How do certificates and ETPs work?

After we wrote about commodities, many people contacted us asking how to invest in commodities. They also wanted to know more about tracking the commodity market.

One way to invest in commodities, but also in indices, currencies and even cryptocurrencies, is through certificates, known as exchange-traded products (ETPs). The advantage is that certificates and other exchange-traded products can be placed in an endowment policy or an investment savings account. In the case of commodities and cryptocurrencies, there is a 100% deductibility of losses, as opposed to 70% for those who choose to invest directly in the underlying asset. However, both have a 100% tax liability.

Other ways to gain exposure to the commodity market are to buy warrants, CFD contracts, Open End Certificates, Mini Futures, Bull/Bear certificates, ETFs, so-called exchange-traded funds, to name just a few instruments. All these products are collectively known as Exchange Traded Products, and they are issued by a bank or financial institution. There are those without leverage and those that come with substantial leverage.

Below is a brief description of the different types of instruments as they differ somewhat from each other.

Open End certificate

Open-end certificates are an increasingly common form of investment for those who want to invest in a commodity without having to physically own it. Open End certificates, as the name suggests, have no end date and track the underlying asset 1:1. If the price of the commodity rises by one percent, the value of the certificates also rises by one percent. The advantage of certificates is that you can invest in a variety of stocks, indices, markets and commodities that are otherwise difficult to invest in. However, since you do not own the commodity itself, but only a certificate, there is always the risk that this will become worthless if the issuer (often the bank) goes bankrupt.

If you wish, you can choose to invest in currency-protected certificates. This does not expose you to changes in exchange rates, but you pay a small fee for this every day. Beyond that, there is usually only a standard brokerage fee. Open End certificates can be traded through a bank or online broker.

Certificate

The futures system is old and still used today. Futures contracts still form the basis of all commodity trading on exchanges around the world. But for a private individual, it is a difficult and complex market to enter. Although the system of semesters seems simple and logical on the description above, there are a variety of things to consider. The investor needs to master and understand concepts such as roll, contango and backwardation to even consider futures as an investment form.

In recent years, however, a number of other products and instruments have been developed to help individuals invest in commodities. One of these is certificates. In simple terms, a certificate is a debt instrument that reflects the value of an underlying commodity. As it is a debt instrument, the certificate has a limited maturity which means that on a specific predetermined date it is liquidated and converted into cash which is paid to the owner. The value of the certificate on that day determines how much money is paid out.

What are certificates?

A certificate is a debt instrument issued by an issuer. Unlike traditional money market certificates that pay a fixed interest rate, the return on these new certificates is linked to the return on an underlying commodity.

NASDAQ OMX, but also Nordic Growth Market, NGM, together with the issuer, offers trading in a number of different types of certificates. At present, there are open-end certificates, credit certificates, coupon certificates, maxi certificates and other types of instruments. The supply of certificates varies over time and is adjusted in line with demand. Different types of certificates have different types of underlying goods. For example, shares and mainstream indices are most common on Max certificates, while more exotic indices and commodities are more common on open-end certificates.

Open End Certificate

An Open End certificate, as the name suggests, has no end date. While different types of certificates can be open-ended, they often refer to certificates that have a 1:1 link to the underlying commodity. If the value of the underlying commodity rises by SEK 1, the value of the certificate rises by the same amount.

Open-end certificates are often issued on assets that may be difficult or costly to invest in directly. Examples include commodities and specially constructed indices or baskets of different assets. On NasdaqOMX, for example, there are currently open end certificates with coffee, Kazakhstan, wind power and more as underlying assets.

Growth certificates

A growth certificate is linked to a share or basket of shares. The certificate provides leverage on the shares in an upward market, but follows them 1:1 in a downward market. The certificate does not entitle the holder to dividends. In principle, the certificate means that, in addition to a direct investment in the share, the investor “borrows” the future estimated dividend and invests it in a call option today. The growth certificate is therefore suitable for those who believe in a strong rise in the share.

Premium certificate

A premium certificate, like a growth certificate, tracks the performance of a share or group of shares. The premium certificate provides an extra return if the underlying share or index does not fall below a certain level, the so-called barrier, at any time during the term and if the underlying index does not rise more than the premium. In the latter case, the holder receives the return of the index instead. For example, a premium certificate could provide a 15% return if the index does not fall by more than 30% at any time during the term. The investment is suitable for customers who believe that the risk of a major decline in the underlying asset is limited.

Credit certificates

A credit certificate is a way to take advantage of the higher interest rates often offered in the corporate market. The credit certificate provides a fixed rate of return which can be reduced if one of the underlying companies suffers a credit event. A credit event is a suspension of payments, reorganisation or similar and is defined in the terms and conditions of the certificate.

Example

Since the different certificates have such different pay-off structures, we can look at how they can work as an alternative to a direct investment in, for example, the OMX index. An Open End Certificate will fully reflect the performance of the index and thus not be an option to change the risk or potential return. An Open End certificate is more common in markets that can be difficult to invest in directly. In this case, the return will be the same as the underlying regardless of how the underlying performs. It can therefore be an alternative to a Sweden Fund. A 10 percent increase in the OMX gives 10 percent in the certificate.

For example, a growth certificate could provide an extra 20% return in an upturn. If the OMX index falls, the return (excluding dividends) is the same in the Growth Certificate as in the index. For example, if the index rises by 10% during the period, the Growth Certificate yields 12%. Consequently, it is most attractive to those who believe in a strong upward trend.

For example, a Premium Certificate could give a 15% return as long as OMX has not at any time fallen more than 30% from its starting price and OMX has not given more than a 15% return – when the return in OMX is obtained. For example, if the OMX rises 10 percent, the Premium Certificate yields 15 percent, provided that at no time during the term has the OMX been down more than 30 percent from the starting price. If the OMX rises above 15 percent, the certificate receives a corresponding return.

For example, a WinWin certificate could provide a positive return even in a downturn as long as the OMX does not fall more than 15 percent. This means that the certificate gives a 10% return on a 10% increase but also a 10% positive return on a 10% decrease. However, if the OMX ends lower than 15 percent below the starting price, the certificate gives a negative return corresponding to the decline in the OMX.

Valuation

Of course, the valuation also depends primarily on the type of certificate. The Open End certificate that fully follows the underlying commodity is in principle only affected by the underlying commodity. Other types of certificates that also have ‘optionality’ elements will also be affected by volatility and maturity. In general, however, it is the performance of the underlying commodity that is most important for the certificates.

The certificates that are clearly positively affected by increased movements are Growth Certificates. Premium and WinWin certificates can also be positively affected under certain circumstances but depending on how the underlying is traded in relation to the barrier, the impact can be negative.

However, maxi certificates will generally lose value if movements in the underlying commodity increase. Again, however, it is important to recognize that the direction of the trend in the underlying commodity is what is most important for the trend in the price of the certificate.

Choosing a certificate

The type of certificate you choose depends on your market confidence and the level of risk you are willing to take. Of course, it may also be the case that people choose certificates as a way to invest in a market to which they otherwise have no access.

In general, Max Certificates, Premium Certificates and WinWin Certificates are ways to lower the risk compared to a direct investment. Open End Certificates are neutral in comparison, while Growth Certificates increase risk – and potential returns.

Mini Futures

With Mini Futures, a leveraged product, you can invest in the rise or fall of a variety of stock indices, shares, currencies, commodities and bond markets. Mini Futures are also equipped with a stop loss. If the underlying price reaches the stop-loss level, the security expires and the investor gets back any residual value.

Today, so-called mini-futures are a very common tool for investing in commodities. Mini Futures are issued by RBS (Royal Bank of Scotland), among others, and are a relatively new type of security on the Swedish stock exchange. You can use them to easily profit from changes in the value of different assets. For example, if you think the price of oil will change, you can invest in a Mini Future linked to the price of oil. If you want to take advantage of a rising price, choose a “Mini Long”, if you believe in a falling price, choose a “Mini Short” instead. Your Mini Future’s value then follows the trend but has built-in leverage, which means it rises and falls more than the underlying asset in percentage terms.

Open End Certificate

There is a relatively new form of certificate called Open End. They are called Open End because in practice there is no fixed end date for the certificate, so they work more like a share. Open-end certificates, like regular certificates, reflect the value of an underlying asset. This is often, but not always, a raw material. The value of the certificate then follows the index price of the commodity, and can be bought and sold on a stock exchange just like other securities.

Bull/Bear certificate

Bull and Bear certificates are leveraged instruments, which means they change value in a higher proportion to the underlying asset than 1:1. Most commonly, this type of certificate has a leverage ratio of 2:1. This means that for every 1% increase in the price of the underlying asset, the value of the Bull certificate increases by 2%. Conversely, of course, if the price falls by one percent, the value of the certificate falls by two. For Bear certificates, the relationship is the opposite: for every one percent decrease in the price of the asset, the value of the certificate increases by two percent and vice versa.

What are Bull & Bear certificates?

An unleveraged certificate can be likened to investing directly in the underlying commodity. The difference is that the certificate is a debt instrument issued by the issuer. The certificates are often listed on underlying commodities where it may be difficult for a normal investor to make a direct investment, such as oil or other commodities. So by investing in the certificate, you receive the return on the underlying asset without direct ownership.

A leveraged bull certificate is an investment where the performance of the underlying commodity is boosted by a factor, e.g. 1.5. This means that a movement of, for example, 1% in the underlying commodity gives 1.5% in the Bull Certificate. The degree of leverage varies from product to product but is normally between 1-3. The Bull Certificate is therefore suitable for investors who have positive market sentiment and want to get extra returns from it.

It is important to note that the leverage in the Bull Certificate is based on daily movements and works in both directions. This means that the return on the certificate is equivalent to what is indicated by the leverage over one day but not over longer periods. Thus, if the underlying rises 1 percent during a day, the return on the Bull Certificate will be 1.5 percent (or close to it). But if the same underlying has risen by, say, 10% in a month, the Bull certificate will not return exactly 15%. How much the Bull Certificate has risen depends on how much the price has moved up and down over the period – how volatile the performance has been. In general, the more volatile the performance of the underlying, the worse the return on the Bull Certificate will be – in relation to the performance of the underlying. See also examples below.

Similarly, a leveraged Bear certificate is an investment where the performance of the underlying commodity is amplified by a factor, e.g. 1.5. This means that a movement of, for example, one percent in the underlying commodity gives 1.5 percent in the Bear certificate. The difference is that the Bear certificate gives a positive return when the underlying commodity falls in price. A Bear certificate is therefore suitable for an investor with negative market sentiment.

Why invest in Bull & Bear certificates?

Both the Bull & Bear certificates normally provide leverage on the invested capital. In this way, a high return on equity is achieved with a correct market belief.

A Bull certificate can also be used to free up capital for other investments. For example, suppose you own Ericsson and want to raise capital for other investments. However, you don’t want to sell the stock right now because you believe in rising prices. If you choose to buy a Bull certificate with a yield factor of 3, you can free up 67% of your capital.

If you previously had 100 exposure to the stock, investing 33 in the Bull Certificate is now enough to give you an exposure of 100. The 33 now have a factor of 3 which makes the return equivalent to the previous exposure. Through the leverage of 3, you have freed up 67 that can be used for other investments. Now keep in mind that leverage works both ways, so a move in the wrong direction will result in a sharply negative return. The effect is similar to that of leverage; both positive and negative returns are amplified by leverage. A Bear Certificate can also be used to insure a shareholding. For example, let’s say you own Ericsson for the long term, but you think it may perform negatively in the short term. Of course, you could simply sell all or part of the holding, but let’s say you don’t want to do that, for example for tax reasons.

A Bear certificate could then act as an insurance against the holding. For example, if the Bear Certificate has a leverage of 2, you could buy the equivalent of 25% of the Ericsson position and thus insure half the holding. Keep in mind that the leverage of 2 is daily, just like in the Bull Certificate, and that this means that the leverage over several days is not exactly 2. The deviation from 2 becomes larger the more the stock moves from day to day.

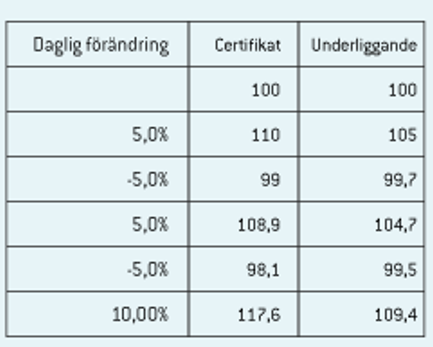

Example: Bull certificate with daily return times 2 on DAX Index

DAX 1 percent, the certificate rises 2 percent and vice versa. What is important to pay attention to is the daily leverage, i.e. a return in the underlying over longer periods will not be matched by exactly double the return in the Bull certificate. The example below shows what happens;

In the example, the underlying has risen 9.45 percent over the period, while the bull certificate has increased 17.61, i.e. slightly less than double the increase. By contrast, the certificate has risen by exactly double on the first day, from 100 to 110.

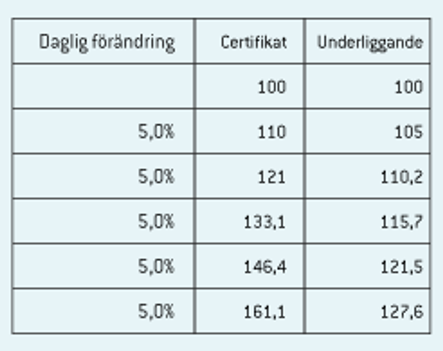

In the example above, the underlying goes up and down, one after the other. If the underlying instead moves in the same direction all the time, the leverage in the Bull Certificate over several periods will instead exceed the daily leverage. The table below shows what happens if the underlying were to rise 5% each day instead;

Here the underlying has risen 27.6 percent over the period, while the Bull certificate has risen over 61 percent, i.e. more than twice as much. This could be likened to an interest on interest effect.

Note also that this effect – i.e. that the return over time deviates from what the underlying provides – increases the higher the leverage.

Valuation

The price of the Bull Certificate is in principle fully linked to the price of the underlying commodity as mentioned above. If the underlying rises by 2 percent, the Bull Certificate rises by 4 percent – given that it has a leverage of 2. At the same time, a Bear certificate with leverage 2 on the same underlying will fall by 4%. The valuation is thus relatively simple and the position is very similar to a leveraged stock. Note also that certificates often have an administration fee that affects the price on a daily basis. For example, if the fee is 0.8% on an annual basis, the price will fall by 0.8/365 every day, all else being equal.

If the certificate is denominated in another currency, such as some of the commodity certificates available, any currency fluctuations will be added.

Choosing a Bull & Bear certificate

Since the Bull Certificate is primarily a way to gain leverage on the invested capital, it is primarily a question of what leverage you as an investor want. In ‘traditional’ certificates, leverage is indicated by the name of the certificate.

Viking offers course data on certificates

Today, Vikingen also offers course data on various types of certificates. In fact, we have more than 30,000 different certificates in our course database. Certificates Sweden can be found here.

In addition to price data on certificates, there is also price data on commodities, cryptocurrencies, various stock indices and selected currencies. This means that you will always find something to shop with.

Shop for certificates

To trade in certificates, a depository is required. Certificates can be traded through most Swedish banks and internet brokers, such as

DEGIRO

,

Nordnet

,

Aktieinvest

and

Avanza

.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)