Norwegian stock market dominated by energy, shipping and fishing

The Norwegian stock exchange, Oslo Børs, is uniquely positioned for companies in the energy, shipping and fishing sectors. Companies in these sectors turn to the Norwegian stock market to raise capital, access liquidity for their shares and benefit from a range of world-leading investment research available in Oslo. Investors interested in these sectors look to the Oslo market for access to high quality Norwegian and international companies.

Energy

Norway is the world’s third largest natural gas exporter and the fifth largest oil exporter, making it a leader in energy production and trade. In terms of the number of listed companies, the Oslo Stock Exchange is the second largest in Europe for energy companies in general and the second largest in the world for companies in the oil services sector in particular.

Maritime transport

Norway is currently the fifth largest shipping nation in the world. In terms of the number of listed companies, Oslo is the largest shipping securities market in Europe, and the second largest globally.

Fishing

Norway is the world’s second largest exporter of fish and other seafood products. Oslo Børs is the world’s largest and most important financial market for the seafood sector. Oslo Børs ASA is Norway’s only regulated marketplace for trading in shares, equity certificates and other securities, such as derivatives and bonds. In 2019, Oslo Børs became part of Euronext, and has been marketed as Euronext Oslo Børs since June 2024.

History

The Oslo Stock Exchange was established by a separate law on September 18, 1818, then under the name Christiania Børs. It was designed to give merchants a place where they could meet and trade news and commercial goods, such as timber. It wasn’t until 1881 that it became an official stock exchange and began listing and trading securities. The exchange changed its name to Oslo Børs in the early 1900s. Trading on the Christiania Børs started on April 15, 1819, but it was not until March 1, 1881 that stock trading began, with 16 series of bonds and 23 shares, including Norges Bank, being admitted to trading. The Oslo Stock Exchange was the first Norwegian stock exchange to be established, but it was quickly followed by local exchanges in Trondheim (1819), Bergen (1837), Kristiansand (1837), Drammen (1839), Stavanger (1878), Kristiansund (1894), Skien (1895), Ålesund (1905), Sandefjord (1912), Haugesund (1914) and Fredrikstad (1921). However, Oslo Børs has always had the main market for listed shares and bonds, the local exchanges were usually devoted to foreign exchange and commodity trading, although they also had some stock exchange activities. After the First World War, the Oslo Børs became the only stock exchange with any significant share trading. As of September 2024, there were 332 companies’ shares listed on the Norwegian stock exchange. Trading on the Oslo Stock Exchange takes place in Norwegian kroner. As brokerage firms grew in popularity in Norway in the late 1990s, traders lost the need to meet in person to facilitate their transactions. As a result, OSL went private and became a limited company in 2001. Oslo Børs VPS Holding ASA, which was formed as a result of the merger of Oslo Børs and VPS Holding, officially took over ownership of the exchange in 2007. Oslo Børs cooperates on trading systems with the London Stock Exchange, among others. It also cooperates with the Singapore and Toronto (Canada) stock exchanges on secondary listing of companies. As part of an effort by Nordic exchanges to attract more international investment, the Oslo Stock Exchange joined the NOREX alliance in 2000. NOREX also includes the exchanges in Stockholm, Copenhagen and Iceland, and provides a common trading platform and streamlined rules for participants.

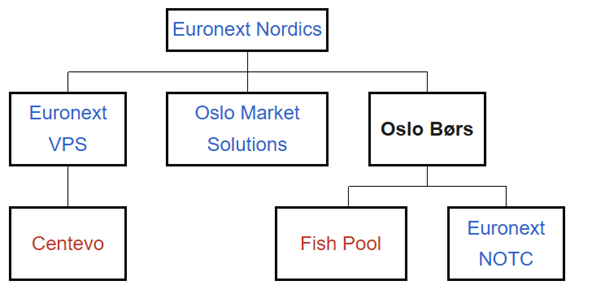

Business structure

In 2006, Oslo Børs bought 50% of the shares in NOTC, the Norwegian marketplace for unlisted shares. In 2017, Oslo Børs bought out Verdipapirforetakenes Forbund, making it wholly owned. In 2012, Oslo Børs bought around 71% of the shares in the fish derivatives exchange Fish Pool, and as of 2020 owns around 97% of the shares. Nasdaq and Euronext both made competing bids to take control of the Oslo Stock Exchange in an attempt to expand their global footprint. Although the exchange’s major shareholders supported the Nasdaq bid, it was withdrawn in May 2019 after the country’s finance ministry approved a competing bid by Euronext. The acquisition was completed in June 2019 when Oslo Børs VPS became part of the Euronext group. In 2021, Euronext sold Oslo Market Solutions to focus on the group’s core business.

Marketplaces

Marketplaces

Euronext Oslo Børs offers listing and trading of equities, equity certificates, ETPs, fixed income and derivative products on four different marketplaces: Euronext Oslo Børs (main list), Euronext Expand Oslo, Euronext Growth Oslo and Nordic ABM. Euronext Oslo Børs is the largest marketplace, often referred to as the main list, where equities, equity certificates, ETPs (exchange-traded funds and debt securities), derivatives and fixed income are listed and traded. Euronext Expand Oslo was established in May 2007, under the name Oslo Access, as an alternative to the main list Euronext Oslo Børs. Euronext Growth Oslo was established in 2016 under the name Merkur Market, and is a so-called multilateral trading facility, where the regulatory framework is less extensive than for companies listed on Euronext Oslo Børs and Euronext Expand Oslo. Nordic ABM was established in June 2005 as an alternative marketplace for fixed income securities.

Euronext Oslo Stock Exchange

Euronext Oslo Børs is the marketplace often referred to as the main list. This is a regulated marketplace and the majority of share trading on Euronext Oslo Børs takes place here.

Euronext Expand Oslo

Euronext Expand Oslo is a regulated and authorized marketplace under the supervision of Oslo Børs. The purpose is to have an offer to companies that do not have the history or size required for the main list Euronext Oslo Børs, but still give them the benefits achieved by having shares listed on a regulated market. Euronext Expand Oslo is intended for companies that want to be listed on a regulated marketplace, but do not meet the requirements for listing on Oslo Børs. The main target group is companies that do not meet the requirements for three years of operation, but the marketplace can also be an alternative for companies that do not have enough shareholders to be listed on Euronext Oslo Børs. Euronext Expand Oslo is authorized by the Ministry of Finance to operate as a regulated marketplace for share trading in Norway. Broadly speaking, the same legislation applies as for the main list Euronext Oslo Børs. The first day of operation of Euronext Expand Oslo was May 2, 2007.

Euronext Growth Oslo

Euronext Growth Oslo is a multilateral trading facility (MTF) created by Euronext Oslo Børs. Both the admission requirements and the ongoing reporting obligations after admission are simpler and less extensive than on Euronext Oslo Børs and Euronext Expand Oslo.

Nordic ABM

Nordic ABM is a list for the listing of bonds where Euronext Oslo Børs determines the rules after consultation with market participants. Nordic ABM is not a regulated market or multilateral trading facility subject to regulation under the Stock Exchange Act or the Securities Trading Act. Oslo Connect is an OTC derivatives marketplace that is regulated as a multilateral trading facility. Participants in Oslo Connect must enter into an agreement with Oslo Børs and a cooperating clearing house.

Stocks

In Norway, a public limited company (ASA) can be listed on the Euronext Oslo Børs marketplaces. It is up to the company itself to apply for listing, but the company must meet the applicable requirements, which include number of owners (spread), number of shares, market capitalization and history. It should be noted that the Exchange imposes strict requirements for the treatment of confidential information and the publication of inside information, among other things. Companies that meet the requirements for listing will have much easier access to capital through issues. Many investors invest exclusively in securities listed on a stock exchange. Such securities are easier to sell. The OBX index consists of the 25 most traded shares listed on the Oslo Stock Exchange. The OBX index is tradable, meaning you can buy and sell listed futures and options on the index. In other words, you can get the same exposure by buying one index product as you would if you bought all the (weighted) shares in the index. The ranking is based on a six-month turnover period and the index is adjusted every third Friday in June and December. OSEBX – Oslo Børs Benchmark Index, also known as the main index, is an investable index that includes the largest and most traded stocks among the companies listed on the Euronext Oslo Børs main list. OSEBX and OBX are indices that are part of the OBX® family and are revised in March and September each year.

Derivative

Derivatives were first listed on Euronext Oslo Børs on May 22, 1990.

Currency

Until 1991, currencies were exchanged on Euronext Oslo Børs. Today, foreign exchange trading takes place at Norges Bank.

Is the Oslo Stock Exchange an EU-regulated market?

Yes, as the Oslo Stock Exchange is owned by Euronext and operates in the EU market, it is EU-regulated. However, unlike Euronext’s other exchanges, the Oslo Stock Exchange is not an emerging market for small or medium-sized enterprises (SMEs). SME markets are designed to provide benefits to companies that would not otherwise meet the criteria for access to Euronext’s regulated markets.

How do I buy Norwegian shares?

The best way to buy Norwegian shares is to trade on the Oslo Stock Exchange. Norwegian shares can be traded through most Swedish banks and Internet brokers, such as DEGIRO, Nordnet, Aktieinvest and Avanza. You can also trade Norwegian shares on markets in the United States by buying something called an American Depositary Receipt (ADR). An ADR is a certificate you buy on a US stock exchange that represents a specified number of shares of a foreign company’s stock. As of May 12, 2022, there were only three Norwegian companies with ADRs listed on U.S. exchanges: Equinor (EQNR), Idex Biometrics (IDBA) and Opera (OPRA).

Summary

Although Norway is not an EU member nation, the company that owns the Oslo Stock Exchange, Euronext, has its headquarters in Amsterdam. The Oslo Stock Exchange is a regulated EU market and is Norway’s only regulated exchange, covering around 340 companies and a number of other financial instruments.

Viking offers price data on Norwegian shares

Norwegian Stock Exchange, Want a better overview of stocks from Norway? Here you will find popular companies like Statoil and Norwegian. You can do this by adding the extension Norwegian shares from as little as 78 kroner per month.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)