S&P 500 a dance with tech giants

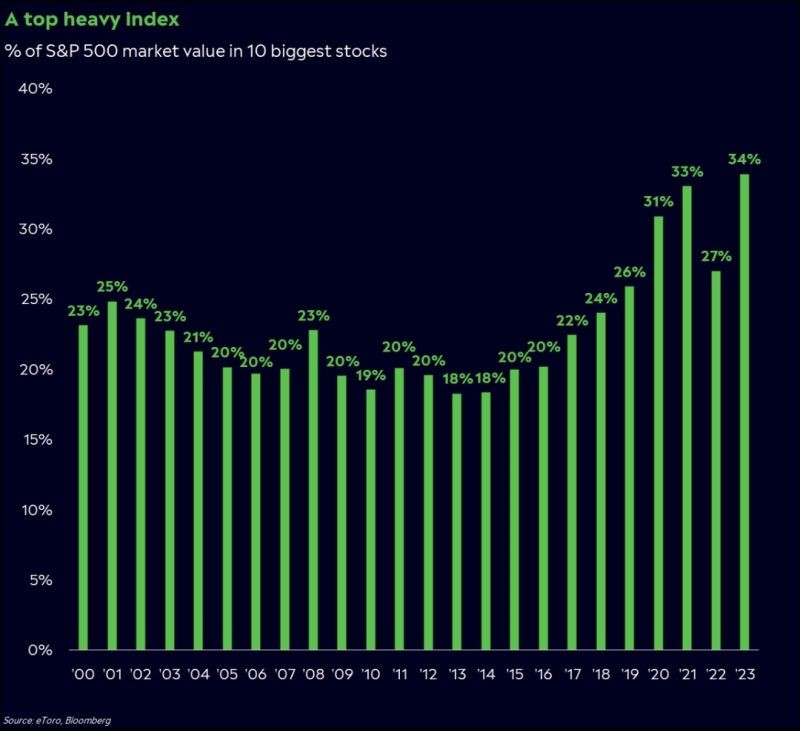

In finance, a ‘top-heavy’ index refers to a situation where a small number of large companies hold a significant share of the total value of a stock market index. An example of this is the S&P 500 which is a dance of technology giants.

These heavyweight companies have a strong influence on the overall performance of the index. Their success or failure can change the direction of the whole index, much like a seesaw tipping under the weight of one side.

The S&P 500, a popular stock market index, is often considered top-heavy. This is largely due to the outsized influence of a handful of tech giants. These companies have experienced massive growth over the years, becoming some of the most valuable companies globally. As a result, they have a significant share of the total market capitalization of the S&P 500. The performance of these technology giants therefore has a major impact on the overall performance of the S&P 500.

When these companies do well, the S&P 500 tends to rise. Conversely, if these tech companies experience a downturn, they can drag the entire index down with them. However, it is important to remember that while these tech giants have a significant influence, the S&P 500 is still a broad index consisting of 500 large companies in different sectors.

Hence the result of the other companies also contributing to the overall movement of the index (albeit to a lesser extent than the tech heavyweights of late!). Where do you see the tech sector heading?  Source: eToro, Bloomberg

Source: eToro, Bloomberg

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)