Description

Our best show. For those who can monitor the Swedish stock market during the day. A very, very high degree of profitable chance. This program is made for option traders. An autopilot chooses good options to sell and buy. Historical data shows at least an 85% chance of making a profit, if you have the opportunity to monitor the stock market very closely. Vikingen Trading, stock and index options, special elections with car pilots and Black & Scholes table.

Presentation av Vikingen Maxi

Do you trade options? Are you thinking of exhibiting options? You want to protect your briefcase? Do you want to make money no matter how the stock market goes? In that case, Vikingen Option is a good program.

With Vikingen Option you get courses for Swedish shares and index options, unique option models, Black & Scholes, simple automatic searches and everything included in Vikingen Trading. In Vikingen Trading you have all shares, indices, currencies, fundamentals, future alarms etc. Possibility to write your own models.

There are very accurate models that have worked for a long time. Of course, here are the Greeks like Delta, Gamma, Theta, Epsilon, Eta in tabular form that you can sort. Vikingen Option includes black & scholes formula where you can get the most affordable option right now. You can rank the table by the difference between theoretical value and fair value. Theoretical value is based, among other things, on number of days to ransom, implied volatility, historical volatility, etc. As you surely know, those who note the option (issuer) are obliged to set rates if you so request. It’s special when you want to issue an option. In Vikingen Option you can see theoretical purchase and seal course. You don’t have to figure anything out yourself.

You can create your own lists on the option you’re interested in. Mix both stock options and index options. You can even get automatic alarms on days when a certain level for each option is broken. Either you pull trendlines yourself and order monitoring or you let Vikingen Option calculate the alarm levels.

Vikingen Option is our most complete program and also the simplest. How is that possible? We’ve already done most of the work for you, you just need to start a program that we call “Autopilot”, and it automatically brings out fresh signals and future alarm levels. It’s good to have a fast computer if you want to work with future signals. We call future signals tomorrow’s signals. There will be many calculations for the thousands of options available.

This is how simple it is.

- Start the Vikingen

- Update courses

- Click Autopilot and autopilot O_optio2.

- On the screen, proposals for options to buy, sell or exhibit are made.

The historical accuracy is very high for issued options. The person who exhibits, has time with them, the one who buys options has the time against them.

Held options, purchased options, are the easiest to monetize when underlying securities or indices move very fast, i.e. when volatility is unusually high. The unique option model in Vikingen also has high accuracy on purchased options, but this places higher demands on the user. For purchased options, it is high adrenaline factor, but should sit there and watch during the day. Of course, there is a chance that with a little money you can make a lot, but it also goes quickly the other way. The bank might tell you: you can only lose what you bet. It is true, the problem is that you bet several times and in the end the money may be gone.

But… then everyone should issue, i.e. sell, options. Well, if only it were that simple. For example, if you issue 10 contracts in Volvo, 1 block, you have an obligation to fulfill your promise to buy 10 times 100 shares within the maturity has expired. If Volvo drops, you must be prepared to buy shares, or buy back the issued option at a loss. Say you issued at 150 SEK, then you must be prepared to buy for 150.000 KR. Your bank continuously checks if there is any danger and will contact you if they see that the risk increases. You must have a certain amount of security in your account to be able to issue, it is usually about 10%, so I exemplify 15,000 SEK. The security amount changes every day. Even the bank does not know how much the security amounts are for all options, but asks the stock exchange itself about it. In the past, that has changed every other day.

Get winning options

Of course, nothing can be promised, but here is a good methodology That is, a suggestion on how you can come up with the best options to bet on.

- How is the stock market as a whole going? Look at the OMXS30 index. If the index has broken a trend, support or resist, the stock market is overbought or oversold. Preferably act in the direction of the stock exchange.

Produce a chart on OMXS30, draw in trend/support/resistance. Here, for example, OMX has broken an upward trend and your strategy will probably be that the stock market will fall, bet in that direction. E.g. issue call options in shares.

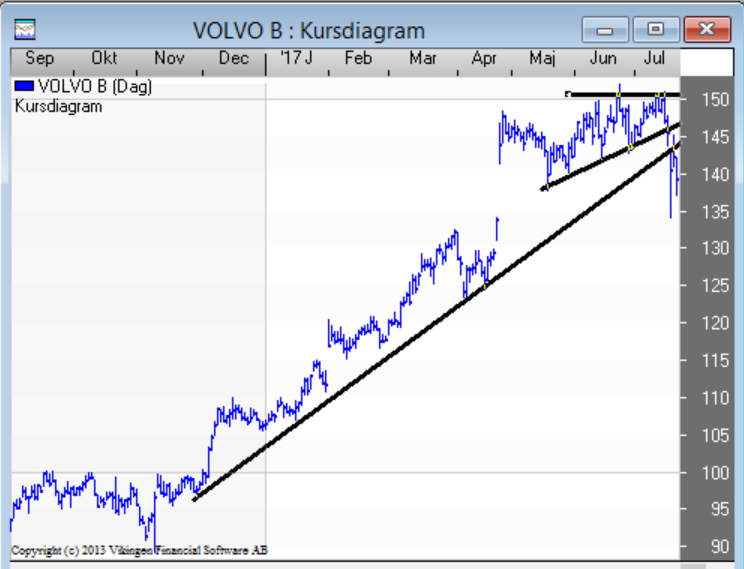

- Review the shares that have options. Who has reached their resistance, who is on their way down? Who has at the bottom until the next support?

For example, Volvo B. Here the stock has broken both medium and short trend. Seems like an extra strong signal.

- An appropriate call option to issue? 150 feels a lot safe, but is probably too far from the current rate, so pari. The closer you get to par, the more money you get, but risk someone wanting to buy your Volvo island Most money you will of course get if you issue “In the money”, that is, the option has a fair value. Say the price is 140 above, and you bet on exhibiting and call option of 140. The fair value of the option will then be SEK 0 (minus kurtage). The expectation value is added.

- Find the option in the Viking, Since we are in quite a few weeks in July, you probably choose septmber as ransom It should be at least 3 weeks left to ransom. The expectation value drops drastically if there are less than 3 weeks left. Figure out which letter the ransom month September has, i.e. the 9th letter of the alphabet: I. The option is then called VOLVB7I140.

- Look for buy and sell signals

You take up an option model and see that you only received a sales signal of SEK 4 and issue.

- Monitor the option and buy back when you receive a buy signal. Here it was 3.50, i.e. a profit of 50 cents. 0.5 / 4 = 12.5%. Decent for a month. NB! With options, it goes quickly, many times in the wrong direction. For example, in August where you got in 3 KR, but had to buy back at 6 KR. Here the important thing is to follow the underlying stock. If it starts to rise, it is good to buy back the option. Tip; Accepting the purchase price that exists within it is getting worse.

How do you use the risk in options, but still make money?

There are many ways, often referred to as strategies. Among the most common are Sold ostrich or sold cradle, bought ostrich or purchased cradle. It involves buying options with different ransoms. This increases the cost and reduces the revenue (premium) but risks decreasing. Vikingen Option does not figure out strategies. What you can do instead is run the autopilot O_Optio2 that is in the Viking and invest in several options that have signal. Then you spread the risks. Of course, you can still make a loss, but the chances of winning are increasing. A good tip is that you settle for a certain profit, e.g. 30% and keep losses short, e.g. no lower than 15% loss.

The unique signal table with high accuracy

Below is an excerpt from the signal table in Vikingen. The column “Current Buying Age” says how many days ago there was a signal. The Column “% from signal” indicates how things have gone since then. If it is buy signals, it should preferably be plus, minus sign means loss (i.e. decline in value). As you can see below, almost everyone has gone with wise… but you may have had the misfortune to bet on those who have made a loss.

| Object | Current Purchase Age | Current Sales Age | % from Signal | Signal sum | Last | Volyme | Date |

| BOLI7L280 | 26 | 195,65 | 6 | 17 | 15 | 170908 | |

| ELUXB7U280 | 19 | 63,79 | 9 | 4,75 | 50 | 170908 | |

| ERICB7V50 | 14 | 58,73 | 7 | 5 | 30 | 170908 | |

| HMB8O250 | 13 | 14,43 | 5 | 55,5 | 25 | 170908 | |

| ERICB7U46 | 8 | 27,27 | 0 | 0,7 | 10 | 170908 | |

| SAND7L130 | 8 | 34,62 | 7 | 8,75 | 14 | 170908 | |

| AZN7L510 | 6 | 175 | 3 | 16,5 | 10 | 170908 | |

| HMB7X230 | 6 | -1,38 | 1 | 35,75 | 74 | 170908 | |

| SSABA7I38 | 6 | 55,1 | 7 | 3,8 | 186 | 170908 | |

| SHBA7U125 | 6 | 72,73 | 5 | 9,5 | 10 | 170908 | |

| SSABA7I40 | 5 | 28,57 | 5 | 1,8 | 2210 | 170908 | |

| VOLVB7L145 | 5 | 158,33 | 6 | 7,75 | 50 | 170908 | |

| EKTAB7I80 | 5 | 6,25 | 3 | 4,25 | 5 | 170908 | |

| VOLVB7I140 | 5 | 20 | 1 | 7,5 | 50 | 170908 | |

| VOLVB7I142.50 | 5 | 10,53 | 1 | 5,25 | 10 | 170908 | |

| ATCOA7L330 | 5 | 7,14 | 4 | 7,5 | 5 | 170908 | |

| ALFA7J185 | 3 | 54,41 | 4 | 5,25 | 16 | 170908 | |

| AZN7I470 | 3 | 115,25 | -1 | 31,75 | 12 | 170908 | |

| EKTAB7J85 | 3 | 73,91 | 4 | 2 | 40 | 170908 | |

| EKTAB7L90 | 3 | 20 | 5 | 1,8 | 20 | 170908 | |

| AZN7J510 | 2 | 186,76 | 5 | 9,75 | 10 | 170908 | |

| AZN7I500 | 2 | 520,69 | 4 | 9 | 10 | 170908 | |

| HMB8C230 | 2 | 5,26 | 3 | 4 | 50 | 170908 | |

| HMB7J210 | 2 | 15,94 | 3 | 4 | 5 | 170908 | |

| HMB7L200 | 2 | 11,11 | 3 | 10 | 10 | 170908 | |

| FINGB7U34 | 2 | -20,83 | 2 | 1,9 | 25 | 170908 | |

| FINGB7U33 | 2 | -12,5 | -1 | 1,4 | 10 | 170908 |

When the purchase signal is sharp, it should say “0” in columns for “Current Purchase Eel”.

| Object | Current Purchase Age | SignalSignalsum | Last | Volyme | Date | ||

| ICA7L330 | 0 | 2 | 4,5 | 20 | 170908 | ||

| SSABA7L38.24X | 0 | 6 | 4,5 | 40 | 170908 | ||

| HMB7J195 | 0 | 3 | 10,75 | 10 | 170908 | ||

| KINB8O230 | 0 | 4 | 8,5 | 100 | 170908 | ||

| HMB7J230 | 0 | 3 | 0,85 | 10 | 170908 | ||

| SSABA7I42 | 0 | 3 | 0,45 | 513 | 170908 |

Den dagen när det är dags att sälja enligt modeller, skall det stå ”0” i kolumner för ”Aktuell Säljålder”

| Object | Current Purchase Age | Current Sales Age | % from Signal | Signal-sum | Last | Volyme | Date |

| OMXS307V1560 | 1 | 6,06 | -1 | 35 | 165 | 170908 | |

| OMXS307V1600 | 1 | 0 | -2 | 59,5 | 2 | 170908 | |

| HMB7U200 | 1 | -3,92 | -3 | 2,45 | 30 | 170908 | |

| OMXS308O1500 | 1 | -0,89 | -4 | 55,75 | 13 | 170908 | |

| OMXS307X1360 | 1 | -8,57 | -5 | 8 | 360 | 170908 | |

| SKFB7K170 | 1 | -15,56 | -3 | 1,9 | 22 | 170908 | |

| OMXS307U1600 | 1 | -2,25 | -3 | 54,25 | 5 | 170908 | |

| SKAB7J185 | 1 | 11,76 | -1 | 1,9 | 40 | 170908 | |

| VOLVB7J155 | 0 | -2 | 2 | 43 | 170908 | ||

| HMB7U225 | 0 | -7 | 24 | 10 | 170908 | ||

| HMB7I205 | 0 | -3 | 2,15 | 397 | 170908 | ||

| HMB7J205 | 0 | -3 | 6,25 | 10 | 170908 |

In Vikingen Option you also get with an option table according to Black &scholes, Here’s what it might look like:

(everything did not fit, that among more Greeks, implicit values, theoretical value, difference, etc…)

| Object | Diff | Diff (%) | Last | Volyme | Pass date | Time | Delta | Gamma |

| OMXS307I08Y1570 | -0,35 | -77,78 | 0,1 | 5 | 2017-09-08 | 2017-09-08 | ||

| OMXS307I1500 | 9 | 21,69 | 50,5 | 1 | 2017-09-15 | 2017-09-08 | 0,98 | 0 |

| OMXS307I1530 | 4,25 | 21,52 | 24 | 8 | 2017-09-15 | 2017-09-08 | ||

| OMXS307I1540 | -0,25 | -1,43 | 17,25 | 10 | 2017-09-15 | 2017-09-08 | 0,7 | 0,01 |

| OMXS307I1545 | -1,5 | -9,38 | 14,5 | 35 | 2017-09-15 | 2017-09-08 | 0,62 | 0,01 |

| OMXS307I1550 | -1 | -8 | 11,5 | 209 | 2017-09-15 | 2017-09-08 | ||

| OMXS307I1555 | -1 | -10 | 9 | 48 | 2017-09-15 | 2017-09-08 | 0,46 | 0,02 |

| OMXS307I1560 | -0,75 | -9,68 | 7 | 92 | 2017-09-15 | 2017-09-08 | 0,38 | 0,01 |

| OMXS307I1565 | 0,25 | 5,26 | 5 | 23 | 2017-09-15 | 2017-09-08 | 0,31 | 0,01 |

| OMXS307I1570 | -0,8 | -17,78 | 3,7 | 413 | 2017-09-15 | 2017-09-08 | ||

| OMXS307I1580 | -0,7 | -28,57 | 1,75 | 186 | 2017-09-15 | 2017-09-08 | 0,14 | 0,01 |

| OMXS307I1585 | -0,2 | -12,5 | 1,4 | 3 | 2017-09-15 | 2017-09-08 | 0,1 | 0,01 |

| OMXS307I1590 | -0,2 | -16,67 | 1 | 411 | 2017-09-15 | 2017-09-08 |