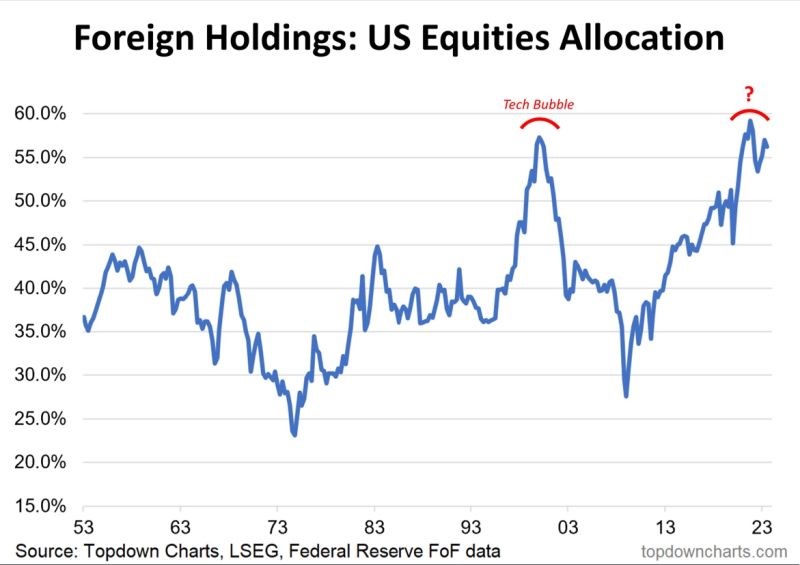

Foreign shareholders own as much US stock as during the tech bubble.

Foreign investors’ allocation to US equities is currently as extreme as it was at the peak of the tech bubble.

Similar to what we experienced back then, the gradual unwinding of crowded sectors such as technology will unleash another big growth for value rotation in markets.

Long overlooked segments such as emerging markets, natural resource companies and overall value-driven stocks are poised to emerge as significant winners in the next decade.

About the Viking

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)