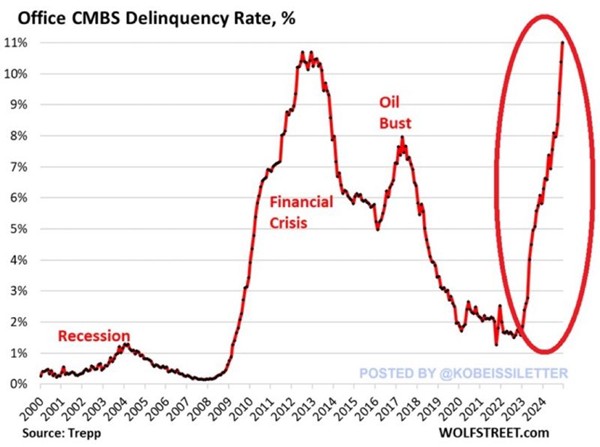

The delinquency rate on commercial mortgage-backed securities (CMBS) for offices jumped to a record 11.0% in December.

Default rates on these loans have now increased by 9.4 percentage points over the past 2 years. This places the delinquency rate above the peak of 10.7% in December 2012. Moreover, default rates on these loans are rising twice as fast as during the 2008 financial crisis. Overall, there were more than $2 billion in office loans that became newly delinquent in December 2024. The commercial real estate crisis is worsening.

Source Kobeissi newsletter

Source Kobeissi newsletter

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)