Sinch in focus – this week’s analysis by StockCharts365.com!

Sinch is an exciting technology company on the Nasdaq Stockholm stock exchange!

The company that StockCharts365.com has taken a closer look at this week is the Swedish technology company, Sinch (ticker on the Stockholm Stock Exchange: SINCH). The Sinch share has had a tough few years on the Stockholm Stock Exchange, falling from a peak of around SEK 200.00 in August 2021 to around SEK 14.00 in September 2022.

The share is currently trading at around SEK 25.00, and the company has a market cap value of around SEK 21.4 billion.

Read more below about StockCharts365.com analysis of Sinch.

First, a brief description of Vikingens Investeringsskola

Vikingen Investment School’s holdings week 33

There is great uncertainty on the world’s stock markets.

It is likely that interest rates will be lowered even further in September, which will stimulate an increase in the equity markets i during October.

We follow the English expression right now “When in doubt – stay out” and wait.

We have the following holdings, but are not making any new investments at the moment.

Per Aarsleff Holding we choose to retain MPC Container Ships we choose to retain NVIDIA we choose to retain

It was the investment school of the week. Feel free to give us feedback and follow us on FB and/or Linkedin.

Vi ser frem til å høre fra deg!

Could there be a major short squeeze soon in Sinch AB (SINCH)?

Is Sinch facing an imminent turnaround? This could lead to a sharp rise in the share price within a short period of time.

According to an overview from 09. August 2024, Sinch AB (SINCH) was number 10 of the 15 most shorted shares on the Stockholm Stock Exchange. Source.

Below is information about the company Sinch AB (SINCH)

This is how Sinch describes themself:

“Pioneering the way the world communicates”

At Sinch, we dream big and we make big things happen – for our teams, our customers and their customers.

Driven by bold ambition and simplicity, we’re pioneering the way the world communicates, helping people and businesses build stronger connections and paving the way for what’s next in cloud communications.

Sinch is pioneering the way the world communicates.

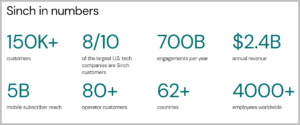

More than 150,000 businesses – including many of the world’s largest technology companies – rely on Sinch’s Customer Communications Cloud to improve the customer experience through mobile messaging, voice and email.

Our shares are listed on Nasdaq Stockholm under the ticker ‘SINCH'”.

For more information about the company, visit their websites here and here.

Technical Analysis of Sinch AB (SINCH)

After a very sharp decline from August 2021 to September 2022, where the share fell from around SEK 200.00 to around SEK 14.00. Today, the share is trading at around SEK 25.00. Over the past two years or so, the share has established a very large Symmetrical Triangle formation. A break upwards from this large symmetrical triangle formation would trigger a strong technical buy signal for the stock. Looking at the shorter term, the stock has broken upwards from a falling wedge formation, and also seems to be about to break above both the 50-day and 200-day moving averages.

There is significant technical support for the stock around the SEK 24.00 – 25.00 level, including technical support down towards the 50-day moving average.

The BEST model in Vikingen is also in a buy signal for the Sinch stock. This popular and effective model was developed by Peter Östevik. He finalized the BEST model around 2019, and after 30 years of experience with technical analysis and Vikingen Financial Software.

Great potential possible for Sinch

Although a strong technical buy signal has not yet been triggered for the Sinch share, StockCharts365.com believes that this is a stock that may be worth keeping a close eye on moving forward. Should there be a break upwards from this large symmetrical triangle formation, the blue dotted lines indicate the potential for the stock. The potential for the share would then be around SEK 100.00 – 120.00 in 1-2 years’ time. In other words, a significant potential will then be triggered for the share, which is currently trading at around SEK 25.00.

What could potentially trigger negative technical signals for the stock would be an established break downwards below the SEK 24.00 and 21.00 levels. This would then trigger a technical sell signal for the stock.

So to summarize this week’s analysis of StockCharts365.com: Keep an eye on Sinch as the company may offer positive surprises further down the line.

What is Vikingen Investment School?

Vikingen Investment School started 13.

May 2024.

We have chosen to invest SEK 10,000 and hope that you will join us to learn how to get rich(er) in the stock market.

Our ambition is that you will want to join us on our journey from beginner to experienced investor.

If you have more than SEK 10,000 to invest, it’s of course even more interesting, but the principles are the same.

Since 10/6, we’re adding even more value to the blog by adding “Analysis of the week” from StockCharts365. com.

Vikingen Financial Software shows the way!

Through Vikingen Financial Software and our mentor Peter Östevik, we at Vikingen Investment School select the shares/other investment objects that are most worth buying here and now.

Vikingen Financial Software would like to remind you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely, Catrin Abrahamsson-Beynon