The American private investor had a return of ….

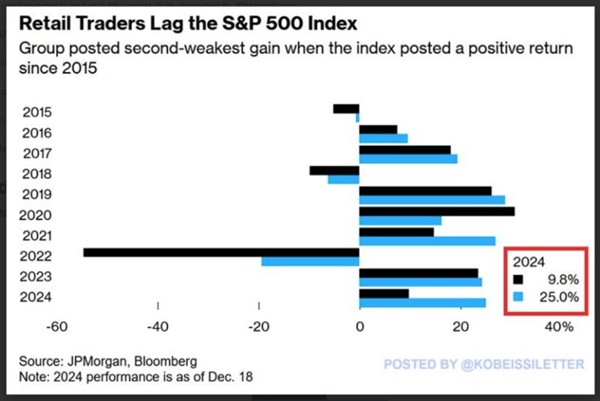

According to JPMorgan, the average retail investor is up just 9.8% year-to-date while the S&P 500 is up 26.6% (as of 12/18). This year’s private investor performance is the second-weakest of any year in which the index has posted a positive return since 2015. Private investors have underperformed the S&P 500 for the fourth year in a row. This comes as many individual investors sold their best performing assets during the August pullback including Nvidia and Tesla.

Source: JP Morgan, The Kobeissi Letter

Source: JP Morgan, The Kobeissi Letter

Viking offers price data on US stocks

Want to follow and analyze some of the biggest companies in the world? Here you can analyze the giants like Berkshire, Apple, Microsoft, JP Morgan and Google. You can do this by adding the extensions Nasdaq and NYSE, the New York Stock Exchange, from as little as $58 per month.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)