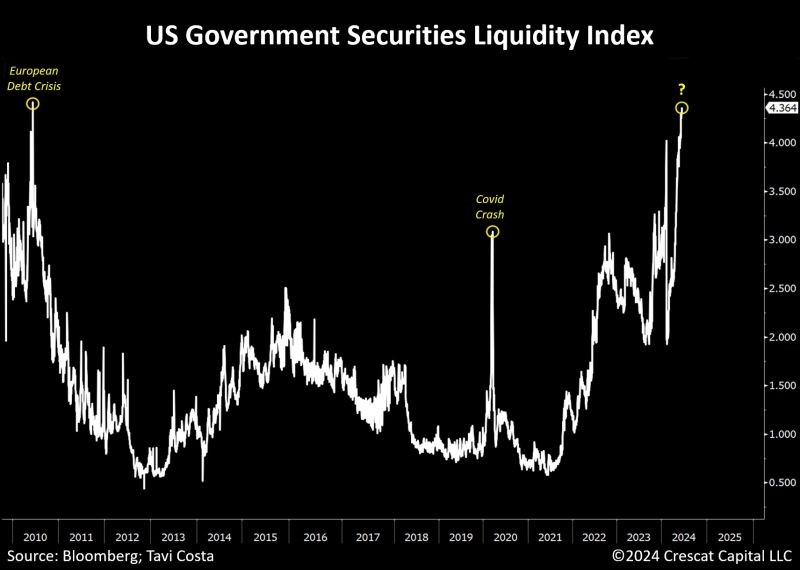

Liquidity in US government securities deteriorates sharply

The liquidity index for US government securities is deteriorating significantly, now at the worst levels since the European debt crisis in 2011. Notably, it is already more severe than the environment during the Covid crash of 2020.

What is even more alarming today is that all this is happening while the US currently has one of the largest interest rate spreads compared to other developed economies in history, but liquidity seems to be eroding.

This situation sets the stage for the US to experience its own ‘Bank of England moment’ as we approach elections.

In September 2022, UK interest rates saw one of the sharpest increases in history following the announcement of £45 billion in unfunded tax cuts, raising concerns about increased borrowing needs and debt sustainability.

Does this scenario sound familiar to American politicians?

We are facing one of the worst fiscal imbalances in history in the midst of an inflationary environment with declining demand from foreign central banks relative to government bond issuance.

At the same time, 60/40 portfolios are starting to realize the need to go back to other defensive allocations – with gold and other hard assets potentially playing an important role as second refuge options.

About the Vikingen

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)