Fractions, percentages, quotas and the stock exchange

Fractions mean a part of a whole. You can use fractions in any case where it might be useful to look at something in parts, rather than the whole at once. The tastiest fractions are parts of pizza. If the pizza is in 8 parts, we know it is 8 parts. This means that every time we talk about its parts, we know it is “__ of 8” or “__/8”. For the whole pizza, we have all 8 parts.

Now we are going to eat a portion! That takes away 1 of our portions and leaves us with 7 and we had 8 portions originally. Or like a fraction:

The bottom number in the fraction is the whole and the top number in the fraction is how much we currently have (in this case, seven slices of pizza). Examples of how to use your portfolio If you look at your pie chart, you can also see examples of fractions (or fractions) using your pie chart:

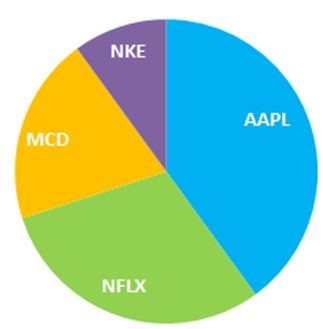

In this case, we can’t divide the pie into as big pieces as we did with the pizza, because some stocks have much more than others. But we can still show what “fraction” of our portfolio is taken up by each stock. In this example, we can say that our portfolio has NKE (Nike), MCD (Mcdonald’s), NFLX (Netflix), AAPL (Apple). Although each stock takes up different amounts of the whole, if we divide our portfolio into equal parts, we can still get the proportion taken up by each stock.

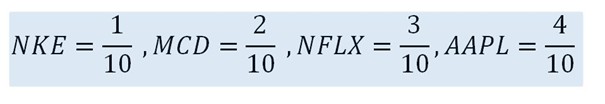

Now if you want to know how much of each share we have as a fraction. We count how many wedges (or slices) we have in total: 10 Then we count how many of each stock we have (counting the same colors) – NKE: 1 – MCD: 2 – NFLX: 3 – AAPL: 4 Just like before, the bottom number in the fraction is called the denominator and is how many parts are in the whole. The top number in the fraction is called the numerator and is how many parts we have:

If we added all these fractions together, we would get 10/10 which is equal to 1 (meaning the whole).

If we added all these fractions together, we would get 10/10 which is equal to 1 (meaning the whole).

Comparing fractions

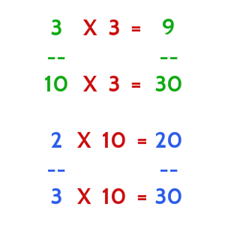

You can only compare two fractions that have the same denominator. For example, we know that 3/10 is greater than 2/10, but you cannot directly compare it to 2/3. When you see the “/” sign, or whatever separates the numerator and denominator, it means “Out Of” (so “1/10” means “1 out of 10”) If you want to compare two fractions, one way is to multiply them so that their denominators are the same. In this example, we can convert our fractions to both show their value of 30 parts instead of 10 or 3. To do this, multiply both the numerator and denominator of each fraction until the denominator is the common number.

As long as you multiply the numerator and denominator by the same number, the value of the fraction will remain the same (“2 out of 3” is the same as “20 out of 30”). Now both our denominators are 30, so we can compare them directly!

When you cannot use fractions

Fractions are only used to look at parts of a thing, they are not used to compare different things. For example, we can use a fraction to show how much of our portfolio is made up of a stock, but we can’t use a portfolio to compare a company’s share price with how much money it makes.

Percentages

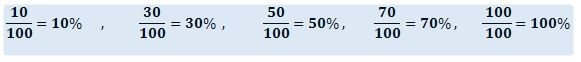

Fractions work well when what we are looking at are always different parts of the same whole, but when we want to compare parts of different things, we need to use percentages. A percentage is a calculation that shows how big one thing is in relation to another thing. For example, you can use a percentage to tell you how big your current portfolio value is compared to how much you started with. Percentages work like fractions, but the denominator is always 100, so you can always know which percentage is bigger or smaller. You can convert any fraction to a percentage to compare them. This means that when you see a percentage, the ‘%’ sign means ‘out of 100’.

Calculate your portfolio return

On the ranking page you will be able to see the Gain/Loss (%). We call this your Portfolio Return. This is calculated by looking at the current value of your portfolio and comparing it to your starting value and multiplying by 100. Or ((Current Value/Starting Value) – 1) * 100 . You need to do it in this order: (Current Value/Starting Value) then subtract 1 and then multiply by 100. 1. Divide current value / starting value. This scales down both numbers so that “Starting Value” = 1. If your Current Value > Start Value, the number you get will be greater than 1. If your Current Value < Start Value, this number will be less than 1. 2. Subtract 1 from the result. This means that the “comparison number” will be 0 instead of 1. 3. Multiply the result by 100. This makes your comparison 100 instead of 0. For education1 on the ranking page above, you can calculate the Portfolio Return using the same steps: 1. 103,985.43 / 100,000 = 1.0398543 2. 1.0398543 – 1 = 0.0398543 3. 0.0398543 X 100 = 3.98543% (we round the percentage to 2 decimal places, so it shows as 3.99%).

Calculate returns

Percentage return is also very useful to compare different stocks. NFLX stock (1.54%) has a higher percentage return than AAPL stock (1.24%) even though the number of AAPL (11.85) is higher than (8.05). The $11.85 is the amount of dollars you earned. The 1.24% is how much the stock price went up by. The percentage (bottom figure) is much more important than the amount of dollars (top figure), because it tells you how much the value changed compared to the price you bought it at. This is because of the number of shares and the price. To calculate the percentage, compare the last price and divide it by the price paid or ((Last Price / Price Paid) – 1) * 100: AAPL: ((96.70 / 95.52) -1) *100 = 1.24% NFLX: ((106.06.70 / 104.45) -1) *100 = 1.54% The relationship between percentages and fractions Let’s go back to the pie charts we used for fractions. Each fraction can be written as a percentage, with “Whole” equal to 1. We bought 10 shares of AAPL (Apple), 5 shares of NKE (Nike) and 5 shares of NFLX (Netflix). The numbers show the percentage of each stock’s value over your total portfolio value. Written as a fraction, it would be Value of this stock in your portfolio / Total value of all your stocks

Going back to the example, we can calculate the percentage of each share by comparing their market capitalization with the total value of all our shares

To get these figures, we first take the market capitalization of each share and add them together, so in our example: 292.75 (NKE) + 958.20 (AAPL) + 532.00 NFLX = 1782.95 = Total Value If we then want the percentage as in the pie chart for NKE, we compare the value of NKE to the total value: NKE: ((292.75 / 1782.95) – 1 * 100 = 16.4% AAPL: ((958.20 / 1782.95) – 1 * 100 = 53.7% NFLX: ((532 / 1782.95) – 1 * 100 = 29.8% Both the fraction and the percent will always be 100/100 or 100% because our pie is whole. By adding 16.4% + 53.7% + 29.8% = 100%

When to use percentages

Percentages are normally used to calculate the growth of something over time (like your portfolio return), or to compare parts of a whole when the denominators would be greater than 10 (in our fractional conversion example, we can also say 2/3 = 66.6% and 2/10 = 20%).

Conditions of use

Ratios are a lot like fractions, but the main difference is that we only use ratios to compare different things. For example, if we want to compare the price of a company’s stock to how much money that company makes per share, we would use what is called the “Price – Earnings Ratio”. Since the “price of a share” is not part of “how much the company earns per share”, we would not be able to use a fraction. We would want to know the P/E ratio because it tells us how much the company actually earns compared to how much we pay for a portion of it. We can actually get all this information and find the P/E ratio ourselves. EPS is “earnings per share”. Using Apple (AAPL) as an example: The stock price is $100.15, while the earnings per share (EPS) for the last 12 months is $9.21. We can make the ratio as $100.15:$9.21 When we read ratios, the “:” symbol means “to”, so we would say “100.15 to 9.21”. Calculating this value is also easier than calculating a percentage. Simply divide the number on the left by the number on the right: 100.15 / 9.21 = 10.5 = PE ratio The P/E ratio gives an idea of how much investors value the company’s current income – high P/E ratios mean that investors expect earnings to grow a lot in the future, low P/E ratios mean that investors think the company will grow more slowly. By calculating P/E ratios for different companies, you can easily compare investor attitudes.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)