Buy signals stocks, options, certificates

Buy signals stocks, options and certificates

Last week’s buy signals for stocks, options and certificates went well. Three out of four options made a profit.

But unfortunately, the stock opportunity with Aravive went badly. This again shows the disadvantage of the Relative Strength Index, RSI; RSI works poorly for trending stocks, i.e. those in a strong up or down trend. Stocks that have a low RSI may still continue to fall. RSI is only one piece of the puzzle, it is NOT enough to use RSI alone.

A very low RSI is not enough. Aravive has now broken through its support and looks set to continue downwards.

Buy signals stocks

Note that buy signals in individual stocks when the stock market is trending downwards are uncertain. Right now the Nasdaq is falling and has broken downwards through its support at 14500.

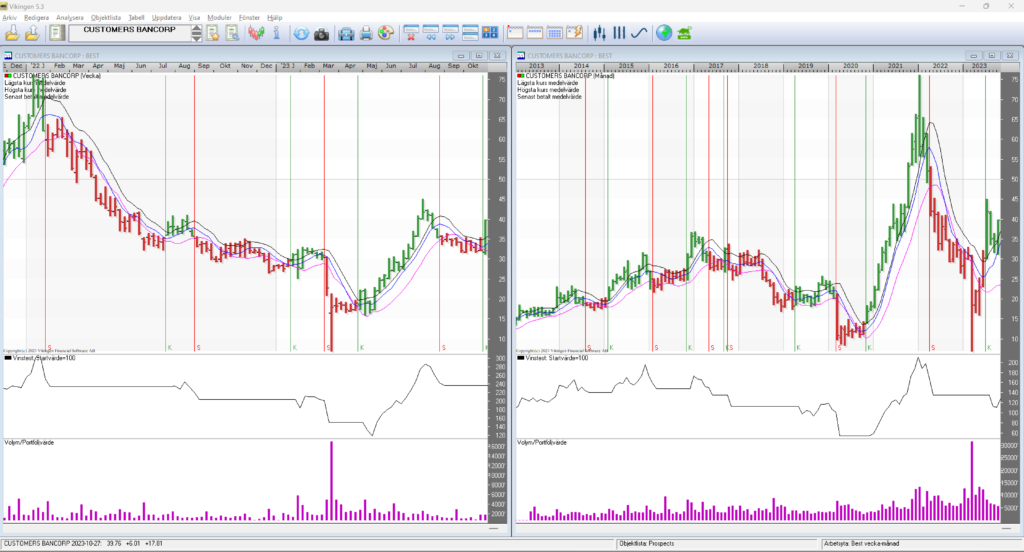

Customers Bancorp, submitted a good report recently with 24% profit on working capital. High volume and high volatility in the last day. Located in day-week-month purchases.

Doro, has provided a very good report. Turnover, profits and cash flow increase. This is reflected in the share price. A good company with a stock that is at its lowest point (that’s what we’re looking for, right?).

Other stocks: Ortovirus b, Hexpol B , NovoZymes, QT Group, Neste, F.secure with a one-week reversal signal, signaling a trend reversal. One-week reversal is an early reliable trend reversal signal. Bettson B reverses up from a support with increased volume. Eidesvik Offshore is trending up from a bowl formation from now NOK 14 to around NOK 30 in a few years’ time. SSAB has a weak buy signal by almost breaking through a resistance with increased volume.

Buy signal options

This week there are also some buy signals on call options, unlike last week. Note that the stock market is still trending downwards and buying call options in a falling market is a big gamble. You have to be prepared to sell quickly. In addition, the table has low scores in the signal sum column, indicating an uncertain situation. All index options indicate a decline, while some stocks indicate an increase.

| Object | Signal sum | Last | Volume | Time |

| SWEDA3X187.46X | 11 | 10,75 | 30 | 231027 |

| SSABA3K64 | 10 | 2,5 | 53 | 231027 |

| OMXS303X2020 | 10 | 40,25 | 30 | 231027 |

| SOBI3K229.21X | 9 | 3,1 | 127 | 231027 |

| ELUXB3X90 | 9 | 5 | 30 | 231027 |

| ELUXB3X128.14X | 7 | 36 | 15 | 231027 |

| SWEDA3X200 | 6 | 22 | 10 | 231027 |

| OMXS303W1950 | 6 | 10 | 497 | 231027 |

| OMXS303X2050 | 6 | 52,75 | 110 | 231027 |

| ELUXB3W120 | 5 | 27,25 | 200 | 231027 |

| TIGO3K180 | 5 | 2,5 | 68 | 231027 |

| AZN3X1230 | 5 | 10,5 | 20 | 231027 |

| OMXS303W2020 | 5 | 25,25 | 56 | 231027 |

| ESSITB3K255 | 5 | 2,8 | 150 | 231027 |

| VOLVB4R190 | 5 | 6,2 | 10 | 231027 |

Buy signal certificate

Here are the certificates among about 10000 certificates with the highest buy score (=signal sum).

| Object | Signal sum | Last | Volume | Time |

| BULL GOLD X15 NORDNET 6 | 11 | 7 | 3394 | 231027 |

| BULL AMAZON X3 NORDNET | 10 | 62,01 | 297 | 231027 |

| BULL KONGSBERG X3 NORDNET N | 9 | 174,85 | 236 | 231027 |

| 3AN | 9 | 3,78 | 3208 | 231027 |

| BULL GOLD X15 NORDNET N6 | 9 | 52,91 | 2622 | 231027 |

| BULL TELENOR X3 NORDNET N1 | 9 | 55,03 | 3500 | 231027 |

| BULL IN X3 ND | 9 | 10,88 | 32814 | 231027 |

| BEAR NASD X20 BNP7 | 8 | 0,32 | 125000 | 231027 |

| ZCSPETNREDEEM29012043USD250636 | 8 | 26,83 | 2859 | 231027 |

| BULL AMAZON X3 NORDNET F1 | 8 | 1,04 | 600 | 231027 |

| BULL ORS X3 ND | 8 | 1,27 | 169543 | 231027 |

| BEAR NVDA X8 SG24 | 8 | 40,98 | 12845 | 231027 |

| BULL GOLD X12 NORDNET 6 | 8 | 8,43 | 500 | 231027 |

Buy signals in the Viking

Buy signals stocks, options, certificates have been produced in Vikingen Maxi. Vikingen Maxi includes all functions and databases. Examples include options, certificates, all Nordic stock exchanges, the US, mutual funds and ETFs. We dare say that the Viking Maxi is the most profitable version. 990 kr/month or 9900 kr/year.

Read more here: Vikingen Maxi, Sweden/Denmark/Norway – Stock market program for those who want to become even richer