Michael Burry’s third largest stock position rose 18% in one day.

Earlier this year, the investment world was stunned when legendary investor Michael Burry, known for his lucrative

“Big Short”

against the housing market in 2008, made another bearish bet, this time targeting US stocks. Last week he made a really good deal, with the share price rising by 18% in one day.

Meanwhile, regulatory filings revealed various other moves made by Burry and his hedge fund, Scion Asset Management, in the stock market. Notably, they increased their holdings in travel and healthcare companies, including Expedia (NASDAQ: EXPE).

While this may not have been a shocking move given Expedia’s prominence in the travel technology sector, it is proving to be an increasingly wise decision for Burry and Scion’s customers.

EXPE share reaches three-month high

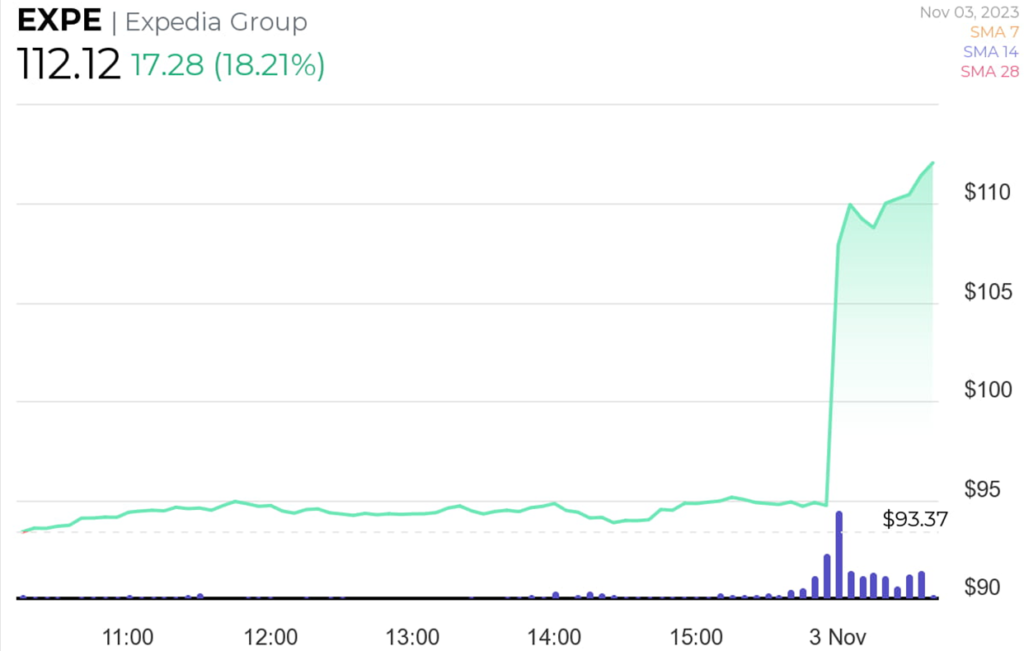

On Friday, November 3, Expedia’s shares rose more than 18 percent on the open market to $112.12, the highest level since early August.

EXPE 1-day daily chart

EXPE 1-day daily chart

Notably, Finbold reported earlier this month that Expedia’s stock was well positioned to attract investor attention after recent data pointed to a resurgence in travel demand ahead of the winter holidays.

The rise was mainly driven by an impressive earnings beat in the third quarter and record revenues.

The travel company reported an adjusted profit growth of 33 percent to USD 5.41 per share, while revenues reached a record high of USD 3.93 billion per quarter. The figures were well above analysts’ expectations for earnings per share (EPS) of USD 5 and revenues of USD 3.68 billion.

“Our strong third quarter performance with record revenues and profitability came ahead of our guidance and reflects the resilience of travel demand.” – Expedia CEO Petern Kern said.

In addition, Expedia announced a new $5 billion share buyback plan, which further lifted investor sentiment towards the stock. That represents a significant figure, given that the company’s total market capitalization currently stands at around $16 billion.

Burry’s investment in EXPE

The regulatory filings published in mid-August revealed that Burry and his Scion Asset Management bought 100,000 Expedia shares for $109.39 each. The investment made EXPE Burry’s largest single shareholding.

This means that after Friday’s price rise, Burry’s profit from his long position in EXPE amounts to more than $3 million.

Besides EXPE, other notable stocks Burry invested in during Q2 2023 include Charter Communications (NASDAQ: CHTR), Generac Holdings (NYSE: GNRC), Geo Group (NYSE: GEO ), and Vital Energy (NYSE: VTLE), among others.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)