How to choose stocks – the basics

The most challenging aspect of starting to invest in the stock market is deciding which stocks to buy, how to choose stocks. Every experienced investor has their own techniques and strategies that they believe in. However, when you are just starting out, learning how to pick stocks can be very challenging. Here at Viking, we want to give you the tools and confidence you need and show you how to buy shares and make your first trades. This will help you get a good start on your portfolio.

Getting started

The first thing you need to know is that all stocks have a unique code, short name or ticker symbol. Here are some popular stocks and their ticker symbols: Investor A (INVE A), Volvo B (VOLV B), Starbucks (SBUX), Walmart (WMT), Coca-Cola (KO), Netflix (NFLX), Amazon (AMZN), Apple (AAPL), Home Depot (HD), and Tesla (TSLA). When you go to make your first trade and enter a short name, you will see the price. So, if the price of your stock is trading at $30 and you buy 100 shares, it will cost $30,000. Those are some of the most popular shares. Now, if you want to get some other ideas from proven sources about the best stock picks in recent years, you can review these articles about the most popular stock newsletters. Each of these has a fee of about $100 for the first year, but since their recommendations have historically been very good and have beaten the market’s overall returns, if you’re thinking about investing your real money in the market, these might be a good place to go. Before you pick your first stock, the first step is to decide what your goals are for your portfolio.

Risk and reward

The biggest choice you will make is balancing risk and reward. Should you invest all your money in very risky stocks with high growth (and loss) potential, or focus on companies that you think can be strong in the long run? Think of this risk and reward choice like this: Would you rather have a 10% chance of doubling your money (risky) or a 100% chance of making 10% on your money? The expected return for each of these choices is 10%, but in the first scenario, 9 times out of 10 you will do nothing.

Set targets

To reduce the risk of choosing stocks, many first-time investors will often ask their friends for stock tips. This is not a good idea. Investing in the stock market is not easy and you need to learn how to do it right. We recommend that you learn stock picking by reading how the professionals do it.

Diversification

Once you think about how risky you feel, then decide how you want to diversify your portfolio, which will help you decide how much money to invest in each symbol. Your challenge can do this automatically – most challenges include a position limit, meaning you can only invest a certain percentage of your money in a single stock. You can check if your challenge has a position limit rule on the Account Balances page. Once you have determined the minimum number of securities you need, you can now start hand-picking stock symbols by using a trading strategy. You can also create a mix of these strategies to get the best out of each strategy.

Trading strategies for beginners

The goal of your trading strategy is to get a list of stocks or ETFs that you might want to invest in. The purpose is just to get a wish list of stocks – at the end of the day, you will probably add half (or fewer) of your initial choices to your permanent portfolio. Once we have the initial list of possibilities, we will take a look at how we can narrow down the list.

“Invest in what you know”

The best way to start when buying stocks is to buy what you know, not try to follow stock tips or read a bunch of analysis you can’t follow. Think of it this way: if you already know a company, they’ve done well enough in the past to already be a household name. This gives you as an investor a big advantage; you can see how the company is doing just by looking at their stores and reading regular business news. Ask yourself the following questions: – Have they started opening new stores around me lately or are they closing some stores? – Do there always seem to be a lot of people you know using their products, or are they still more obscure? – Do you find yourself using more of their services (giving them more money) month after month? – Does their current news look positive or negative? If all of these are positive, this might be a good place to invest.

Results strategy

An investor can always handpick stocks based on the earnings calendar. To do so, you need to know your investment time horizons and browse through the earnings calendar to find gems (i.e. stocks that you can buy and that will skyrocket during the earnings season, or stocks that will drop and that can be shorted in advance). The earnings strategy is somewhat of an evolution of the “Invest in what you can” strategy – you will look for companies that you think will have high earnings announcements coming soon, which could cause their stock price to rise. Once you have found your stocks, it is very important to analyze them and back up your assumption about how the market will react to their earnings report. You can compare to other stocks with recently released earnings using Viking’s analysis software.

The passive approach

If you are not sure which specific stock to choose, you can always invest in ETFs and market indices. These products are already diversified and will track a specific market for you. The most popular ETFs are those that match the most popular indices: Dow Jones Industrial Average, S&P500, Nasdaq or our own Swedish OMXS30. Starting your portfolio with any or all of these is often the best place to start. ETFs are also available in specific industries. As an example, let’s say you want to invest in a gambling company, but don’t know which company specifically. You can always invest in an ETF that tracks the gambling market for you. In this situation, you could invest in the VanEck Video Gaming and eSports UCITS ETF, which tracks this market for you. They have invested in various aspects of video game technology, such as game developers, retailers, and console or chip manufacturers. This means that the stock selection and allocation tasks have already been taken care of by the fund managers of this ETF. Many investors also start with a passive strategy, and slowly break out. This would involve starting your portfolio by selecting ETFs in 5 industries you want to invest in, and then looking at each of those industries in detail using some of the other strategies here. Once you have identified some stocks within these industries, you can sell off some of the ETF holdings and use the money to invest in the stocks you have researched.

Stock Screeners Strategy

You can also use Viking’s stock screeners to find good buys and short selling. Viking is a program that will ask you a few questions about what you’re looking for in a stock and return a list of stocks that match your criteria. You can then do extra research on these stocks to determine whether they should be added to your portfolio.

Few trade ideas

We also have a trading ideas page to help you review the overall health of the market and help you adjust your stock picks.

How to choose stocks – intermediate analysis

Now that you have a couple of stocks in mind, you should do a more advanced analysis of your selection. This extra step in your research will be useful for two main reasons: – You will check whether these stocks are really good investments. They may be rejected if you find that there has been a lot of hype, but the company is not actually doing well. – You will back up your assumptions about these stocks. This is where you can pick the stocks that actually go into your portfolio over the long term. If you started with a passive strategy, your portfolio might already have some industrial ETFs, but now we will look at specific companies to replace some of those investments. We will explore a couple of basic analysis methods that will complement your findings.

Technical analysis

Technical analysis is the process of establishing patterns and trends using historical data for a security and charts for a specific time frame. Charts are clearly an effective way to visually notice a pattern and act on a specific trend. We will revisit a couple of basic chart patterns and put them into real-world context as well. Most of the technical analysis tools make use of the charts you can find in The Viking.

Trends & Trend lines

A trend line is a straight line that connects the stock’s price movement and creates an upward or downward pattern. It is often recommended to connect more than 2 points to get a stronger trend line. Trend lines are useful to give you a general idea of how a stock’s price generally moves. A positive trend line does not mean it will continue upwards forever, but can be an indication that there are some strong underlying business fundamentals.

Support and Resistance

A support line represents a price level where the stock never went under. In other words, it is the point where the stock struggles to go under. On the other hand, a resistance line represents the price level for which the stock cannot break through. Stocks near their support lines tend to rebound, so they can make a good investment (at least in the short term). Stocks near their resistance line tend to fall back, so they can signal a shorting opportunity. When a stock breaks through its support or resistance lines, it’s called a breakout.

Symmetrical triangle

This pattern consists of two trend lines that are symmetrical to the horizontal plane and are convergent. To prove a symmetrical triangle, one must have oscillation between the two lines. A triangle pattern indicates that the price is about to move – but a symmetrical triangle gives no clear indication that the price will go up or down.

Ascending triangle

The ascending triangle pattern refers to two converging trend lines. The first line is an upward slope which is the support and the second is a horizontal resistance line. To validate the ascending triangle, there must be an oscillation between the two lines.

Descending triangle

The descending triangle pattern refers to two converging trend lines. The first line is a downward slope which is the support and the second is a horizontal resistance line. To validate the ascending triangle, there must be an oscillation between the two lines.

Fundamental analysis

Fundamental analysis is the process of examining the fundamental aspects of a company. It involves reviewing a company’s financial statements, such as their income statement, cash flow statement and balance sheet, to define its health and attractiveness. Because financial statements are standardized across companies, this can help compare two potential investments apples-to-apples. Warren Buffet famously said:

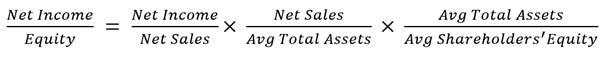

“Never invest in a company you can’t understand.” What he meant was to read the company’s balance sheet and their other financial statements. Study the role they play in their industry so you understand how they operate. Keep an eye on any changes in their dividend yield. This is all part of fundamental analysis. You can directly find most of the key figures by clicking on Key Figures in Viking. One of the most popular and simple fundamental analysis is the DuPont model. DuPont Analysis breaks down a company’s return on equity (ROE) based on its profitability decisions, how efficiently their assets are used, and their financial leverage. The model focuses on a company’s profitability by using the following equation:

![]() This equation can be rewritten as:

This equation can be rewritten as:

To analyze a company using the Dupont model, you can use the following tables:

Analysis of company XYZ from 2020 to 2023

| DuPont Models components | 2020 | 2021 | 2022 | 2023 |

| Net income | ||||

| Equity capital | ||||

| Net turnover | ||||

| Average total assets | ||||

| Average equity | ||||

| Profit margin | ||||

| Turnover of assets | ||||

| Equity Multiplier | ||||

| ROE |

Analysis of company XYZ with industry competitors

| DuPont Models components | Company XYZ | Company A | Company B |

| Net income | |||

| Equity capital | |||

| Net turnover | |||

| Average total assets | |||

| Average equity | |||

| Profit margin | |||

| Turnover of assets | |||

| Equity Multiplier | |||

| ROE |

These tables allow you to see the company’s performance in terms of their profitability. This can be useful for analyzing whether a company will be profitable in the long term or whether this is a growth stock that will soon reach its zenith. You will also get a bird’s eye view of the business and its competitors in the same industry. By doing this, you can find a competitor that would be a better stock pick or ensure that your stock pick is the best in its category.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)