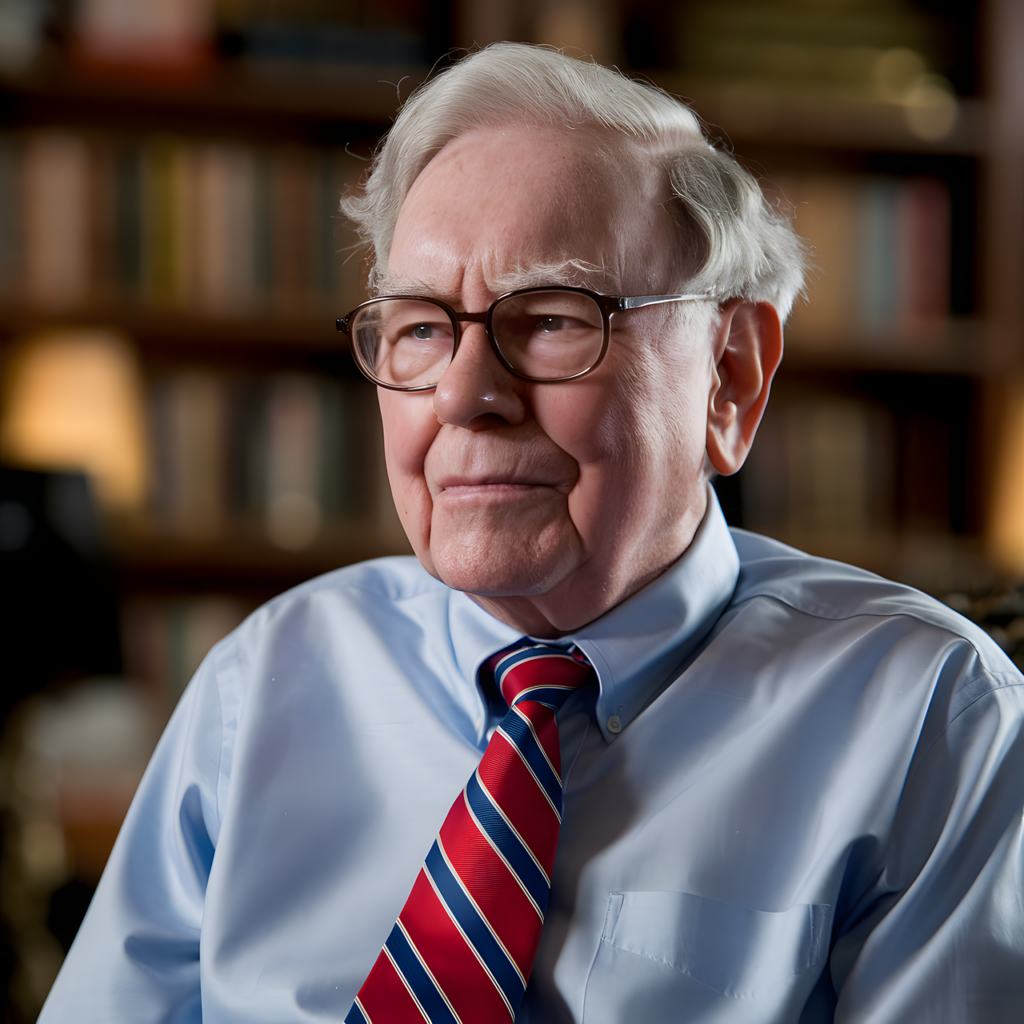

10 Warren Buffett rules to help the middle class get rich

In a world where financial security often feels out of reach for the middle class, Warren Buffett stands out for his proven wisdom and practical advice. As one of the most successful investors of all time, Buffett has distilled his insights into simple but powerful rules that anyone can follow to build wealth, or in short, help the middle class get rich. This article explores ten fundamental principles from Buffett’s philosophy, offering practical guidance for individuals looking to improve their financial well-being. Whether you are just starting your investment journey or want to refine your approach, these rules can help you achieve a more prosperous future.

1. Live below your means

“If you buy things you don’t need, you will soon have to sell things you do.” – Warren Buffett.

This principle forms the basis of wealth building. Living below your means creates a surplus that can be invested for future growth. Avoid unnecessary spending and focus on needs rather than wants. This discipline allows you to save more and invest in your financial future.

2. Invest in yourself

“The most important investment you can make is in yourself.” – Warren Buffett.

Continuous learning and skills development increases earning potential and improves financial decision-making skills. Invest time and resources in education, training and personal development. This investment in human capital often provides the highest return over a lifetime.

3. Start investing early

“Someone is sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffett.

The power of compound interest, compounding of capital gains and reinvestment of dividends means that starting to invest early, even with small amounts, can lead to significant wealth over time. Start investing as soon as possible and take advantage of tax-advantaged accounts like 401(k)s and IRAs (Investment Savings Accounts and endowment policies). Time is of the essence in building wealth, so don’t delay.

4. Focus on long-term investments

“Our favorite period is forever.” – Warren Buffett.

This long-term perspective allows investors to remove market volatility and benefit from the growth of the economy. Choose quality investments and hold them for longer periods. Avoid the temptation to time the market or chase short-term gains. Patience and persistence are essential for successful long-term investments.

5. avoid debt

“The two biggest weak links in my experience are that I’ve seen more people fail because of booze and leverage – leverage is borrowed money.” – Warren Buffett (quoting Charlie Munger)

High-interest debt can erode wealth and financial stability. Prioritize paying off high-interest debt and avoid accumulating new debt. Use debt sparingly and only for investments that are likely to generate returns that exceed the cost of borrowing.

6. Build multiple income streams

“Never become dependent on a single income. Make investments to create a second source of income.” – Warren Buffett.

Diversifying sources of income provides financial security and accelerates wealth accumulation. Explore opportunities for side hustles, rental income or dividend-paying investments. Multiple income streams can provide a safety net and increase your earning potential.

7. Invest in what you understand

“Never invest in a company you can’t understand.” – Warren Buffett.

Stick to investments within your circle of competence. Research and understand the companies or industries you invest in. This approach will help you make informed decisions and avoid costly mistakes based on hype or speculation.

8. Be patient

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett.

Building wealth takes time. Avoid get-rich-quick schemes and focus on steady, long-term growth. Stay committed to your investment strategy through market ups and downs. Patience will allow you to capitalize on the power of compounding and long-term market trends.

9. Learn from mistakes

“It is good to learn from your mistakes. It’s better to learn from the mistakes of others.” – Warren Buffett.

Analyze your financial mistakes and learn from them. Study the experiences of successful investors and avoid common pitfalls. Continuous learning and adaptation are essential for long-term financial success.

10. Invest in low-cost index funds

“A low-cost index fund is the most sensible equity investment for most investors.” Warren Buffett.

Warren Buffett recommends that middle-class investors focus on low-cost index funds that track broad market indices. These funds provide diversification and typically outperform actively managed funds over the long term.

Conclusion

Warren Buffett’s wisdom offers valuable guidance for middle-class individuals who aspire to build wealth. You can develop a solid foundation for financial success by following these ten rules. While these rules may seem simple, their consistent application can lead to significant wealth accumulation over time. Buffett’s approach emphasizes discipline, continuous learning, and a long-term perspective. By adopting these principles, middle-class individuals can work towards financial independence and security. Building wealth is a gradual process that requires commitment and persistence. There are no guaranteed shortcuts to riches, but you can improve your chances of financial success by following Buffett’s proven principles. Start implementing these rules today, and you’ll be on your way to a more secure financial future.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)