Participants in the foreign exchange market

There are different players in the foreign exchange (Forex) market and all are important in one way or another. In this chapter, we look at each of them and describe their main attributes and responsibilities in the overall foreign exchange market.

Interestingly, internet technology has really changed the existence and way of working of Forex players. These players now have easier access to data and are more productive and fast in offering their respective services.

Capitalization and sophistication are two important factors in categorizing FX market participants. The sophistication factor includes money management techniques, technical level, research skills and discipline. Given these two broad measures, there are six major FX market participants.

– Commercial and investment banks

– Central banks

– Companies and businesses

– Fund managers, hedge funds and sovereign wealth funds

– Internet-based trading platforms

– Online broker-dealer

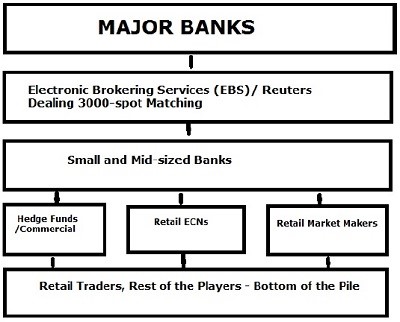

The following figure shows the top-to-bottom segmentation of FX market participants in terms of the volume they handle in the market.

Commercial and investment banks

Banks need no introduction, they are ubiquitous and numerous. Their role is crucial in the Forex network. Banks participate in foreign exchange markets to neutralize their own and their clients’ currency risks. Banks also try to multiply the wealth of their shareholders.

Each bank is different in terms of organization and working policies, but each of them has a desk responsible for order processing, market making and risk management. The trading desk has a role in making money by trading currencies directly through hedging, arbitrage or mixed financial strategies.

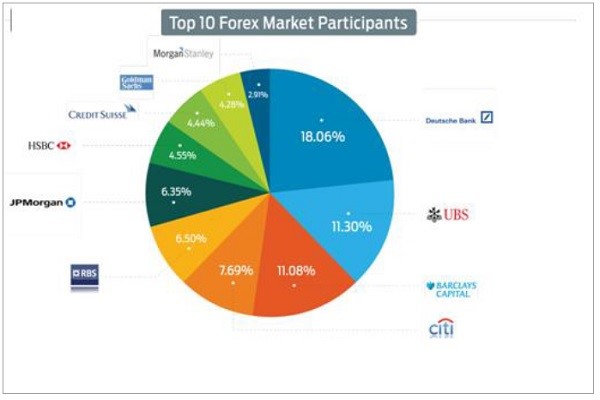

There are many types of banks in a foreign exchange market; they can be huge or small. Most large banks trade in large amounts of funds that are traded at any time. It is a common standard for banks to deal with 5 to 10 million dollar packages. The largest ones even handle 100 to 500 million dollar packages. The following image shows ten of the largest participants in the foreign exchange market.

Central banks

Central banks

A central bank is the dominant monetary authority for a nation. Central banks follow individual economic policies. They are usually under the authority of the government. They facilitate the government’s monetary policy (keeping the supply and demand of money in check) and make strategies to smooth out the ups and downs of their currency’s value.

We have previously discussed about the reserve assets. Central banks are the bodies responsible for holding foreign currency known as ‘reserves’ or sometimes ‘official reserves’ or ‘international reserves’.

The reserves held by the central banks of a country are used to manage foreign policy. The reserve ratio indicates significant attributes about a country’s ability to pay foreign debts. It also affects the nation’s credit rating actions. The following image shows the central banks of different European countries.

Company

Not all participants involved in the foreign exchange market have the power to set prices for the currency as market makers. Some of the players only buy and sell currency at the prevailing exchange rate. They may not seem very significant, but they make up a large part of the total volume traded on the market.

There are companies and businesses of different sizes; they can be a small importer/exporter or a tangible influencer with a multi-billion dollar cash flow. These players are identified by the nature of their business policies which include:

(a) how they obtain or pay for the goods or services they usually provide; and

(b) how they engage in business or capital transactions that require them to either buy or sell foreign currency.

These ‘commercial traders’ aim to use financial markets to offset their risks and hedge their activities. There are also some non-commercial traders. Unlike commercial traders, non-commercial traders are considered speculators. Non-commercial actors include large institutional investors, hedge funds and other business entities that trade in the financial markets for profit.

Fund managers, hedge funds and more

This category is not involved in defining prices or controlling them. They are basically asset managers. They can trade hundreds of millions of dollars worth of currency, as their portfolios of investment funds are often quite large.

These participants have management rules and obligations towards their investors. The main purpose of hedge funds is to make profits and grow their portfolios. They want to achieve absolute returns from the Forex market and dilute risk. Liquidity, leverage and low costs of creating an investment environment are the advantages of hedge funds.

Fund managers invest mainly on behalf of the various clients they have, such as pension funds, individual investors, governments and even central bank authorities. Wealth funds managing government-sponsored investment pools have grown rapidly in recent years.

Internet-based trading platforms

The internet is an impersonal part of foreign exchange markets today. Internet-based trading platforms do the task of systematizing customer/order matching. These platforms are responsible for being a direct access point to collect pools of liquidity.

There is also a human element to the mediation process. It covers all persons involved from the moment an order is entered into the trading system until it is processed and matched by a counterparty. This category is handled by straight-through-processing (STP) technology.

Like the prices on a Forex broker’s platform, many interbank trades are now handled electronically by two primary platforms: the Reuters web-based trading system and Icap’s EBS, which is short for “electronic brokering system” that replaces the brokers once common in the forex markets.

Online brokers

The last segment of the Forex markets, the brokers, are usually very large companies with large trading revenues. These companies provide the basic infrastructure for ordinary individual investors to invest and make money in the interbank market. Most of the brokers are considered to be retail marketers. In order to offer competitive and popular two-way pricing model, these brokers usually adapt to the technological changes available in the Forex industry.

A trader needs to produce profits independently when using a market maker or having a convenient and direct access through an ECN.

The Forex broker-dealers offset their positions in the interbank market, but they do not act exactly the same way as the banks do. Forex brokers do not rely on trading platforms like EBS or Reuters Dealing. Instead, they have their own data feed that supports their pricing engines.

Brokers usually need a certain pool of capitalization, legal business agreements and simple electronic contacts with one or more banks.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)