Stock & forex trading with mini futures vs CFDs

Before we can look at the differences between these two ways of trading, we need to see what is what. While there are a lot of similarities between these instruments, there are also major differences between them and how they are traded and priced.

What are Mini futures?

A mini future is an alternative way to invest in listed products. You can trade currencies, commodities, shares and indices. The currency, commodity or index is referred to as the underlying asset. A mini future is listed and traded on the stock exchange just like the underlying product. It is the performance of the underlying product that drives the price changes of the product of interest. Mini futures are a fast-growing investment option, listed on both NGM and Nasdaq in Sweden. The performance depends on the underlying asset and whether it is a long or short product. The main advantages you can enjoy with mini futures are potentially faster returns and the absence of the erosion effect. A mini future consists of two parts – Capital Investment and Financing. The funding is provided by the CFD issuer and it is thanks to this that the leverage exists, while the Capital Stake is simply the amount invested. Mini futures do not have an expiry date or maturity like futures do. Mini futures exist until they are sold or until their stop loss is reached. An interest rate is paid to the CFD issuer for the financing. This interest is deducted daily from the capital investment. The value of a mini future is always equal to the capital investment, which makes it very easy to see how your investment is developing.

Mini Long vs Mini Short

When trading mini futures, it is possible to make money both in a rising and falling market. Depending on your market beliefs, you can choose either a Mini Long or a Mini Short. The Mini Long is for those who believe in a rising market, price or rate, while the Mini Short is for those who believe in a falling market, price or rate (works in the same way as a “short sale”). When the underlying asset rises in value, a Mini Long (MINI L) moves positively and a Mini Short (MINI S) moves negatively. When the underlying asset falls in value, a Mini short goes positive and a Mini long goes negative. Mini futures can be traded on assets as diverse as currencies, various stock indices, commodities, bonds and individual stocks.

How does leverage affect development?

The leverage built into a mini future multiplies the performance of the underlying asset. If the leverage is 10 and the price of the underlying asset increases by one percent, it means that the value of a mini long (MINI L) will increase by ten percent while the value of a mini short (MINI S) will decrease by the same amount. The leverage of a mini futures moves during the life of the product as the underlying asset increases in value. When this happens, a mini long will have a lower leverage and vice versa. The reverse is true for a mini short.

Mini long

Underlying asset increases in value -> lower leverage Underlying asset decreases in value -> higher leverage

Mini shorts

Underlying asset increases in value -> higher leverage Underlying asset decreases in value -> lower leverage Mini futures do not have an expiration date and are therefore what is commonly referred to as open-end products. Mini futures therefore generally stay in the market until the underlying asset reaches the stop loss level or until the issuer decides to delist the security. This happens in rare cases if the issuer cannot continue trading in the underlying asset for various reasons.

Stop loss and knock

All Mini Futures have a built-in stop loss, meaning that if the price of the underlying asset falls to or below this level, the Mini Future will expire, sometimes referred to as being knocked out. The issuer will then sell the underlying asset and any residual value will be paid to the holder of the knocked-out mini future. Depending on how fast the underlying asset moves, the residual value may be SEK 0. Each mini future has a so-called stop loss buffer, which is simply the difference between a mini future’s stop loss and its funding level (the loan). Normally this buffer is between 2 and 3% above the funding level, but depending on the volatility of the underlying asset it can be higher than that.

What is residual value?

When a mini future is knocked down, any residual value can be paid out. The amount can vary and depends on the price at which the issuer managed to realize the underlying asset. In the best case, the residual value will be the difference between the instrument’s stop loss level and the funding level. In the worst case, the residual value may not be paid at all.

Trading Mini Futures

Mini Futures are listed on both Nasdaq and NGM, but an account with an exchange member is required to trade on these marketplaces.

Nordnet Mini Futures

However, we recommend CFD trading over trading Mini Futures.

CFD

CFD stands for Contract for Difference. It is a derivative instrument that gives the investor a high leverage when investing in CFDs that mirror an underlying asset, such as a futures contract. The leverage comes from the fact that the investor does not have to fund the entire amount invested, but only a certain percentage of it. Instead, the investor benefits from the entire price change in the contract. CFDs can be traded both bullishly and bearishly, i.e. used by both those who speculate on a rise and those who want to speculate on a fall. The leverage is high, but so are the risks in this form of investment, which is why you should do your homework before investing real money in it. As the name suggests, a CFD is a contract between two parties where investors can bet on changes in the price of an underlying share, commodity or index. CFDs are derivatives, so investors do not invest in the share, index or commodity on which the CFD is issued. Instead, they invest in a contract with an issuer. This is because Contract for Difference are usually traded over the counter (OTC), meaning that trading and price formation occurs between investors and individual CFD providers rather than on an exchange. With an OTC derivative contract, the two counterparties are forced to take risk on each other. If one investor is unable to pay, this can affect all other clients who have positions with that derivatives provider. A counterparty is, as the name suggests, a company or firm on the other side of a financial transaction. When you buy or sell a CFD, the only asset you are trading is a contract issued by the CFD provider, so the CFD provider acts as your counterparty. This is because a CFD is essentially a contract between the trader and the issuing CFD broker, meaning that the contract can only be closed out with the counterparty that issued the contract. In addition to the CFD provider, trading CFDs also exposes the trader to the provider’s other counterparties, including other clients and other companies that the CFD provider deals with. Additional risks for both investors and traders in OTC derivatives include whether the derivatives provider hedges its exposures effectively, the quality of its compliance procedures and its overall risk management. When any of these potential risk exposures translate into actual problems, investors cannot simply transfer their over-the-counter derivatives to other parties. Even in good market conditions, inadequate risk management and clearing processes can still lead to a provider encountering difficulties. CFDs are synthetic, derivative instruments that require responsible risk management by the CFD provider you trade with. While this is true for all trading instruments, the excessive nature of the CFD market, as well as the fact that there is no real underlying asset being acquired to which legal ownership can be transferred, makes counterparty risk a risk factor. The trade is hard enough and you cannot afford to have any counterparty risk. You should have no doubts about the financial standing of your CFD provider.

Now, when you consider how even the largest financial institutions have struggled to survive in the current economic climate, you have to think twice about the counterparty and client risks when trading CFDs with companies that are smaller and unknown. At Valutahandel.se, we are careful to do proper due diligence on the companies that we write about, or even mention on our site. The simple truth is that once you fund your CFD account, you become an unsecured creditor in most cases. In other words, you have to trust your CFD provider to stay in business. Many CFD brokers are market makers, which means that your counterparty, i.e. the entity that takes the other side of the trade is your CFD provider, which means that the CFD provider can bet directly against the trader. A number of companies will say this is not true because they hedge all trades, go ahead and read their company disclosure statements. They will say that they are not obliged to hedge client positions and that they do not have to inform you if they hedge. You will also read a clause about their conflict of interest, that they may take positions that are opposite to yours and be in competition with your interests. You then have to click on something that says you understand all this, even if you don’t. Surely this is not supposed to happen. CFD providers are supposed to cover all their positions by buying or selling the underlying stock. This makes them neutral with respect to the trading client and whether the stock goes up or down. They make money on the spread, the difference between the buy and sell prices. But with competition, as traders shop around to find the lowest prices, there is pressure on CFD brokers to find ways to increase their profits. One obvious way is to take the opposite side to the trader when it seems appropriate. Effectively, the CFD brokers are taking their own view of the direction of the market and making money when they are right and the trader is not. The other big problem is the risk that unprotected CFDs pose to the rest of the market. Many CFD companies insist that they hedge their positions by buying the underlying asset but this seems unlikely to be true in all cases. The profit margins would be too small for the CFD provider to stay put. In the current economic climate, it may be a choice by the dealer to do this or risk going under. One of the problems that can arise from this pressure on the broker, if they have a dealer desk, is that they can be accused of rigging the prices, perhaps spiking the price in a way that is not widely seen to take out a trader with a stop loss order. The dealer is open to this accusation if they have acted questionably, simply because of the set up. Given that many clients of CFD firms do not make money, these people would be eager to find someone to blame for their failure. The collapse of MF Global 2011, the eighth largest bankruptcy in US history. MF Global traces its roots to the sugar trading business started by James Man in England in 1783, which evolved into broader commodities trading before later transforming into a financial services firm during the 1980s specializing in commodity futures trading.

The company’s bankruptcy highlights the broader issues of client and counterparty issues. When the company ceased trading, the message sent to existing clients with open positions was simple; liquidate long positions and close short trades. This is dangerous because leveraged positions can typically require a fair amount of cash to liquidate. Clients who wish to continue may be able to open or transfer their positions to a competing provider but this involves significant hassle and uncertainty; let alone the certainty that your transactions will be honored. Take the time to do your due diligence and ask relevant questions about your CFD provider. Particularly important is to get answers to the question of whether client funds are pooled or segregated? What happens to this money if there is a default? In terms of counterparty risk, who owns the company they are trading with, what is their financial position and what is their business model? This is the fine print that traders and investors need to be spelled out in plain language, not buried in the back of a legalistic product disclosure statement. In any case, it is possible to reduce your counterparty risk when trading CFDs by choosing a broker that has market connections and does not bear the risk entirely yourself. This is known as DMA (Direct Market Access) and which allows traders to trade directly on the electronic stock market. This may cost money for the price flow, but on the other hand can provide better bid-offer prices. You will also find that the execution speed is usually better. One possible disadvantage of the DMA setup is that you will not be able to get guaranteed stop losses with the market. Guaranteed stop losses are only available due to dealer intervention in the price, as a normal stop loss order simply becomes a market order when the price is reached without guaranteeing what level it will be filled at. However, you are paying for guaranteed stop losses, even if they are not needed or used, so you may not want them as part of your trading plan. The success of CFD trading doesn’t just depend on finding the right market direction. When you trade CFDs, you rely on the CFD broker to execute your trades, make payments owed to you while your trades are open, credit any proceeds of profitable trades to you, and pay you money out of your CFD trading account when you ask for it. There is also a fundamental difference between buying shares and trading CFDs for CFDs you are basically buying a promise from the issuing company, let’s say CMC Markets. CFDs issued by CMC Markets cannot be sold by any other CFD company, and if CMC Markets was shut down my investment in their CFDs would be worthless.

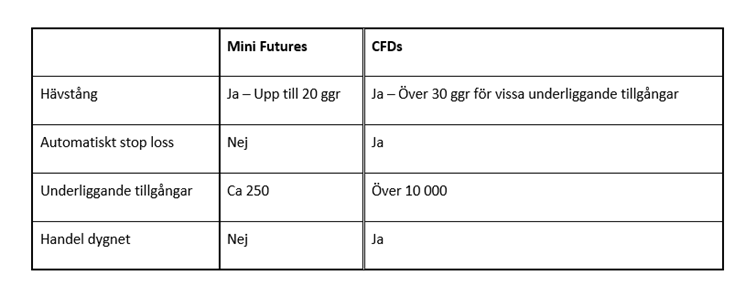

Comparison Mini Futures and CFDs

Mini Futures summary

Mini Futures summary

Capital Stake – the investment and price of the Mini Futures Financing – the issuer’s portion of the stake for which the buyer pays interest and is the reason for leverage Leverage – the issuer’s portion of the stake, i.e. the financing that allows for more extreme increase/decrease on the investment Mini Long – for those who believe in rising prices Mini Short – the issuer’s portion of the stake believes in falling prices Risk – Mini Futures is a high risk investment, always keep this in mind when trading Mini Futures.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)