Is it better to trade the commodity companies than the commodity directly?

After 2022, a year that produced the worst return for a “60/40″* balanced portfolio since 1942, it is natural for investors to start looking for an alternative to stocks and bonds. Through this search for alternative asset classes, several of our clients have turned to us with questions about commodity investments. Although commodities are a common topic in the media, investing in them requires a different analysis than investing in stocks and bonds. We would like to discuss our current views on commodity investment in this strategic view, including by looking at commodity companies in relation to direct commodity investment.

* We define “60/40” here as a portfolio consisting of 60% large caps and 40% 10-year US Treasury bonds.

Diversification benefits of commodities

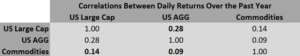

The main benefit of commodity investment, in our view, is diversification. The commodity space contains four main sectors: energy, agriculture, industrial metals and precious metals. A diversified basket of these commodities tends to have long-term returns that differ from stocks and bonds. Below is a table of daily return correlations** between the price returns of US large cap stocks, US bonds and commodities, looking back over the last twelve months.

** We define correlation here as the degree to which two sets of price data are related to each other; for example, a correlation close to 1.0 would imply an extremely strong relationship, meaning that these two investments would have returns of similar magnitude for a given period, while a low correlation close to 0.0 would imply close to no relationship, meaning that their returns are unrelated, in our view.

Source: Vikingen.se. Dates on 6 February 2023. Shown for illustrative purposes only. Past performance is no guarantee of future results. In the chart above, ETFs are used to replicate benchmark indices and are for information purposes only.

Over the past year, commodity investments have had a low correlation to both bonds and equities. This low correlation can be seen in the table above. For example, commodities are only slightly correlated to the S&P 500, as can be seen by the correlation ratio of 0.14. Importantly, this correlation is lower than the statistical correlation between stocks and bonds, at 0.28. We believe that this correlation shows that commodities can be an additional source of diversification in a portfolio of stocks and bonds. Over the past five years, commodities have been more closely correlated with equities than bonds.

The four trade-offs of commodity investment

There are two main instruments for gaining investment exposure to commodities: direct investment and equity investment. Direct investment in commodities for most people is a bit of a misnomer; most commodity investors use futures contracts and do not usually receive physical commodities.

Futures contracts are preferable to some investors because the delivery and storage of physical goods requires a lot of logistics and physical space, making it costly for investment purposes. However, this form of investment differs from buying shares in commodity-related companies, whose revenues and profits are affected by commodity prices. In deciding between these two types of investment, we believe there are four main trade-offs to consider.

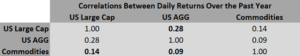

1. Direct investment provides more diversification. The first trade-off concerns the diversification effect of investments. As can be seen in the table below, both physical commodities and commodity-producing equities offer diversification benefits relative to equities. While direct investment in commodities provides the lowest correlation (0.14) to equities, it comes with its own disadvantages as discussed below.

Source: Vikingen.se. Dates on 6 February 2023. Shown for illustrative purposes only. Past performance is no guarantee of future results. In the chart above, ETFs are used to replicate benchmark indices and are for information purposes only.

2. Unlike direct investment in commodities, equity investment can generate cash flows. Since equity investments are in companies rather than the commodity itself, there is an associated cash flow with these investments that can be analyzed and potentially unwound. In particular, several of these companies return cash flows to shareholders in the form of both dividends and share buybacks, a function that we believe is particularly important in the current investment landscape. On the other hand, direct commodity investments are usually non-cash generating. For an investor who needs his portfolio to produce consistent income, this can be a major disadvantage for direct commodity investments.

3. Direct investment through futures can be complicated. One of the complications of direct commodity investment is that it has to be done through the futures markets. In its simplest form, a futures contract is the agreement to buy or sell a commodity at a specific price on a fixed date in the future. What makes forward investing difficult is the fact that forward prices can vary significantly from the current (spot) price of the commodity. In essence, the futures price may have already incorporated a significant rise (or fall) in commodity prices. Therefore, investments in commodity futures may not lead to investment success even if the investor correctly predicted the direction of the spot price.

4. Taxes and structure can be more complex for FDI. Since direct investments are achieved with futures, there are tax complications with them.

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed Comparison – Stock exchange software for those who want to become even richer (vikingen.se)