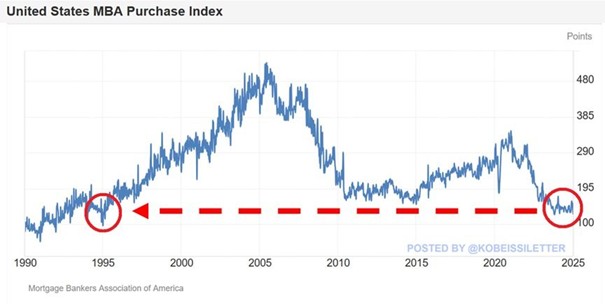

Demand for mortgages collapses in the US

Mortgage demand collapses in the United States: US mortgage applications for single-family homes fell by 3.7% in January, marking the fourth consecutive weekly decline. As a result, the US mortgage demand index has fallen to its lowest level since February 2024 and the third lowest level in almost thirty years. The index has now fallen by as much as 63% over the past four years. This is because the cost of housing finance has risen rapidly while US home prices remain at their highest level ever. Since mid-September, 30-year fixed mortgage rates have risen by about110 basis points and are back above seven (7) percent. Demand for mortgages is at 1990s levels.

Source: The Kobeissi Letter, MBA Purchase index

Source: The Kobeissi Letter, MBA Purchase index

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)