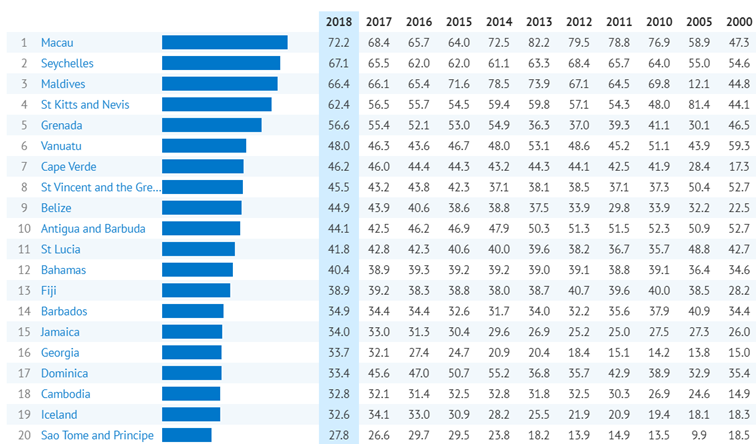

Tourism’s share of different countries’ economies

The coronavirus pandemic had a major impact on many countries’ economies, and therefore their currencies. Looking at travel and tourism’s contribution to GDP as a share of GDP (%), we see that one of the biggest losers was Macao. Macao or Macau (澳門; pinyin: Àomén; jyutping: Ou3 Mun4; Portuguese: Macau), is a special administrative region on a small peninsula in southern China, 65 km west of Hong Kong. Macao is also known as Magok (媽閣廟), Haojing’ao (壕鏡澳), Xiangshan’ao (香山澳) and Liandao (蓮島 “Lotus Island”). The currency used is mainly Macanese Patacas (MOP) or Hong Kong Dollars (HKD). One Hong Kong Dollar is worth 1.03 Macanese Patacas. Macao is today, like Hong Kong, a Special Administrative Region (SAR) of China under the concept of “One Country, Two Systems”. Macao’s economy is largely based on gambling and casino activities, which generate about half of the revenue for the state budget. The monopoly that previously existed in the gambling industry has been removed and foreign companies can obtain a license to operate in Macao. As more and more mainland Chinese travel to Macao, the tourism and gambling sector is expanding rapidly to turn Macao into the Las Vegas of Asia. 85% of Macao’s exports are textiles and footwear. Macao’s main trading partners are China, the United States, Hong Kong and Japan. Macao is the top country by contribution of travel and tourism to GDP (% of GDP) in the world. In 2018, the contribution of travel and tourism to GDP (% of GDP) in Macao was 72.2%. The five countries where tourism has the highest share of GDP also include Seychelles, Maldives, Saint Kitts and Nevis and Grenada. So what does this have to do with currency trading? The idea we have is that the countries with the highest share of tourism in their GDP should have been the countries most penalized by the effects of the Coronavirus pandemic and should therefore be the winners when it is possible to resume travel.

What is the contribution of travel and tourism to GDP (% of GDP)?

The share of travel and tourism expenditure or employment in the corresponding economy-wide concept in the published national income accounts or labor market statistics. Visitor exports are compared with exports of all goods and services Domestic travel and tourism expenditure is compared with GDP Government individual travel and tourism expenditure is compared with total government expenditure Internal travel and tourism consumption is compared with total internal consumption (i.e. total domestic expenditure plus total exports) Leisure travel and tourism contribution to GDP is compared with total GDP Business travel and tourism contribution to GDP is compared with total GDP Travel and tourism investment expenditure is compared with all fixed investment

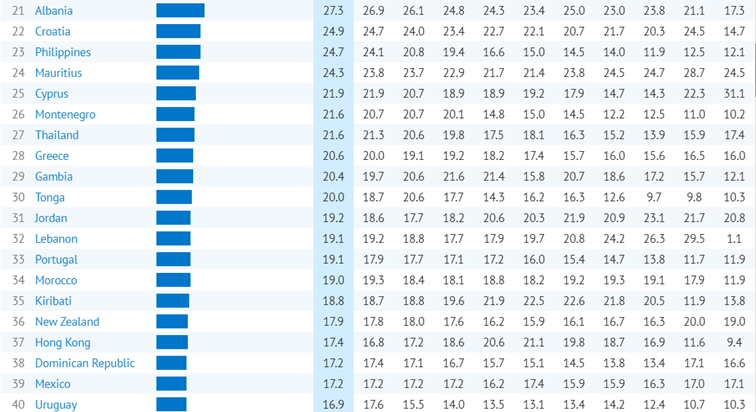

However, the idea is somewhat complicated to translate into practical currency trading. None of the twenty countries in the table above are currencies that are normally traded at the forex brokers. So let’s go ahead and look at the countries numbered 21 to 40 and see if we can find alternatives on the list

However, the idea is somewhat complicated to translate into practical currency trading. None of the twenty countries in the table above are currencies that are normally traded at the forex brokers. So let’s go ahead and look at the countries numbered 21 to 40 and see if we can find alternatives on the list

At number 27 we find Thailand, at number 36 is New Zealand, 37 is occupied by Hong Kong, and 39 by Mexico. There are also a number of European countries, such as Portugal, Greece and Cyprus, but as these are part of the European Monetary Union, we leave them out.

At number 27 we find Thailand, at number 36 is New Zealand, 37 is occupied by Hong Kong, and 39 by Mexico. There are also a number of European countries, such as Portugal, Greece and Cyprus, but as these are part of the European Monetary Union, we leave them out.

Thailand The latest news is that Thailand is opening up to “safe” tourism, but needs to find ways to do so. Thailand opening up “safe and restricted” parts of the country to tourists is good for the country’s economy. The first destination is expected to be Phuket. The decision is a way for the Thai government to boost the country’s economy which, in the wake of the Corona pandemic, has collapsed more than since the Asian crisis. At the same time, anti-government demonstrations are escalating in Thailand. The opening up of Thailand may be a good sign that it’s time to buy the Thai stick, but the anti-government demonstrations in Thailand may be a worse sign.

New Zealand

The New Zealand dollar is often described as a commodity currency with its value closely tied to the price of New Zealand’s agricultural exports, making this currency pair particularly volatile. In particular, the price of milk powder is considered to have a major impact on the New Zealand dollar.

However, tourism in New Zealand constitutes an important sector of the national economy, it directly contributed NZ$ 16.2 billion (or 5.8%) of the country’s GDP in the year ending March 2019. In 2016, tourism accounted for 188,000 jobs (almost 7.5% of New Zealand’s labor force). Despite the country’s geographical isolation, international tourist spending accounted for 17.1% of New Zealand’s export earnings (almost USD 12 billion). International and domestic tourism contributed a total of USD 34 billion to New Zealand’s economy each year as of 2017. Australia accounts for 39.6% of visitors to New Zealand. There is talk of allowing travel between Australia and New Zealand in the fourth quarter, which could make this currency a winner.

Hong Kong

The Hong Kong dollar is a very special currency. Not only is the Macau Pataca pegged to the Hong Kong Dollar (One Hong Kong Dollar is worth 1.03 Macanese Pataca), the HKD is also pegged to the US Dollar. The Hong Kong dollar is traded in a band against the US dollar, which allows the Asian currency to trade in the band of 7.75 to 7.85 HKD per USD. Hong Kong, like Macao, is currently a Special Administrative Region (SAR) of China under the “one country, two systems” concept. This means that China also has a major influence on the Hong Kong dollar. Then add the standoff between the US and China over civil liberties in Hong Kong. Beijing’s plan to introduce security legislation in Hong Kong could lead to US sanctions. This could exacerbate the already tense situation between the world’s two largest economies, the US and China. Overall, it seems that there are too many external factors that could affect the performance of the Hong Kong dollar beyond a recovery in tourism.

Mexico

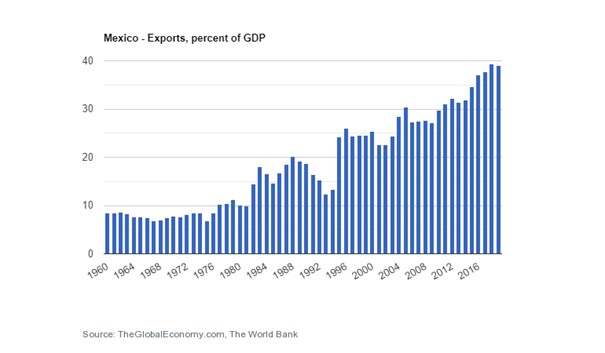

USD/MXN is the US dollar against the Mexican peso. Tensions have increased between these two countries after US President Donald Trump won the 2016 presidential election. The current 20% tariff has already led to a significant increase in the volatility of this currency pair. The average value of exports from Mexico over the period 1960 to 2019 was 18.85%. The latest value from 2019 is 39.06%, a value only exceeded by 2018 when the same figure was 39.29%.

Tourism is an important economic sector in Mexico, and the country plays a prominent role in tourism globally. The sector directly accounts for 8.5% of GDP, 5.8% of full-time paid employment (in the formal sector) and 77.2% of service exports. Mexico has also been affected by the fall in oil prices, although it hedges almost all of its oil production. However, the fall in oil prices has reduced interest in investing in the country’s oil sector. Overall, Mexico was hit hard by the coronavirus pandemic, with a loss of tourism, falling oil prices and reduced exports. As signs began to brighten and travel became possible, demand for Mexican pesos increased sharply. The country’s currency was the strongest of all in 2023.

Tourism is an important economic sector in Mexico, and the country plays a prominent role in tourism globally. The sector directly accounts for 8.5% of GDP, 5.8% of full-time paid employment (in the formal sector) and 77.2% of service exports. Mexico has also been affected by the fall in oil prices, although it hedges almost all of its oil production. However, the fall in oil prices has reduced interest in investing in the country’s oil sector. Overall, Mexico was hit hard by the coronavirus pandemic, with a loss of tourism, falling oil prices and reduced exports. As signs began to brighten and travel became possible, demand for Mexican pesos increased sharply. The country’s currency was the strongest of all in 2023.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)