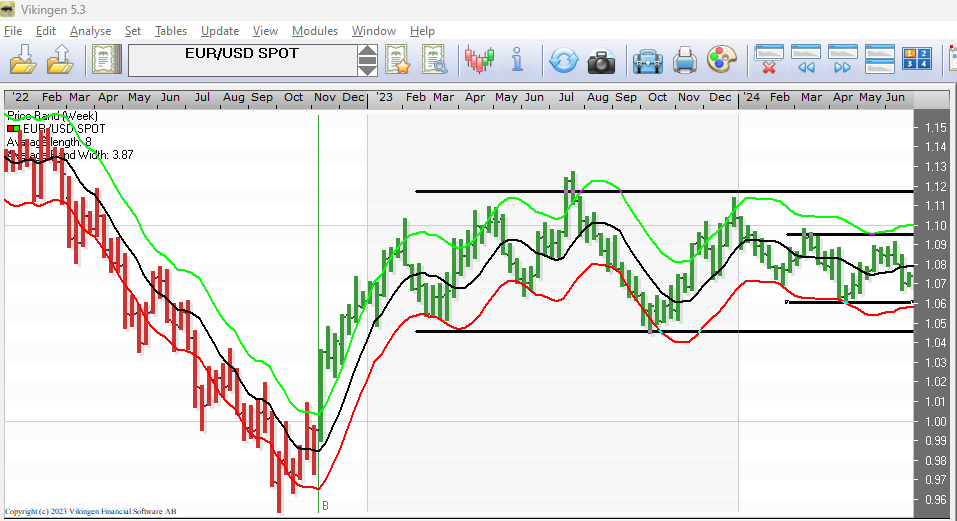

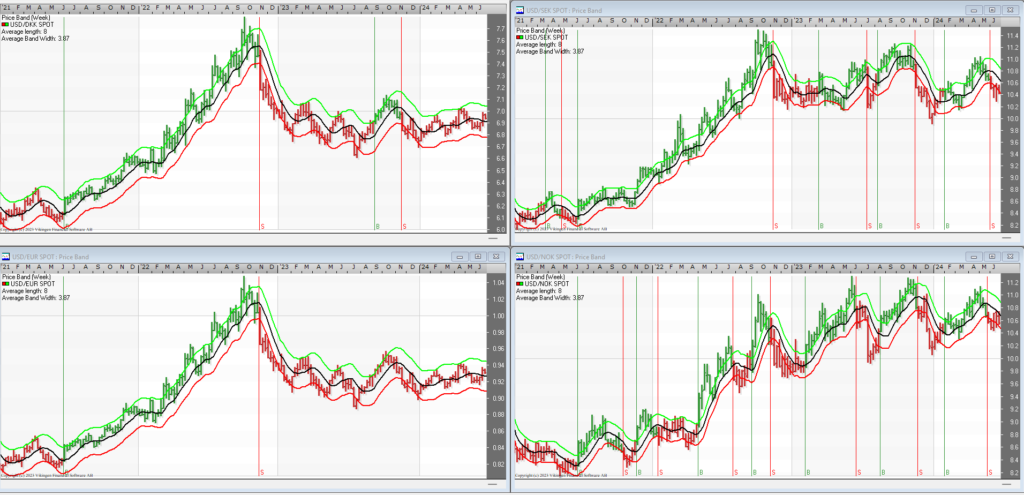

Nordic currencies versus USD

It is quite common to buy shares from the US, on NYSE or Nasdaq. If you don’t already have Nasdaq or NYSE in Vikingen, I highly recommend adding it to your subscription. I myself have made a lot of money from US stocks this year. 50-70%. In the example below, I have used the X-Curr object list in Viking and created a workspace with the Price Band Model week, because it gives good signals for sluggish objects like currencies.

Watch the training video part 1 if you want to know how to make a workspace.

USD/DKK and USD/EUR have long been giving a sell signal and now the exchange rate is flat compared to the past. The USD/SEK and USD/NOK on the right are moving quite a lot and gave a sell signal a few weeks ago. That is, the Swedish krona and the Norwegian krone strengthen against the US dollar. However, the long upward trend for USD/NOK is still ongoing. The Swedish krona is stuck in short-term support against the US dollar.

Pst. Sorry if I don’t write much anymore, I’m winding down and using my knowledge for my own investments. (Peter) Ds

Vikingen Financial Software AB would like to remind you that past, positive results do not always indicate future profits, and that all trading is at your own risk.