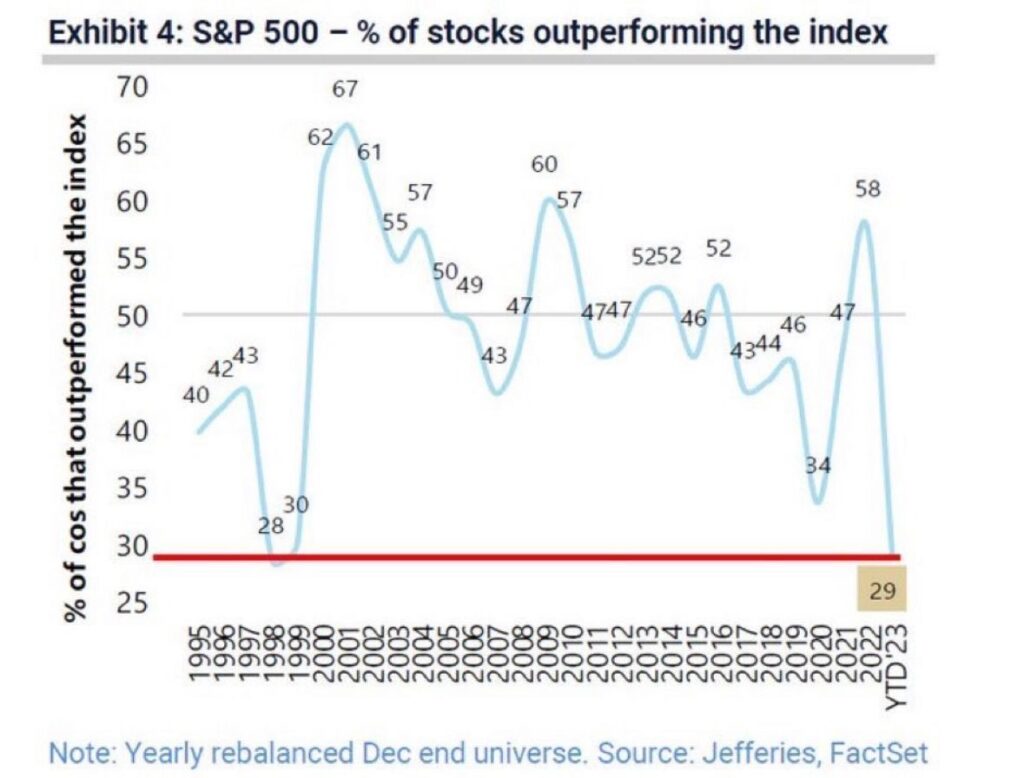

29% of S&P 500 stocks outperform the index

Only 29% of the more than 500 stocks included in the broad US stock market index, the S&P 500, outperform the index’s own performance. This is the lowest figure since 1999.

Due to the large number of stocks included in this index, it is inherent that not all stocks will outperform the index. However, it is not necessarily the case that half of all stocks outperform the index because, unlike the Dow Jones, the S&P 500 is a market cap weighted index. This means that larger companies will be given more weight than smaller companies.

In the case of the Dow Jones, one share from each constituent company is added to the index and it is the share price that has the greatest impact. In the case of the S&P 500, we see that it is a small number of companies that are doing well that contribute to the index’s performance.

Source: Jefferies / Michael A. Arouet)

Source: Jefferies / Michael A. Arouet)

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots, price data, tables and stock prices, you can sort out the most interesting ETFs, shares, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)