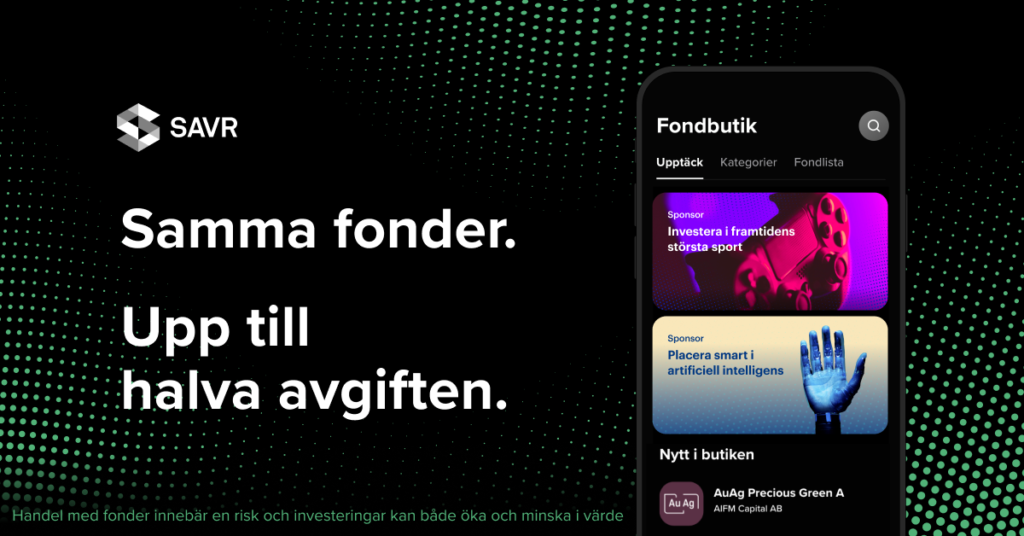

The same funds. The same security. Lower fees

SAVR, which sometimes calls itself the fund rebel, is a platform whose business idea is to make saving in funds cheaper.

SAVR

gives its customers a discount on the fund fee for more than 1400 different funds, the same funds you can buy elsewhere, but without a discount on the fund fee. This makes your money grow faster than it would if you invested your money with another operator.

At the time of writing, the company is just over seven years old. In a single year, SAVR managed to reach one billion in assets under management since launching its fund platform. In one year, tens of thousands of investors have transferred over a billion in fund capital to SAVR, saving millions in fees.

Who is behind Savr?

Halved fund fees are the appeal when some 20 Swedish venture capitalists launch a fund marketplace. The owners include Daniel Aarenstrup, founder of

SAVR

. He is also the CEO of the company. The initiative is backed by financial professionals and business angels such as Krister Sundling and Sebastian af Jochnick.

What is better about Savr?

What needs to be stressed is that

SAVR

has a wide range. 11 out of 12 of the funds that won the Fund of the Year award in January 2020 are on the platform. In total, there are around 1,400 funds to choose from.

It takes less than 3 minutes to open an account with a bank ID. You can start trading funds on the SAVR fund marketplace as soon as you deposit money in your account.

By far the biggest advantage of the SAVR, however, would be the low fees. In reality, these are the same costs as elsewhere, but the SAVR pays these back to its savers. This means customers can save up to 0.55% per year. It sounds like a very small amount, and it is, but with interest on interest it becomes significant money. It can therefore determine whether or not you, as a saver, get an extra boost to your pension.

SAVR’s customers

The average customer saves SEK 156,546 while the average monthly savings is SEK 1,084.

The most popular fund, TIN Ny Teknik A, is owned by 13% of all client portfolios. The other most popular funds are Robur Ny Teknik (9 percent), Spiltan Högräntefond (6 percent), Länsförsäkringar Fastighetsfond A (5 percent) and Sverigefond Småbolag C/R 4 percent.

SAVR says that the company has a new customer every ten minutes, and an ISK, Investment Savings Account, every hour. The latter type of account usually comes from Avanza https://www.valutahandel.se/goavanza/hemsida.

Deposits moved to SAVR come from

Avanza (66%)

Swedbank (8 percent)

Nordnet (8 percent)

LF Bank (4 percent)

SEB (3 percent)

Every month, 64,000 fund purchases are made through SAVR, and every day SEK 8 million in funds are received through SAVR.

Is there anything negative?

SAVR has a wide range of over 1,400 funds. The range includes funds that are not available elsewhere, such as several Vanguard funds, but is it enough? Online brokers like Avanza and Nordnet have in the past created problems for other companies trying to establish themselves in Sweden. E*trade tried to establish itself, but eventually won because the Swedish alternatives were perceived as more user-friendly.

The latest example is Dutch Degiro, which launched its trading platform a few years ago in Sweden. This company also failed to break into the Swedish market. In many cases, DeGiro offers better brokerage conditions than the Swedish online brokers. In addition, DeGiro has a platform that is much simpler than what online brokers offer.

SAVR will face the same problems in dealing with online brokers as they did with banks. When online brokers were established, many customers were not entirely comfortable leaving their bank. They preferred to have all their affairs in the same place, transaction accounts, savings, funds, etc. This pattern has largely changed, but there are still many people who find it easy to keep their investments together. They want a one-stop shop.

SAVR’s next step is to offer advice, occupational pensions and endowment insurance. This will make it easier for investors and broaden the choice. Compared to many other platforms, SAVR lacks some securities. Stocks and bonds are a few types of savings that people seek. With an absence of these options, many potential customers can.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)