Battery boom: €400 billion forecast, more than experts assumed so far

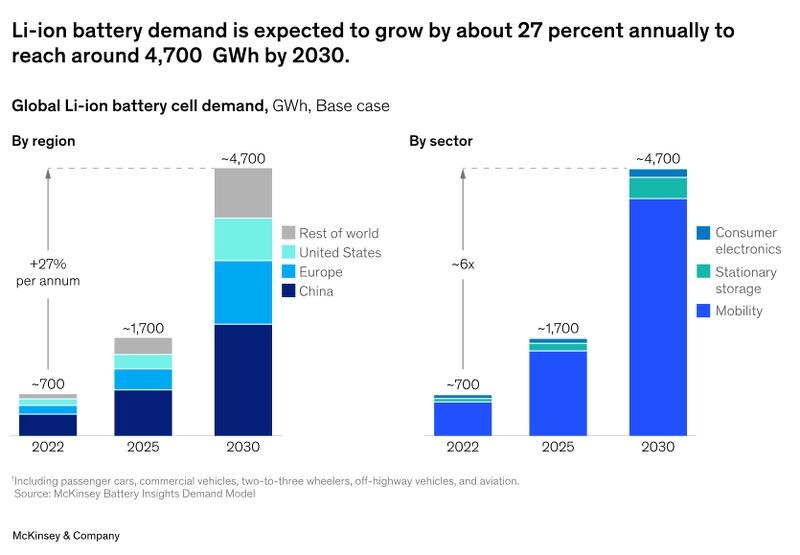

The race for market share against China has long since begun. The European Batteries Directive therefore not only aims to protect the environment and human rights along the value chain, but is also a strategic instrument to secure Europe’s position in the battery industry, which is currently experiencing a battery boom. By 2030, demand for lithium-ion batteries will increase by 27% annually, according to a study by @McKinsey & Company.

Stomach ache in China? On the contrary, the new battery regulation is perceived as an incentive to meet European requirements. In April, CATL announced its intention to make its core business CO2 neutral by 2025 and to achieve carbon neutrality across the entire battery value chain by 2035.

The catch: without Chinese investment, it will be difficult to meet battery regulation targets. 90% of anodes and cathodes and 60% of electric cars currently come from China. It is of course interesting for these companies to invest here and meet the requirements.

We cannot do it with or without the Asian giant – it is important to strongly promote European projects to reduce our dependence.

About the Viking

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)