eToro eyes $5 billion IPO: A catalyst for stock trading and ETF growth

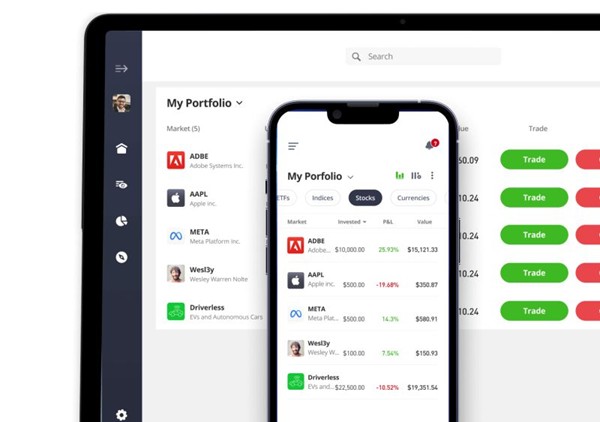

Global financial giant eToro has confidentially filed for an IPO in the United States, with a valuation of $5 billion, the Financial Times reports. This milestone, expected to be completed in New York in the second quarter of 2025, underlines eToro’s ambition to expand its global presence and strengthen its role in democratizing investment. ETF Growth: eToro’s platform supports trading in a wide range of assets, including ETFs, making it a key player in broadening retail access to these cost-effective investment instruments. Retail Reach: With 32 million registered users, eToro provides an intuitive, self-managed platform that is in line with the increasing retail interest in ETFs and diversified portfolios. Asset Management opportunity: The IPO could pave the way for partnerships with innovative companies like ARK Invest, leveraging their thematic and disruptive innovation ETFs to attract even more retail and institutional investors.

Strategic insights

Benefits of listing in the US: CEO Yoni Assia emphasized that a US listing offers greater liquidity and visibility, which is crucial for eToro’s global growth ambitions and scaling of its ETF offerings. Market timing: With a business-friendly regulatory climate and renewed enthusiasm for IPOs in 2025, eToro is well positioned to capitalize on this momentum.

Recent developments

Expanding Asset Base: eToro continues to grow its assets under management (AUM) and trading volumes, driven by strong retail participation in stocks, ETFs and cryptocurrencies. Platform Evolution: Founded in 2007, eToro has established itself as a leading global fintech platform that caters to both novice and experienced investors. eToro’s IPO represents a defining moment not only for the company but also for the broader fintech and ETF ecosystem, driving innovation and accessibility for retail investors worldwide.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)