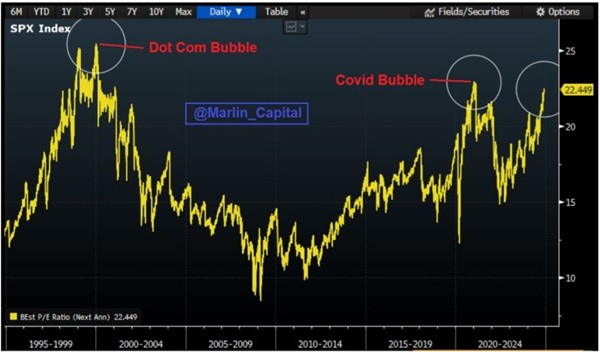

The S&P500 has only traded at a higher p/e twice before

The US benchmark index S&P500 has only traded at a higher p/e, a P/E multiple higher than the current level (22.5x) twice in history: 1.) Dot Com bubble 2.) Covid-QE bubble

Source: David Marlin @Marlin_Capital, Bloomberg

Source: David Marlin @Marlin_Capital, Bloomberg

Viking offers price data on US stocks

Want to follow and analyze some of the biggest companies in the world? Here you can analyze the giants like Berkshire, Apple, Microsoft, JP Morgan and Google. You can do this by adding the extensions Nasdaq and NYSE, the New York Stock Exchange, from as little as $58 per month.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)