In focus in this week’s analysis of StockCharts365.com – a Danish Brewery!

This week StockCharts365.com analyzes an interesting Danish brewery!

Read on below and find out what makes the brewery stock worth buying right now!

Vikingens Investmentschool is on vacation and will be back again in August. See you then!

In this ‘Weekly analysis with stock tips’ from StockCharts365.com, we take a closer look at an exciting company in Denmark: Harboes Brewery B A/S (Ticker on Nasdaq Copenhagen: HARB B). The overall technical view of Harboes stock looks very positive and indicates further growth for the stock in the short to medium term. Read the technical analysis below.

First some facts about the company Harboes Brewery B A/S (Ticker on Nasdaq Copenhagen: HARB B)

Harboes Brewery is a producer of alcoholic and non-alcoholic beverages. The operations are global and divided based on the company’s business segments with respective focuses. The product range mainly consists of beer, but also energy drinks, soft drinks, juice, cider and water. The company was originally founded in 1883 and is headquartered in Skælskør, which is located on western Sjelland. For more information about the company, visit their website here.

Technical analysis of Harboes Brewery B A/S (Ticker on Nasdaq Copenhagen: HARB B)

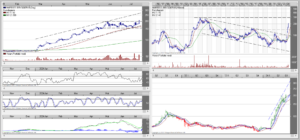

Harboes stock has shown strong performance so far this year and the stock is moving in a steep upward trend. The stock may now be in the process of providing new positive technical signals by breaking out of a rectangular consolidation formation. The stock has recently tested the support level down towards the 50-day moving average and has been well received at that support level. Various momentum indicators such as RSI, Stochastics and MACD signal further upside for the stock in the short term and this suggests that the stock will now break out of the aforementioned consolidation formation.

The BEST model also provides a buy signal for Harboes stock!

A break above the DKK 200.00 level will trigger a new technical buy signal for Harboes shares, and there will then be very little technical resistance for the stock until around the DKK 300.00 level. The BEST model also provides a buy signal for Harboes stock. This popular and efficient model has been developed by Peter Östevik. He developed the model around 2019 after 30 years of experience in technical analysis and Vikingen Financial Software. Based on this overall positive technical view presented above, the Harboes share is considered an exciting buy candidate at today’s price level, and with a 3-6 month term potential around DKK 300.00.

Vikingen Financial Software would like to remind you that previous, positive results do not always indicate future profits, and that all trading is done at your own risk.

Sincerely Catrin Abrahamsson-Beynon