13 common mistakes inexperienced forex traders make

13 common mistakes inexperienced forex traders make

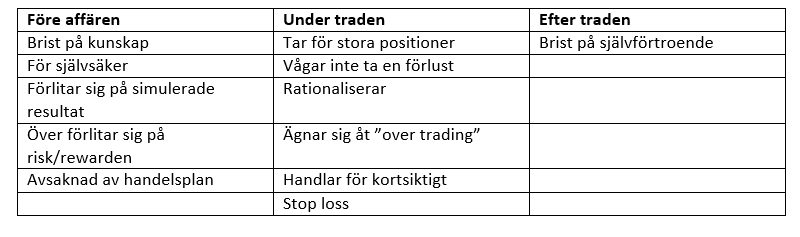

Lack of knowledge – Trading successfully, whether in currencies, stocks, commodities or anything else is unlikely if you don’t know what you’re doing. Before you start trading, you should have an understanding of trading in general and Forex trading in particular. Understanding charts and graphs is all well and good, but it is important that the knowledge goes beyond just understanding the technical indications. Most new traders do not take the time to understand what is driving prices – primarily fundamentals – and are therefore forced to close their positions when the news arrives, often standing on the sidelines when the best opportunities arise. They learn to act only when markets have calmed down, which means they miss the big ups and downs and only trade in the “white noise” of fundamental price changes.

Self-confidence – Just because a trader has been successful in making good trades in other asset classes does not mean that he or she will be successful in Forex trading, at least not without studying, practicing and gaining experience. Trading is a profession, and it takes respect and patience to master it. Trading is not easy, there are statistics showing that no less than 95 percent of all new traders lose money in their first trades. Success in the first few deals is no guarantee of continued success. Therefore, always keep your eyes open for new ways and opportunities to improve your skills and your trade.

Relying on simulated results – Beware of “black box” systems, those trading systems that do not disclose how the trading signals are generated. The vast majority of these schemes have little substance behind their systems. Many of these systems have a history of extraordinary results, but think about it, if you had the facts in hand when you built your system, you could also create a phenomenal system. The future is a completely different story.

Over-reliance on risk/reward – You have probably heard many times that you should only bet on those trades that have a risk/reward of 3 to 1 or higher. This means that you should try to make 3 times as much profit as you risk. Ask yourself if it sounds realistic. If you have bought a property, would you buy it only if there was an opportunity to triple your investment? And what time horizon would you envisage for this?

Lack of a trading plan – Making money is not a trading plan. A trade plan is the roadmap to success in your trade. A trading plan shows what you see as your strength, what it is that will allow you to trade at a profit. If you don’t have a strength or a trading strategy, you don’t have a plan and it’s likely that you’ll become one of the players that the high-profit traders live off.

Betting too much – The amount you risk in each individual deal is a double-edged sword, a big bet can generate big profits if you get it right but it can also lead to bigger losses if your decision was wrong. It is therefore important to ensure that the size of the business increases with success and is not used as a means to try to reach it.

Don’t dare take a loss – it’s not the least bit macho to stay in a wrong position. It takes discipline to take a loss and wait until the next opportunity arises to take the next position. “Marrying” a bad position is something that has ruined many traders. It is important to remember that markets often behave irrationally, and that a deal is just a deal. A single good deal will not lead to success and wealth, being able to make the right decisions every day, week, month and year is what brings the best results.

Don’t rationalize – choose your business carefully, do it and then close it. If it reaches your predetermined stop loss close the position immediately.

Think of yourself as a professional boxer who has been knocked out. Moving your stop loss down (or getting up and trying to continue boxing) after you have been knocked down is pointless, it will only make the situation worse. Instead, come back the next day, or in the next shop. A small loss won’t hurt you, a catastrophic loss is guaranteed to be painful.

Over trading – trading with tight stop losses or small profit targets is in the long run a strategy that will not generate profits.

Trading too short-term – If you have too small a profit target, the spread, the difference between the bid and ask price, will make the odds go against you when chasing those small profits.

Stop loss – setting too tight stop losses is a guaranteed way to lose money. When you enter a deal, set a realistic stop loss that gives your deal a fair chance of developing into a winning deal. Just keep in mind that there is so much more than a stop loss that determines whether your deal will be a good deal or not.

Lack of confidence Confidence comes from successful trading and if you start by losing money in your career it is difficult to gain confidence, the trick is to make sure you learn to crawl before you can walk – or run.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)