Central banks report record gold purchases in commodity markets

We had a longer piece on raw materials in the fall, but it’s important to all of us. Take your breakfast, for example: both your orange juice and your coffee are among the most traded commodities. Furthermore, there are also futures contracts for things like butter, eggs and cheese, although they are generally cash settled and do not attract as much interest as the major commodities.

Last winter, many people learned to monitor the price of electricity to charge their vehicles and run their laundry and dishwasher. The price of oil has a direct impact on the price of gasoline, which affects a large part of the Swedish vehicle fleet, while the discovery of swine fever in several countries, including Sweden, has led pig farmers to send their animals to slaughter, putting downward pressure on prices.

This is one of the most fascinating things about the commodity market, both where commodities are traded on exchanges and where they are traded on contracts. An event has direct, or almost direct, effects several steps away. If coffee plants in Brazil are affected by coffee leaf rust, it doesn’t take long for this to be reflected in the retail price.

In the last month, we have seen two of the major commodities, oil and gold, being particularly volatile and moving a lot. This is because these two commodities have been affected by the conflicts we are currently seeing in Ukraine and the Middle East. The latter is a region that is a major producer of crude oil. Gold, on the other hand, tends to rise in price when inflation increases or when there is global unrest. This has caused investors from around the world to flock to the yellow precious metal, which in turn has caused the price of gold to rise again. Normally, gold is not a commodity that benefits from high interest rates.

Central banks started buying gold 15 years ago

Central banks around the world now hold more than 35,000 tons of gold in their vaults, about a fifth of all gold ever mined. But what is it about gold that makes it such an indispensable asset for central banks?

Key reasons why central banks buy gold

Before looking at why central banks buy gold, let’s first look at what a central bank is and what its key functions are.

A central bank is a government institution that oversees a nation’s monetary policy and controls its money supply. Simply put, central banks allow the printing of legal tender (paper notes) that you can find in your wallet. In Sweden, the central bank is Sveriges Riksbank.

In addition, a central bank holds a nation’s financial reserves, which consist of foreign currencies, precious metals and other assets. In 2020, central bank demand for gold reached record levels, pushing global gold reserves to the highest in almost 30 years. In 2021, central banks continued to buy gold, and that’s when we saw emerging markets step up as important net buyers.

Why do central banks want gold so much?

Central banks want gold for the same reasons most of us do when we decide to buy it. The two main reasons why central banks want gold are;

Gold usually performs well in times of crisis

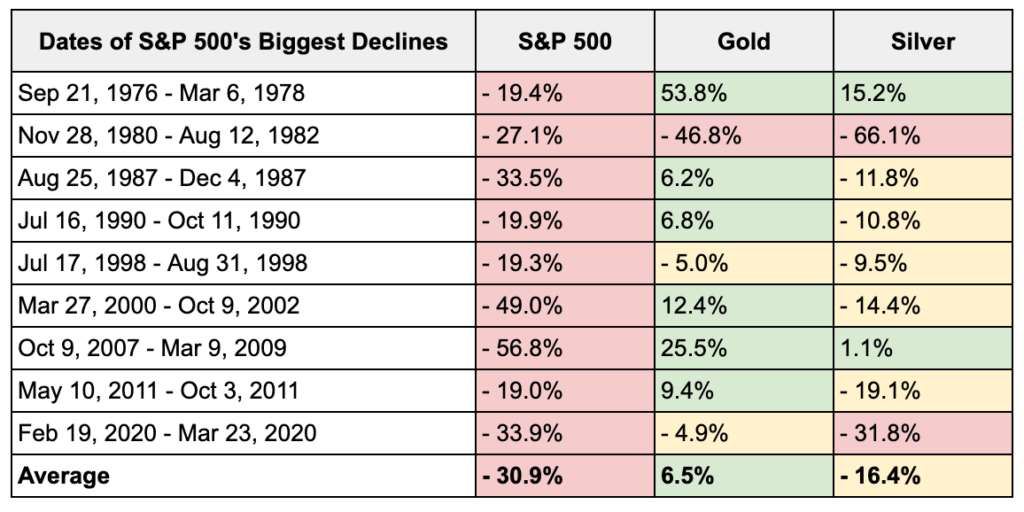

Gold is a well-known safe haven investment that retains its value or even goes up in value in times of uncertainty, stock market volatility or geopolitical crisis. Take a look at this table showing the evolution of the gold price during the biggest stock market crashes in history:

As you can see, the price of gold rose in most cases and large-scale geopolitical crises are usually no exception. When things get bad on the international scene, both investors and central banks rush to buy gold to protect their assets. As we know, greater investor interest will affect the price of gold, often pushing it upwards. This is called the law of supply and demand.

As you can see, the price of gold rose in most cases and large-scale geopolitical crises are usually no exception. When things get bad on the international scene, both investors and central banks rush to buy gold to protect their assets. As we know, greater investor interest will affect the price of gold, often pushing it upwards. This is called the law of supply and demand.

This is exactly what happened during the upheavals in the Middle East in the 1970s and the US bombing of Libya in 1986. The same happened when Russia invaded Ukraine in February 2022 and when war broke out in Israel a month ago.

Last week, the gold price approached its peak of $2,068 per troy ounce, breaking its previous record set in the summer of 2020. The bottom line is that for central banks, gold is obviously the ultimate asset:

“If the whole system collapses, the gold asset provides security to start again. Gold provides confidence in the strength of the central bank’s balance sheet. It gives a sense of security”, according to a report by the Dutch central bank.

Gold is an effective portfolio diversifier

Another primary role of gold for central banks is to diversify their reserves. As we noted earlier, banks are responsible for their nations’ currencies. But as you know, these currencies can be subject to fluctuations in value, depending on the state of the country’s economy.

In times of distress, central banks may be forced to print more money to avert economic turbulence but at the cost of devaluing their national currencies. This is what they did during the outbreak of the Covid pandemic by printing billions of dollars, euros, etc. to protect their economies.

Gold, on the other hand, is a finite physical commodity whose supply cannot be increased other than by increasing extraction, which is not as easy as it sounds as it often takes up to 10 years or more before a new mine can become operational. As such, it is a natural hedge against paper money losing value.

Moreover, gold almost always has an inverse relationship with the US dollar, meaning that when the dollar falls in value, gold usually rises, allowing central banks to protect their reserves in times of volatility.

Or, as American banker and financier JP Morgan once famously put it: “Gold is money. Everything else is credit.”

Of course, there are more reasons why central banks choose to invest in gold, including the fact that gold cannot go bankrupt, unlike every single bank, company or government in the world.

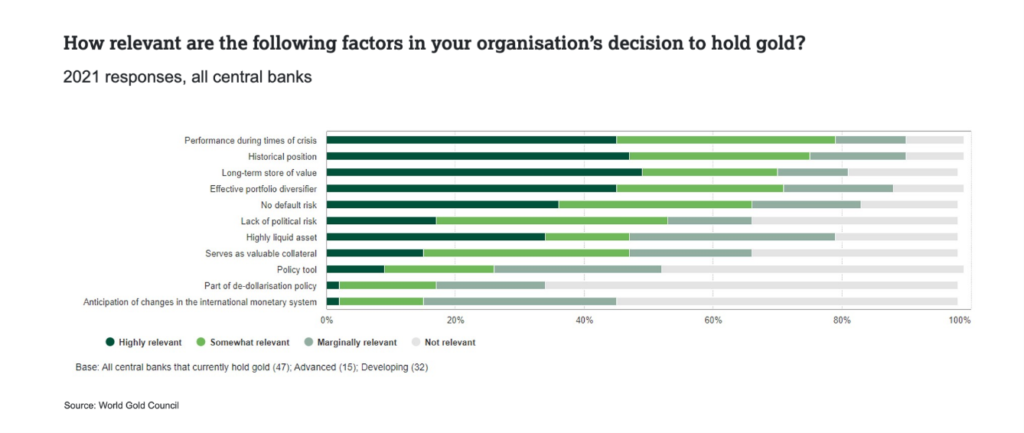

Below is a chart showing the reasons why central banks bought gold in 2021:

Source: World Gold Council

Source: World Gold Council

As you can see, the main reasons why central banks own gold:

– gold’s performance in times of crisis

– the historical position of gold

– Gold is a long-term preserver of value.

Overall, this shows that central banks see gold as the ultimate hedge in 2021, a year marked by the ongoing Covid crisis, rising inflation and supply chain chaos.

Now that we know the main reasons why central banks buy gold, it’s time to see how much gold central banks have bought in recent years.

How do central banks buy gold?

Until the 2009 financial crisis, the year of the worst economic crisis since the Great Depression, central banks were net sellers of gold, mostly to increase their holdings of US assets such as US government securities.

In 2009, driven by concerns about global currencies and economic uncertainty, central banks switched from being net sellers to net buyers of gold for the first time in 20 years.

What is a net buyer or a net seller?

A net buyer is a person, company or central bank that buys more than it sells; a net seller sells more than it buys.

Since 2010, central banks have been consistent net buyers of gold, although there were also several instances of monthly net sales in 2016 and 2020. The Russian Central Bank started buying back in 2009.

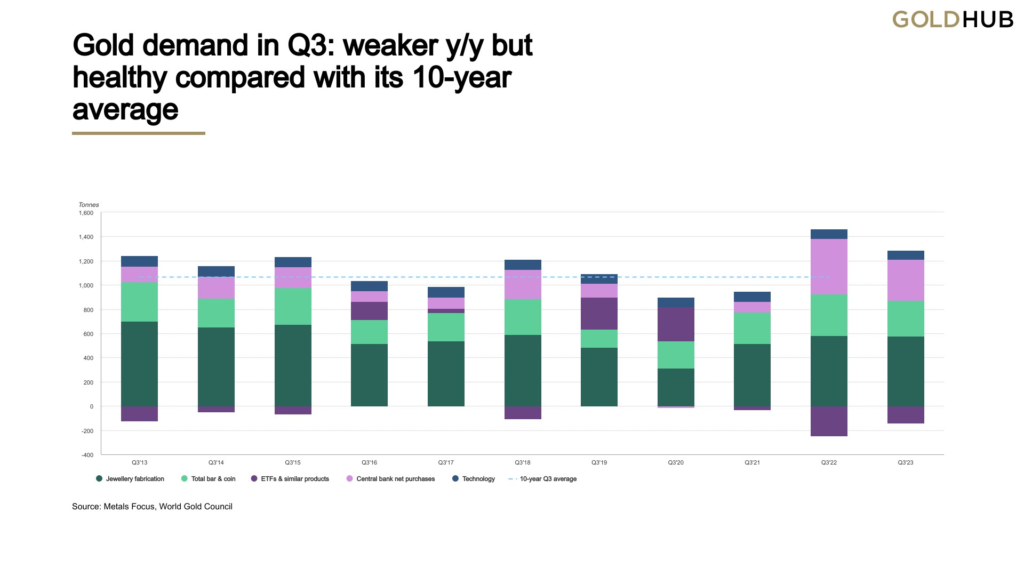

Central bank gold purchases maintained a historic pace in the third quarter of 2023, but fell short of the record purchases made in the third quarter of 2022. Demand for jewelry was slightly subdued in the face of high gold prices, while the investment picture was mixed.

Demand for gold (excluding OTC) in the third quarter was eight percent higher than its five-year average, but six percent weaker year-on-year at 1,147 tons. Including OTC and stock flows, total demand increased by six percent year-on-year to 1,267 tons.1

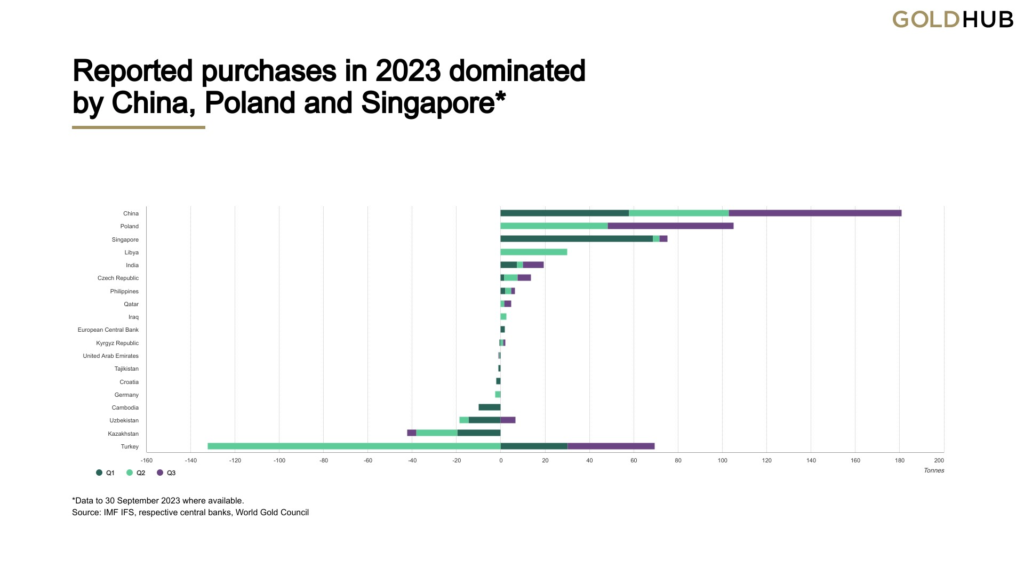

The net purchase of 337 tons of gold by central banks was the third strongest quarter in the World Gold Council’s data series, although it failed to match the exceptional 459 tons purchased by central banks in the third quarter of 2022. Nevertheless, year-to-date demand from central banks is 14% higher than the same period last year at a record 800 tons. The figure is the highest ever for the first nine months of any year. Although there is a core of committed regular buyers, the range of countries whose central banks have added to their reserves in recent quarters is broad-based.

Here is a list of countries that were the biggest gold buyers in 2023:

Source: World Gold Council

Source: World Gold Council

Of the reported gold purchases in 2023, most of the gold has been bought by China, Poland and Singapore. China has spearheaded global central bank purchases of gold worldwide in the first nine months of the year, as countries seek to hedge against inflation and reduce their dependence on the dollar.

As it turns out, emerging economies such as India, Libya and the Philippines rose to become key buyers of gold, and, more recently, EU members such as Poland and Hungary have made regular additions to their gold holdings. As of July 2016, the European Central Bank held 28% of its reserves in gold.

Gold demand in the third quarter of 2023

Yet the US remains the world’s largest holder of gold with 530,000 bars. The US Federal Reserve has 8,133.5 tons of gold, in the form of 650,000 gold bars. In 1973, the Fed stored more than 12,000 tons of monetary gold in its vaults. Of this, 147.3 million troy ounces – about 4,600 tons – of gold are held in the US Bullion Depository at Fort Knox.

Yet the US remains the world’s largest holder of gold with 530,000 bars. The US Federal Reserve has 8,133.5 tons of gold, in the form of 650,000 gold bars. In 1973, the Fed stored more than 12,000 tons of monetary gold in its vaults. Of this, 147.3 million troy ounces – about 4,600 tons – of gold are held in the US Bullion Depository at Fort Knox.

Where do central banks buy their gold?

The most common way for central banks to add gold to their reserves is to buy it on the over-the-counter (OTC) market. This simply means that a central bank buys gold directly from a gold bank or an internationally recognized gold refinery such as MKS PAMP or one of its competitors.

The second way for central banks to buy gold is through the Bank of International Settlements (BIS). It is a financial institution based in Basel, Switzerland, which literally acts as ‘a bank for central banks’.

Finally, central banks can buy locally produced gold. Of course, this mostly refers to gold-producing countries like China, Russia, Canada, etc.

For example, there are several central banks around the world that run local gold purchase programs, including the Central Bank of the Philippines and the Central Bank of Mongolia. Other central banks, such as the Central Bank of Russia, buy locally produced gold from local commercial banks.

Will central banks continue to buy gold?

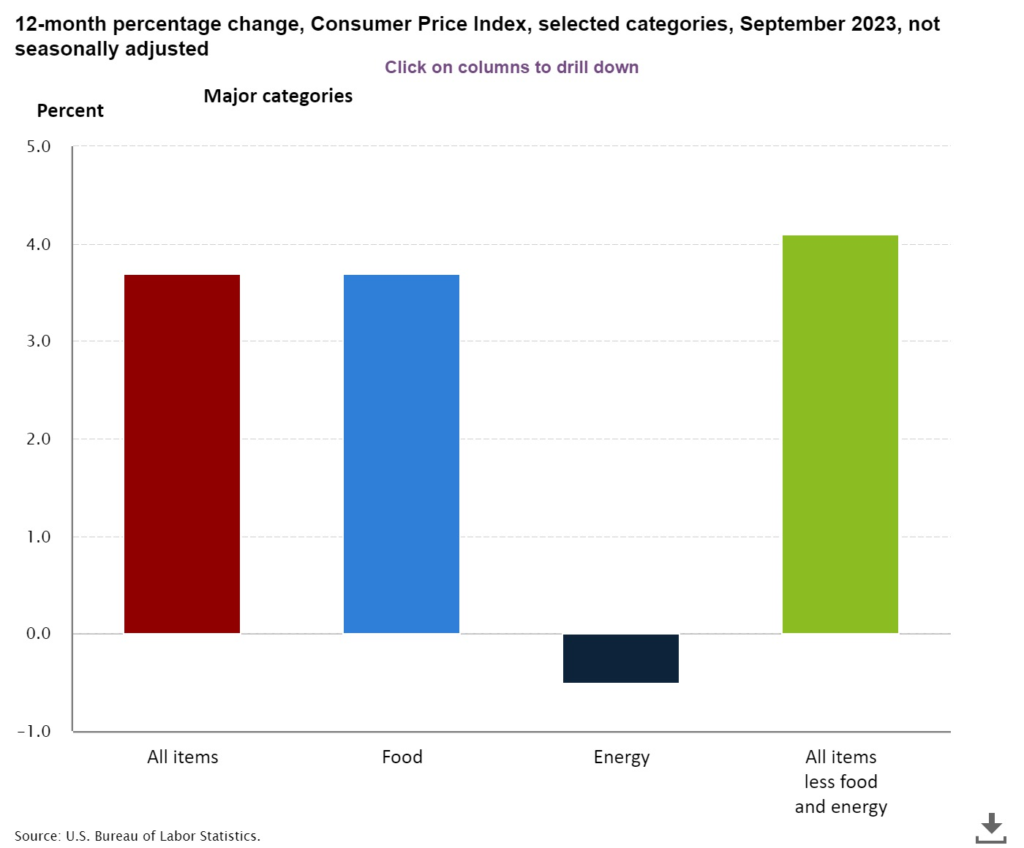

US inflation is undoubtedly falling, however, the outdated protective data in the Consumer Price Index (CPI) calculation masks the reality. An alternative inflation measure, calculated by US asset manager WisdomTree (which replaces real-time housing inflation with housing), stands at 1.4 percent instead of the 4.1 percent official Bureau of Labor Statistics (BLS) headline inflation, with real-time core inflation at 2.1 percent – almost exactly the Federal Reserve’s (Fed) inflation target.

The official BLS reports use a protective inflation measure that is reported to be four percent over the past 12 months.

However, Wisdomtree’s alternative measure puts the increase in house prices at 0.5%. This single variable would dramatically change the Fed’s inflation story and shows that the US central bank, the Fed, should cut interest rates.

However, Wisdomtree’s alternative measure puts the increase in house prices at 0.5%. This single variable would dramatically change the Fed’s inflation story and shows that the US central bank, the Fed, should cut interest rates.

Other central banks in the developed world are getting ready to raise interest rates. The European Central Bank (ECB) is keeping a hawkish stance and in 2023 has warned the financial markets of upcoming hikes, with President Lagarde saying that they have done “significant progress”, but “can’t declare victory yet.” The Bank of England (BoE) has resorted to shocking the market with 50 bps hikes as upside inflation surprises remain. While we do not believe that inflation metrics in Europe share the same price distortions as in the US, we know that monetary policy lags are long and variable. The rapid pace of interest rate increases may have an exaggerated effect once the lag is taken into account.

Central banks continue to buy gold

After reaching a record level of gold purchases in 2022, central bank demand for gold has remained strong, with official sector gold purchases in the first quarter of 2023 being the largest ever in the first quarter, albeit lower than Q3 2022 and Q4 2022. In April 2023, a sale of gold by the Central Bank of Turkey of 81 tons appeared to be more of a technical dynamic than a change in the country’s gold purchase policy: the gold was sold to the domestic public markets to satisfy a strong demand for jewelry, ingots and gold coins after a temporary partial ban on the import of gold ingots. That ban was put in place to mitigate the economic blow from the February 2023 earthquake.

A YouGov survey, sponsored by the World Gold Council, showed that developing market central banks are expecting to increase their gold reserve holdings and decrease their US dollar reserves.

Different ways to invest in gold

There are a number of different ways to invest in gold. First, it is by investing in gold companies, either those that are gold producers, i.e. operate mines that produce gold. The other option is to buy so-called ‘ junior mining companies’, companies that are involved in exploration and development, which roughly translates to looking for gold. This type of company can be found on the Stockholm Stock Exchange, but is more prevalent on the Canadian stock market.

Another way is to

buying certificates

which we have written about before. A certificate is a debt instrument issued by an issuer. Unlike traditional money market certificates that pay a fixed interest rate, the return on these new certificates is linked to the return on an underlying commodity, such as gold.

NASDAQ OMX, but also Nordic Growth Market, NGM, together with the issuer, offers trading in a number of different types of certificates.

The third way to gain exposure to gold is to buy your own gold bullion, or part of it. In Sweden, it is possible to buy so-called share gold through, for example, Nordic Gold Trade.

Shared gold means that you buy physical gold in shares where Nordic Gold Trade stores the gold in a security deposit with the security company Loomis including insurance. It is possible to buy gold for as little as 1,000 kronor in this system, but it is also possible to buy gold in the form of ingots weighing as little as 1 (2) gram from various gold dealers.

Evolution of the gold price

Source: The Viking

Source: The Viking

We are used to seeing gold prices often in USD/oz,” says Michel Rufli, CEO and founder of Nordic Gold Trade AB. This is not an optimal way of looking at the price of gold for those of us who live and work in Sweden. Getting your salary in Swedish kronor, buying food in Swedish kronor and paying bills in Swedish kronor is natural for most people. So why shouldn’t we look at the price of gold in Swedish kronor? In fact, what is important for us in Sweden is how the gold price develops in Swedish kronor.

The gold price in Swedish kronor is shown daily on the Nordic Gold Trade website and here is a graph of the historical development in kronor since 2000. There is no doubt that the gold price is on an upward trend in a long-term perspective, but given the increase in money supply in the world, there is still a long way to go to the top, says Michel Rufli.

A general rule of thumb is that gold in most currencies other than USD & Euro is less volatile. This improves gold’s role as a hedge in a diversified investment portfolio. If you haven’t already bought gold, it’s not too late, reduce your financial risk with physical gold in your portfolio. It’s always good to have!

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)