This stock has raised its dividend in the last three recessions.

Dividend stocks have long held a central place in the portfolios of investors who value stability and income. Realty Income (NYSE:O) is considered by many to be among the best of the bunch, for reasons that include management’s commitment to increasing its payouts every year, year after year, through thick and thin. In fact, Realty Income has raised its dividend during the last three recessions.

This includes the three recessions we have seen so far in the 2000s: the dot-com bubble in 2001, the Great Recession and the COVID-19 collapse in 2020. The first was relatively mild, but the second was the most severe since the Great Depression in some respects, and the third was short but rather spasmodic.

Retailers were particularly hard hit by the pandemic shutdown, and many of their publicly owned landlords – in the form of real estate investment trusts (REITs) – were forced to cut or suspend their distributions. But not Realty Income, owner of more than 13,100 properties, most of them under long-term net lease agreements with commercial clients.

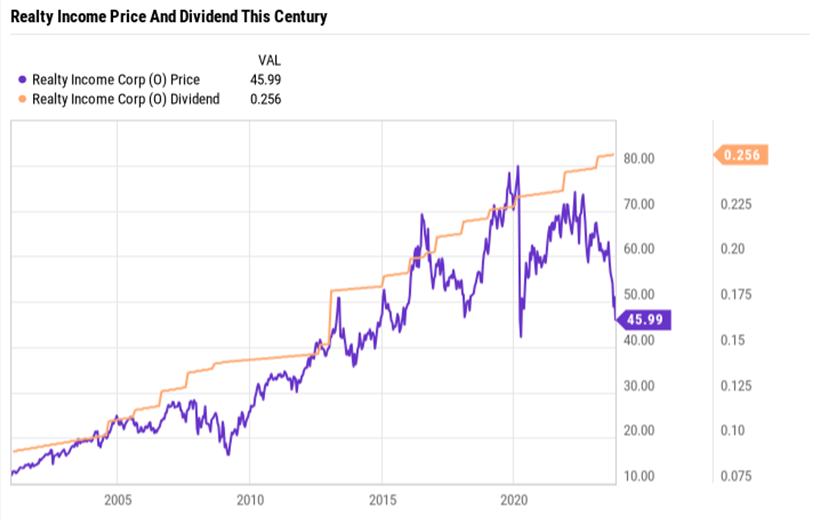

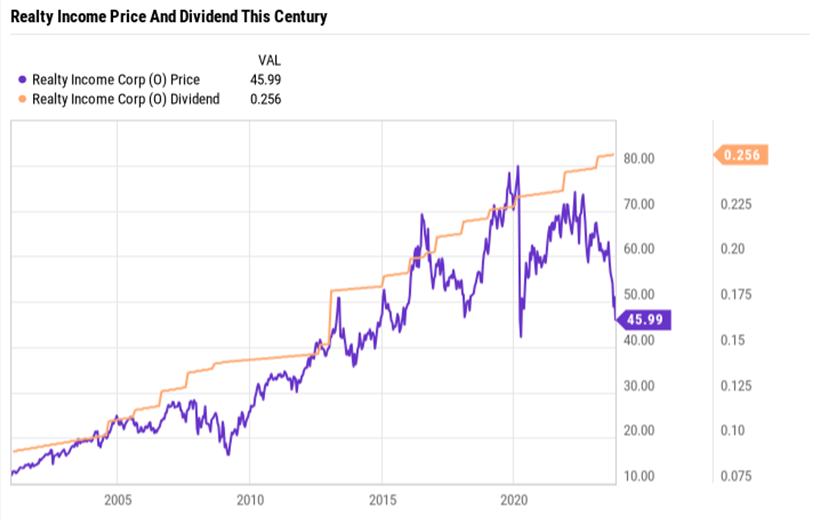

This chart shows how Realty Income has raised its dividend every year without fail since 2000. Meanwhile, the share price has taken a big dip recently, pushing the current yield to around 6.5%, notably higher than its historical average.

Source: Ycharts

Source: Ycharts

A well-oiled dividend machine keeps on rolling

“The Monthly Dividend Company”, as Realty Income calls itself, has been in operation for 54 years and has paid 639 straight monthly dividends in that time. And since going public in 1994, the San Diego-based REIT has raised that payout 122 times.

That consistency has helped this dividend machine deliver a compound average annual return of 14.2% since its IPO, compared to about 10.7% for the S&P 500. During that time, Realty Income has steadily grown its portfolio, which is anchored by branded recession-resistant operators in convenience stores, grocery stores, pharmacies and home improvement businesses.

Walgreens and Dollar General are the top two clients, representing only 3.8% each of the REIT’s growing portfolio, while properties in all 50 states and Puerto Rico and a growing presence in Europe provide geographic diversification.

Realty Income makes major acquisitions

Naturally, investors expect growth, and growth for a company this big can only come in big chunks. Realty Income managers have used their strong balance sheet to secure favorable financing for some recent major acquisitions.

That’s highlighted by the nearly $12 billion deal for VEREIT, which nearly doubled Realty Income’s portfolio when it closed at the end of 2021. Realty Income also spun off its office holdings into a separate entity, Orion Office REIT, which eliminated its exposure to this flag. sector.

Realty Income has also been spending big money lately to diversify into another resilient business: casinos. It includes a $950 million investment for a large portion of the Bellagio in Las Vegas and the $1.7 billion acquisition of Encore Boston Harbor from Wynn Resorts.

Although owning casinos seems like a risky business for the storefront owner, these casino operators sign much longer leases than Realty Incomes’ traditional tenants, providing reliable cash flow for decades.

Then on October 30, Realty Income announced a $9.3 billion deal to buy Dallas-based Spirit Realty Capital that will add nearly 2,100 more single-tenant retail and industrial properties, nearly 100% leased to 345 tenants, with a strong presence in Florida and Texas, high-growth states where Realty Income has less of a presence.

Now could be the time to take action or add to it

Realty Income says it expects the highly scrutinized Spirit Realty acquisition to increase its adjusted funds from operations (FFO) by about 2.5%. The figures point to its continued ability to practically cover its dividend as well. For example, its latest forecast for 2023 year-end FFO is $3.96 to $4.01 per share, while the payout is currently $3.07 per share on an annualized basis, paid monthly at a current rate of $0.256.

Now may also be a particularly good time to buy some shares in this reliable income stock. The price was already beaten down along with many of its peers, and the market’s reaction to the Spirit Realty purchase pushed it further.

Realty Income stock is currently selling for about $48 per share (as of November 1) and analysts on average give it a target price of $63.58. With this company’s strong track record and commitment to that dividend growth, I’m confident in the stake I already have in it and plan to add more, whether or not a long-predicted new recession finally arrives.

Dividend stocks have long held a central place in the portfolios of investors who value stability and income. Realty Income (NYSE: O) is considered by many to be among the best in the group, for reasons that include management’s commitment to increasing its payouts every year, year after year, through thick and thin. In fact, Realty Income has raised its dividend during the last three recessions.

This includes the three recessions we have seen so far in the 2000s: the dot-com bubble in 2001, the Great Recession and the COVID-19 collapse in 2020. The first was relatively mild, but the second was the most severe since the Great Depression in some respects, and the third was short but rather spasmodic.

Retailers were particularly hard hit by the pandemic shutdown, and many of their publicly owned landlords – in the form of real estate investment trusts (REITs) – were forced to cut or suspend their distributions. But not Realty Income, owner of more than 13,100 properties, most of them under long-term net lease agreements with commercial clients.

This chart shows how Realty Income has raised its dividend every year without fail since 2000. Meanwhile, the share price has taken a big dip recently, pushing the current yield to around 6.5%, notably higher than its historical average.

Source: Ycharts

Source: Ycharts

A well-oiled dividend machine keeps on rolling

“The Monthly Dividend Company”, as Realty Income calls itself, has been in operation for 54 years and has paid 639 straight monthly dividends in that time. And since going public in 1994, the San Diego-based REIT has raised that payout 122 times.

That consistency has helped this dividend machine deliver a compound average annual return of 14.2% since its IPO, compared to about 10.7% for the S&P 500. During that time, Realty Income has steadily grown its portfolio, which is anchored by branded recession-resistant operators in convenience stores, grocery stores, pharmacies and home improvement businesses.

Walgreens and Dollar General are the top two clients, representing only 3.8% each of the REIT’s growing portfolio, while properties in all 50 states and Puerto Rico and a growing presence in Europe provide geographic diversification.

Realty Income makes major acquisitions

Of course, investors expect growth, and growth for a company this big can only come in big chunks. Realty Income managers have used their strong balance sheet to secure favorable financing for some recent major acquisitions.

That’s highlighted by the nearly $12 billion deal for VEREIT, which nearly doubled Realty Income’s portfolio when it closed at the end of 2021. Realty Income also spun off its office holdings into a separate entity, Orion Office REIT, which eliminated its exposure to this sector.

Realty Income has also been spending big money lately to diversify into another resilient business: casinos. It includes a $950 million investment for a large portion of the Bellagio in Las Vegas and the $1.7 billion acquisition of Encore Boston Harbor from Wynn Resorts.

While owning casinos seems like a risky business for the storefront owner, these casino operators sign much longer leases than Realty Incomes’ traditional tenants, providing reliable cash flow for decades.

Then on October 30, Realty Income announced a $9.3 billion deal to buy Dallas-based Spirit Realty Capital that will add nearly 2,100 more single-tenant retail and industrial properties, nearly 100% leased to 345 tenants, with a strong presence in Florida and Texas, high-growth states where Realty Income has less of a presence.

Now could be the time to take action or add to it

Realty Income says it expects the highly scrutinized Spirit Realty acquisition to increase its adjusted funds from operations (FFO) by about 2.5%. The figures point to its continued ability to practically cover its dividend as well. For example, its latest forecast for 2023 year-end FFO is $3.96 to $4.01 per share, while the payout is currently $3.07 per share on an annualized basis, paid monthly at a current rate of $0.256.

Now may also be a particularly good time to buy some shares in this reliable income stock. The price was already beaten down along with many of its peers, and the market’s reaction to the Spirit Realty purchase pushed it further.

Realty Income stock is currently selling for about $48 per share (as of November 1) and analysts on average give it a target price of $63.58.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)