Storage rental, a specialized sector among real estate companies

Storage rentals exploded in the US during the pandemic as bedrooms became offices and basements became home gyms, leaving many items out of place. Yankees like to buy more than they can store at home – more than one in ten Americans rent storage space, according to the WSJ. On average, these customers pay $165.55 per month for their storage units. The typical customer is said to be irrational as they are willing to pay significantly more for the storage over time than the value of the stored gadgets

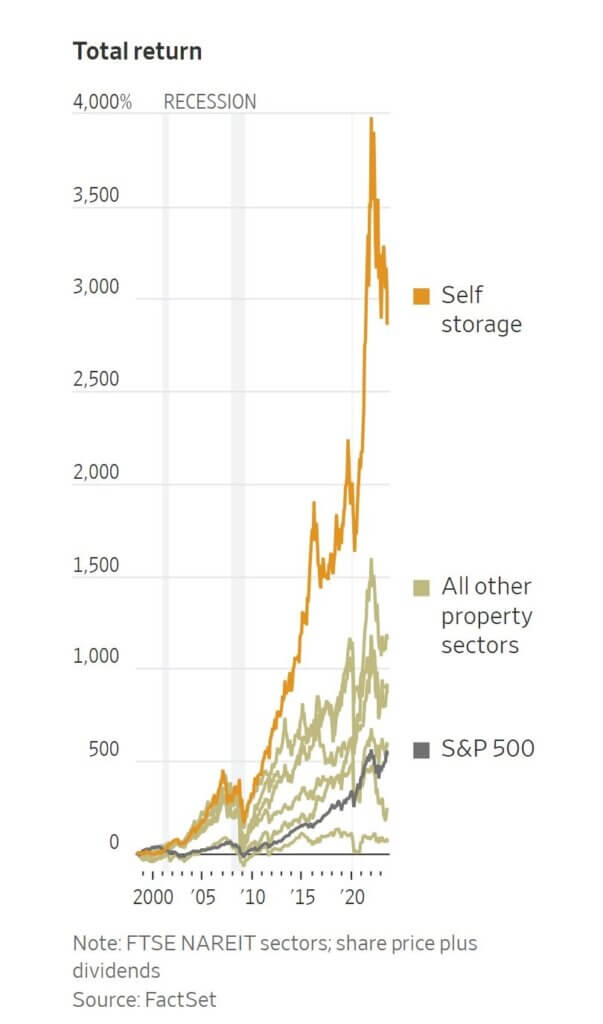

There are currently several REITs (Real Estate Investment Trusts) in the US that invest in self storage.

Public Storage

This company is traded on the New York Stock Exchange under the symbol PSA. Public Storage is the industry’s leading owner, operator and developer of self storage facilities.

Extra Space Storage

This REIT is also traded on the NYSE, with the ticker symbol EXR. Extra Space Storage is the second largest owner of self-storage stores in the US and the largest self-storage company.

National Storage Affiliates

This share is traded under the ticker symbol NSA. National Storage Affiliates is a leading self-storage operator with a unique business model for participating regional operators (PROs).

What is unique about National Storage Affiliates is that they do not consolidate their properties under a national brand. Instead, it owns, operates and manages strong regional brands. It had a dozen brands at the start of 2022, including two corporate brands and 10 participating regional operators (PROs).

National Storage Affiliate’s PRO structure encourages private self-storage operators to come under its umbrella. REITs benefit from being able to expand their portfolio while PROs absorb more of the downside risk. At the same time, PROs benefit from the scale of a larger company, the ability to maintain management and to participate in the upside. PRO may eventually sell its business to National Storage Affiliates.

Source: FactSet

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)