ChatGPT predicts the S&P 500 index for the end of 2025

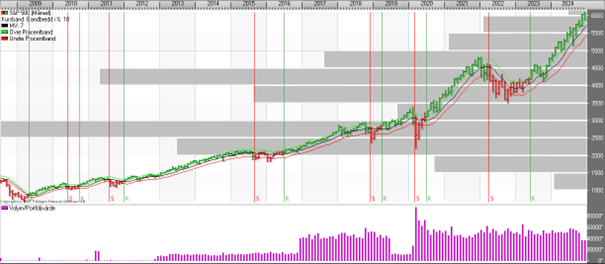

The S&P 500 index is riding a wave of historic highs, with over 50 record-breaking days in 2024 alone. The year has been marked by the dominance of the Magnificent Seven – a tech-heavy collection of market titans who have harnessed the AI boom and ChatGPT to fuel unprecedented growth. Yet, as we enter 2025, the market’s amazing run is starting to face turbulence. Rising US interest rates and inflation concerns have injected some caution into an otherwise euphoric rally. Over the past two weeks, the index has been slipping, testing the resolve of the bulls. Yet, fresh data on robust personal spending and buzz from a Santa Claus rally have rekindled optimism, suggesting the bull may not be over yet. From a technical standpoint, all eyes are on key levels. Resistance at 6,000 and 6,026 looms large, representing psychological and technical hurdles that the index must clear to maintain its upward momentum. On the downside, support zones at 5,922 and 5,882 offer some reassurance for traders seeking stability amid volatility. However, a break below these levels could challenge the bullish narrative that has dominated 2024.

The S&P 500 index

Source: Vikingen.se

Source: Vikingen.se

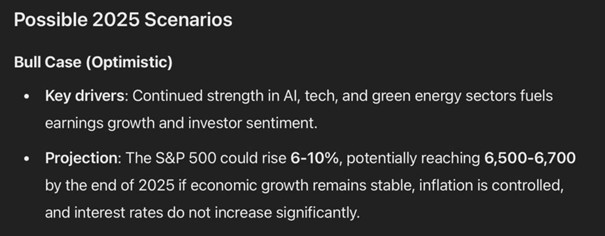

Scenarios for 2025

The outlook for the S&P 500 in 2025 is anything but straightforward, with the market poised at a critical turning point. Optimists argue that the same forces that have driven the index to its current heights – AI, technological innovation and strong consumer demand – could continue to drive gains. If so, we could see the index rise as high as 6,700 by the end of 2025, a scenario that relies on stable economic growth, controlled inflation and a Federal Reserve that keeps interest rates in check. As ChatGPT-4o boldly predicts:

“The S&P 500 could rise 6-10%, potentially reaching 6,500-6,700 by the end of 2025 if economic growth remains stable, inflation is controlled and interest rates do not rise significantly.”

ChatGPT predicts the S&P 500 index price. Source: Finbold/ChatGPT

ChatGPT predicts the S&P 500 index price. Source: Finbold/ChatGPT

The base case – a more measured but still optimistic outlook – suggests a growth path that mirrors historical averages. In this scenario, the index could rise at a modest annual clip of 7-8%, landing somewhere between 6,300 and 6,400 by year-end. This assumes no major economic disruption and a continuation of the current growth momentum, albeit at a steadier pace. For the bears, the picture is less rosy. Persistent inflationary pressures or an aggressive Fed could lift the market and pull the index back to 5 500-5 800. A slowdown in consumption or geopolitical shocks could further exacerbate the downturn, forcing investors to reassess valuations and growth prospects. ChatGPT-4o notes:

“The index could return to the 5,500-5,800 range as investors reassess growth prospects amid tightening financial conditions.”

What lies ahead

Revenue growth will also be crucial, especially in sectors like AI, green energy and technology, which have dominated the narrative in 2024. Companies that lead the charge in these areas are poised to set the tone for the broader market.

Consumer spending remains the market’s backbone. Robust spending data has underpinned much of the S&P 500’s resilience, but inflationary pressures could erode purchasing power and dampen demand. On the geopolitical front, trade tensions and global conflicts could inject further uncertainty, disrupting supply chains and investor confidence. As 2025 unfolds, the S&P 500‘s trajectory will depend on a delicate balance of factors. Optimism around AI and technology has been well-founded, but markets rarely move in straight lines. The Magnificent Seven may have driven this bull market, but their continued dominance will require tangible earnings growth and robust demand to justify their high valuations. Investors should account for volatility but realize that periods of consolidation can present opportunities. The psychological resistance at 6,000 is a test not just of technical levels but of market sentiment itself. If it breaks, it could unleash another wave of buying that drives the index into uncharted territory.

Viking offers price data on US stocks

Want to follow and analyze some of the biggest companies in the world? Here you can analyze the giants like Berkshire, Apple, Microsoft, JP Morgan and Google. You can do this by adding the extensions Nasdaq and NYSE, the New York Stock Exchange, from as little as $58 per month.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)