In this week’s Analysis – A global leader in clean energy solutions!

Aksjeanalyser.com takes a closer look at Hexagon Composites

(HEX) on the Oslo Stock Exchange

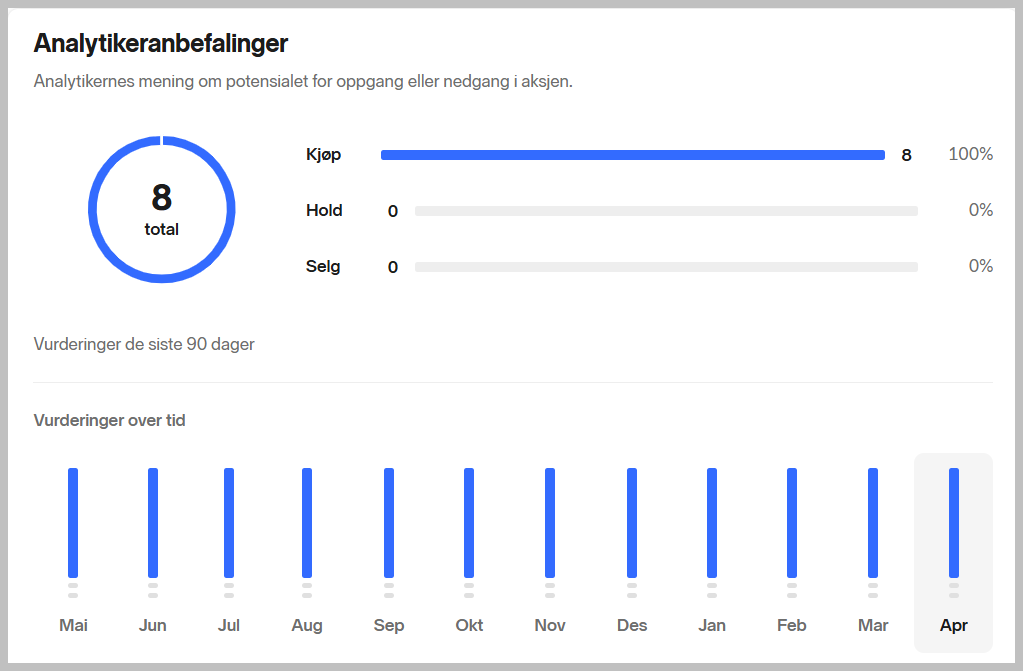

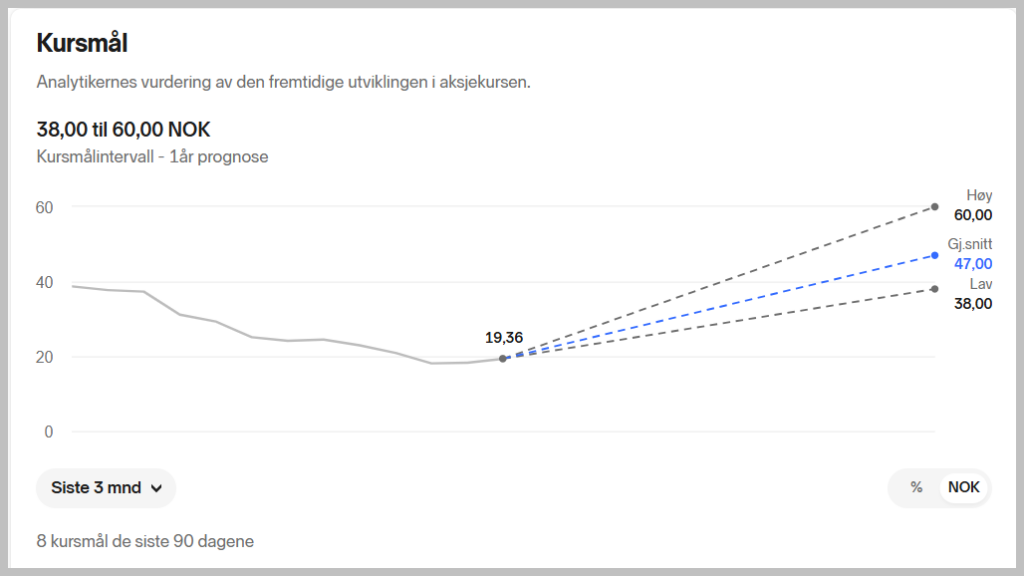

The share has long been an analyst favorite on the Oslo Stock Exchange, and Nordnet’s overview shows that eight out of eight analysts have a buy recommendation on the share with a price target that varies between a low of NOK 38.00 and a high of NOK 60.00. On average, the price target for the HEX share from these eight analysts is NOK 47.00.

The share is on Monday morning, April 14, trading at around NOK 19.60, and should thus have significant potential according to these eight analysts’ buy recommendations and price targets for the HEX share.

The HEX share is heavily shorted!

It should also be mentioned that the HEX share is heavily shorted, and there could quickly be a really strong short squeeze if the shorters start to cover their short positions. Furthermore, it is mentioned that Hexagon Composites has decided to initiate a share buyback program of up to 4 million shares for an amount of up to NOK 75 million. Source.

Aksjeanalyser.com has taken a closer look at the technical picture for the HEX share, which indicates that it may have reached a bottom now around the current price level. Read more about this below under the technical analysis of Hexagon Composites (ticker on Oslo Børs: HEX).

Hexagon Composites – a Global Leader in Clean Energy Solutions!

Hexagon Composites – a Global Leader in Clean Energy Solutions!

(ticker on Oslo Stock Exchange: HEX)

Hexagon believes that technology is no longer a barrier to enabling clean energy for all. Their world-leading high-pressure cylinder technology enables the safe delivery of clean gaseous energy to industry – decarbonizing transportation on land and at sea.

To date, Hexagon has thousands of solutions and sixty years of experience helping customers reduce CO2 emissions.

Strong global footprint

Hexagon is headquartered in Norway with 23 international locations, including the world’s most important clean energy markets in Europe, Asia and North America. The company has 1000 employees in 23 locations worldwide.

The company is organized into three business areas

Hexagon Agility, Hexagon Digital Wave and Hexagon Purus.

The business areas are global leaders in their segments, driving the energy transition with a range of clean energy solutions.

Read more about the company here and here.

Hexagon Composites ASA, Fourth quarter 2024

Hexagon Composites ASA, Fourth quarter 2024

Outlook 2025 and beyond

As Hexagon enters 2025, they see a continued soft North American freight market in the first half of the year. With the expected upturn in the freight market, and the increased availability of North American X15N natural gas truck platforms in the third quarter, they expect a strong second half of 2025.

In the years ahead, global emission reduction targets and the economic competitiveness of natural gas (RNG/CNG) are expected to drive higher volume for Hexagons Mobile Pipeline and Fuel Systems businesses. With an expected accelerated 10x growth of natural gas transportation in North America by 2030. With the company’s proven track record, market-leading products, state-of-the-art manufacturing facilities and a team of industry experts, Hexagon Group is poised to capture growth from 2025 and beyond.

Technical Analysis of Hexagon Composites

Technical Analysis of Hexagon Composites

(ticker on Oslo Stock Exchange: HEX)

The HEX share has shown a very weak development since the end of 2024, falling from around NOK 50.00 to a recent low of around NOK 17.00.

The stock has now tested a significant technical support level from previous bottoms in 2019, 2022 and 2024, around the NOK 17.00 level, and Aksjeanalyser.com is tempted to try a bottom-picking of the stock around the current price level.

The stock rises sharply on Monday morning, April 14, and now triggers positive technical signals, breaking out of a large falling wedge formation (see day chart).

There is little technical resistance upwards, but some technical resistance around NOK 23.00 – 25.00 and where there will be some resistance up towards the 50-day moving average.

There is little technical resistance upwards, but some technical resistance around NOK 23.00 – 25.00 and where there will be some resistance up towards the 50-day moving average.

Should the stock break above the NOK 25.00 level and above the 50-day moving average, and as Aksjeanalyser.com believes may happen in the near future, the next significant technical resistance level will be around NOK 30.00 – 35.00.

Various momentum indicators such as RSI, Stochastics and MACD all signal further upside for the stock in the short term.

Based on the overall positive technical signals currently shown for the HEX share, the Aksjeanalyser.com considers the HEX share to be an exciting and interesting buy candidate at the current price level of around NOK 19.60.

The potential for the share is considered to be up to around NOK 23.00 – 25.00 in the very short term (1-3 weeks) and up to NOK 30.00 – 35.00 in the medium term (3-6 months). What could potentially change the current positive technical picture for the share would be if the share were to break below the important technical support level around NOK 17.00.

Don’t miss out on Vikingen’s Easter campaign!

https://webshop.vikingen.se/en

Here you will find Vikingens Programs in the webshop!

Each week, the 10 strongest buy signals from the BEST model will be presented on Vikingen’s website!

Here are the signals for week 16!

And here you can watch free trainings (in Swedish) on the Vikingen Mini, Börs, Trading and Vikingen Maxi programs.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours