The ten countries with the largest gold reserves

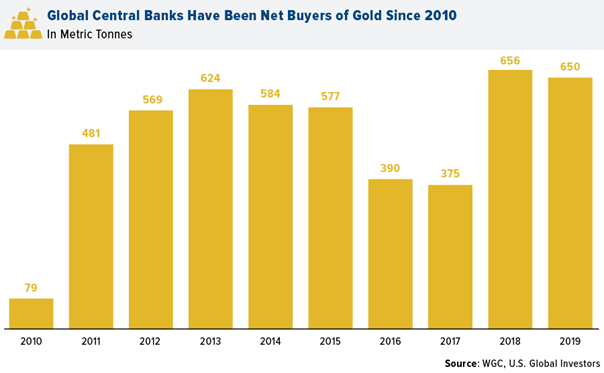

In 2010, central banks around the world turned from being net sellers of gold to net buyers. Last year, official sector activity fell by one percent from the year before, while central banks added a total of 650.3 tons to their reserves. This is slightly lower than in 2018 when banks bought 656.2 tons – the second highest level this century, according to data compiled by the World Gold Council (WGC).

Source: U.S Global Investors

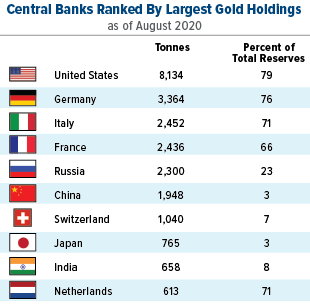

The list of the ten central banks with the largest gold reserves has remained unchanged in recent years. The United States still holds the spot with over 8,000 tons of gold in its vaults – almost as much as the next three countries combined. As many as 15 central banks made net purchases of a ton or more in 2019, highlighting the continued demand for gold bullion around the world. Turkey was the biggest buyer, adding 159 tons to its reserves. Poland made the single largest purchase of the year, buying 94.9 tonnes in June. The WGC notes that central banks bought 5,019 tonnes over the past decade, more than offsetting the 4,426 tonnes they net sold from 2000 to 2009. Gold reserves are now only 12% below their 1966 peak of 38 491 tons. Below are the top ten countries with the largest gold holdings, starting with the Netherlands, recently surpassed by India.

Source: WGC, World Gold Council

The reported figures are as of August 2020 and do not include the International Monetary Fund (IMF) as a country, otherwise this organization would have been in third place.

10. The Netherlands

Tons: 612.5 Percent of foreign reserves: 71.4% The Dutch central bank announced that it will move its gold vaults from Amsterdam to Camp New Amsterdam, about an hour outside the city, citing onerous security measures for the current location. As many others have pointed out, this seems strange, given that the bank quite recently repatriated a large amount of its gold from the US.

9. India

Tonnes: 657.7 Percentage of foreign reserves: 7.5% It’s no surprise that the Bank of India has one of the largest gold reserves in the world. The South Asian country, with 1.25 billion people, is the second largest consumer of the precious metal and is one of the biggest drivers of global demand. India’s festival and wedding season, which runs from October to December, has historically been a great boon to the gold trade.

8. Japan

Tons: 765.2 Percentage of foreign reserves: 3.2% Japan, the world’s third largest economy, is also the eighth largest holder of the yellow precious metal. The central bank has been one of the most aggressive practitioners of quantitative easing. In January 2016, the Bank of Japan cut interest rates below zero, which has increased demand for gold around the world.

7. Switzerland

Tonnes: 1,040.0 Percentage of foreign reserves: 6.5% In seventh place is Switzerland, which actually has the world’s largest reserves of gold per capita. During the Second World War, the neutral country became the centre of the gold trade in Europe, transacting with both the Allies and the Axis powers. Today, much of its gold trade is with Hong Kong and China.

6. China

Tons: 1,948.3 Percentage of foreign reserves: 3.4% In the summer of 2015, the People’s Bank of China began communicating its gold purchases on a monthly basis for the first time since 2009. Although China comes in sixth place, the yellow metal makes up only a small percentage of its total reserves – just 3.4%. In fact, China has been a gold buyer since December 2018. China has purchased almost 100 tons as of August 2019.

5. Russia

Tons: 2,299.9 Percentage of foreign reserves: 23% The Russian central bank has been the largest buyer of gold over the past seven years, overtaking China in 2018 to hold the fifth-largest reserves. In 2017, Russia bought 224 tons of gold bullion in an effort to diversify away from the U.S. dollar, as its relationship with the West has soured since the annexation of the Crimean Peninsula in mid-2014. To raise the cash for these purchases, Russia sold a huge proportion of its U.S. Treasury securities.

4. France

Tonnage: 2,436.0 Percentage of foreign reserves: 65.5% France’s central bank has sold little of its gold in recent years, and there is talk of stopping it altogether. Marine Le Pen, the president of the country’s far-right National Front party, wants not only to cease the sale of the country’s gold but also to repatriate the full amount from foreign vaults.

3. Italy

Tonnage: 2,451.8 Percentage of foreign reserves: 71.3% Italy has also maintained the size of its gold reserves over the years, and it has the support of European Central Bank (ECB) President Mario Draghi.

2. Germany

Tonnes: 3,363.6 Percentage of foreign reserves: 75.6% In 2017, Germany began a four-year repatriation operation aimed at moving a total of 674 tons of gold from the Banque de France and the Federal Reserve Bank of New York back to its own vaults. When first announced in 2013, the move was expected to take until 2020 to complete. Although demand for gold declined in 2017 after reaching an all-time high in 2016, this European country has seen its gold investments rise steadily since the global financial crisis.

1. THE USA

Tons: 8,133.5 Percentage of foreign reserves: 79% With the largest official holdings in the world, the United States has almost as much gold as the next three countries combined. It also has the highest gold distribution as a percentage of its foreign reserves at 79%. From what the outside world knows, the majority of US gold is held at Fort Knox in Kentucky. The rest of the U.S. gold reserves are held at the Philadelphia Mint, the Denver Mint, the San Francisco Assay Office, and the West Point Bullion Depository. Which state loves gold the most? Well, Texas went as far as to create its very own Texas Bullion Depository to protect investors’ gold.