-

Pingback: Primer: Bitcoin, An Emerging Store of Value Asset | Aktiegruvan

Primer: Bitcoin, An Emerging Store of Value Asset

This research primer acts as a guide for investors to understand Bitcoin fundamentally. You will learn how the technology works, discover the current and future state of Bitcoin, the different ways to value the asset, and finally assess the various associated risks.

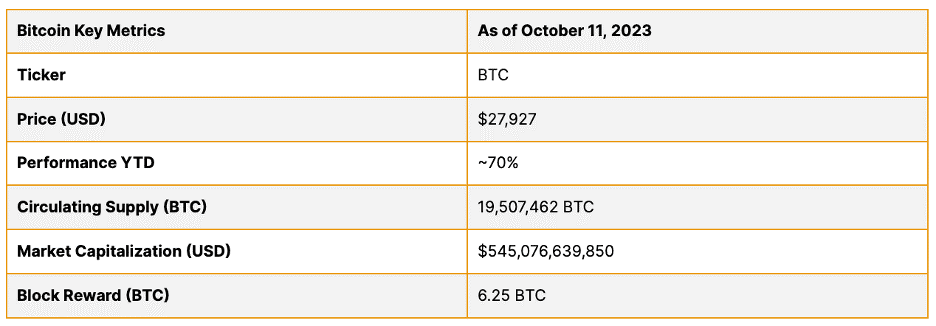

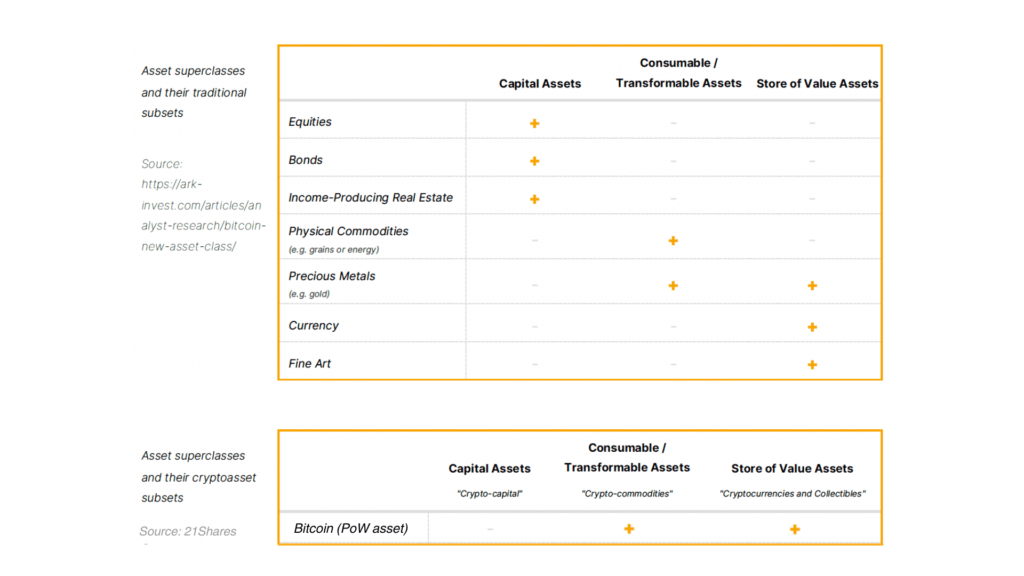

Bitcoin is an emerging store of value asset often called the world’s first “digital gold” and may provide a viable hedge against global economic instability. Over the last three years, Bitcoin surged by over 120%, making it one of the best-performing assets over the last decade. Currently, Bitcoin’s total market capitalization sits at over $540 billion. The rest of this report will also show that there is still a potential upside for Bitcoin and its technology in the foreseeable future. The first table (below) shows some of the current key metrics for Bitcoin, including its price, circulating supply (the number of BTC currently in existence), and market capitalization. The second table demonstrates where Bitcoin sits in the asset superclass amongst equities, commodities, real estate, and other asset classes.

Table 1: Bitcoin Key Metrics

Source: CoinGecko

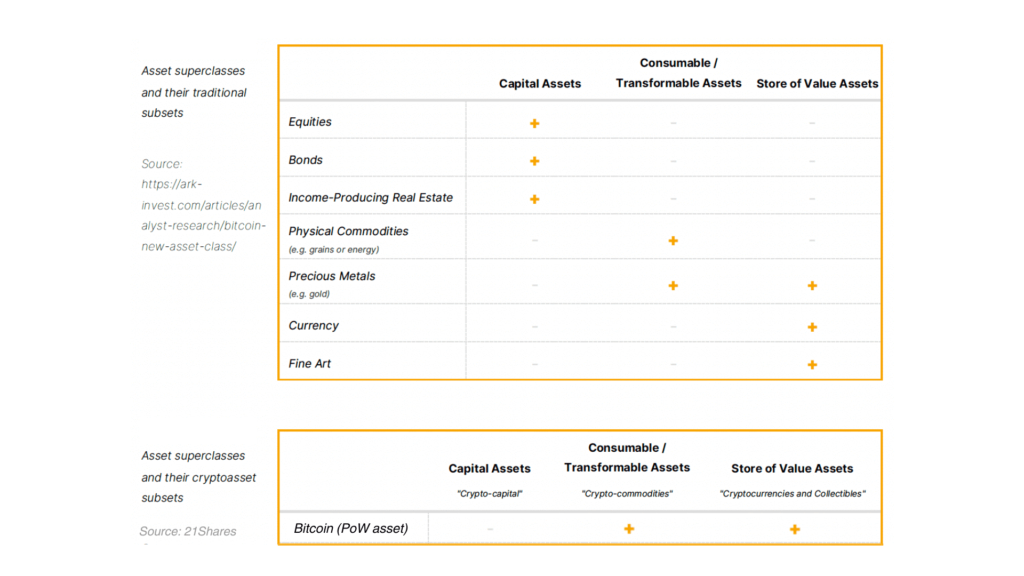

Figure 1: Asset Superclasses

Source: 21Shares

How Bitcoin Works

So you may be wondering: how exactly does Bitcoin work? The key innovation of Bitcoin is that it allows for peer-to-peer and decentralized transactions on the internet. This is facilitated by two inventions: the ledger or its blockchain acting as the asset’s balance sheet and its security and verification mechanism called Proof of Work mining.

The Bitcoin Blockchain

A blockchain is a data structure — in the same way an Excel sheet is a data structure — which holds a growing list of records, called blocks, which are linked to each other through the use of cryptography. Within a blockchain, each block is ordered in a sequence, and each contains encoded information about its predecessor (a hash), the date and time at which it was created, and data about the transactions included in it. Every transaction that has settled on the Bitcoin network is contained within a particular block of transactions.

Blockchains are helpful for storing sensitive data for which one needs strong assurance, such as security, safety, and integrity. Typically, blockchains are stored on a network of users across the internet who each keep a version of the Bitcoin blockchain. Once data has been recorded onto a blockchain, the block cannot be altered retroactively without changing all subsequent blocks – this is only possible if the majority of the network agrees.

Proof of Work Mining

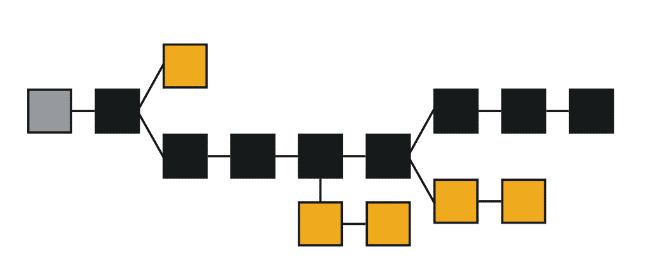

Proof of Work (PoW) mining is the process that allows new transactions and blocks to be added to the Bitcoin blockchain. It is also the method through which new Bitcoin enters the money supply. Proof of Work is similar in abstract to the process of gold mining. Stakeholders (called “miners”) use specialized supercomputers to process an algorithm that creates a piece of data called a proof of work. A proof of work is, by definition, difficult to solve and requires extensive computing power, capital investment, and energy to find. Once a miner finds a solution, it is very easy for others in the Bitcoin network to verify. The Bitcoin network is designed so miners only solve a proof of work on average every 10 minutes and are rewarded for their efforts through newly-issued Bitcoin, currently at an amount of 6.25 BTC per block or approximately $218,750. Bitcoin’s monetary policy has a limit of 21 million BTC. To reach this amount, every 4 years the new emission of Bitcoin happening each 10 minutes programmatically decreases by half, called the Halving. The use of mining makes it extremely hard for Bitcoin’s transactions to be manipulated, as a malicious actor would have to expend a large sum of capital and energy to do so. The diagram below (Fig. 2) shows an illustration of a blockchain where the black blocks represent the path of the blockchain that all miners and nodes in the Bitcoin network agree on. If miners or nodes disagree on a specific blockchain, it is discarded — as demonstrated by the yellow blocks.

Figure 2: A simplified illustration of a blockchain

Source: 21Shares

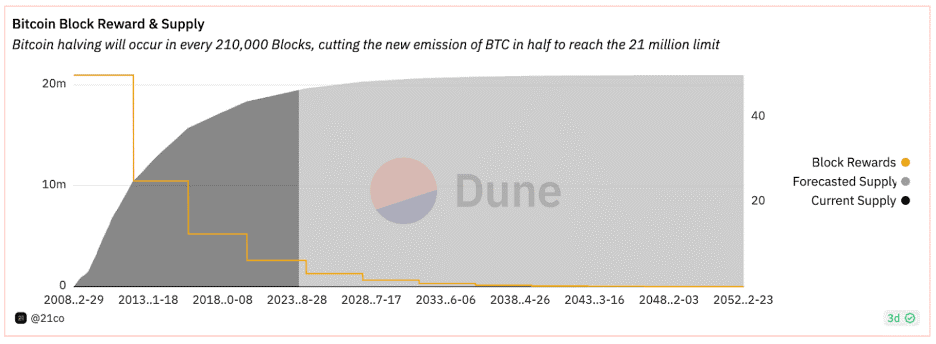

The State of Bitcoin

Since its launch on January 3, 2009, Bitcoin has grown into an asset with a market capitalization of over $540 billion and created an entire asset class, cryptoassets, with a cumulative market capitalization of over $1 trillion. We believe Bitcoin represents a paradigm shift in finance by being the peer-to-peer, decentralized asset class and history’s first digital gold. This claim is justified given that Bitcoin has a fixed and programmatic maximum supply of 21 million ending in 2140— making it an incredibly scarce asset. In recent years, Bitcoin has matured as an investment product and become increasingly institutionalized. The chart below shows how Bitcoin’s supply follows a predictable and trackable schedule as it reaches the 21 million limit. As mentioned, the current block reward amounts to 6.25 BTC, which will be reduced by 50% during Bitcoin’s upcoming halving, which will most likely take place at the end of Q1 or beginning of Q2 2024.

Aside from the adoption side, Bitcoin also has a thriving technological and developer community that will continue to expand the technical tools to interact with the Bitcoin network — making it easier, for example, to self-custody one’s assets, transact at a low cost, or understand Bitcoin’s blockchain data.

Figure 3: Bitcoin projected supply and monetary inflation

Source: 21.co (Parent company of 21Shares)

The Future of Bitcoin – Bitcoin as a tech investment

Part of the appeal of Bitcoin is its yet unrealized potential, whether it be technical developments that enable a deeper range of types of transactions and ways to improve transaction speeds or innovation in the blockchain infrastructure. Several interesting product developments within Bitcoin include the emergence of several promising scaling solutions (Layer 2s)): The Lightning Network — a protocol that exists on top of Bitcoin as a potential way to improve scalability; Rootstock and Stacks — smart contract platforms built on Bitcoin allowing more complex transactions; and Ordinals Inscriptions — similar to NFTs, a way to inscribe digital content on the Bitcoin blockchain.

In addition, Bitcoin is gearing up to rival Ethereum as a settlement platform for stablecoins and real-world assets, thanks to the Lightning Lab’s taproot upgrade. This enables developers to create and oversee a wider array of assets on Bitcoin, with over 2,000 tokens already minted on the testnet, demonstrating the demand for assets issued on the network while helping BTC to serve as a medium of exchange. Additionally, experimental initiatives such as Bitcoin VM and Bitcoin Spiderchains are in the works, aiming to expand on Bitcoin’s capabilities by offering scaling solutions that don’t require modifying the Bitcoin base code itself. Their impact, however, remains uncertain, given their early developmental stages.

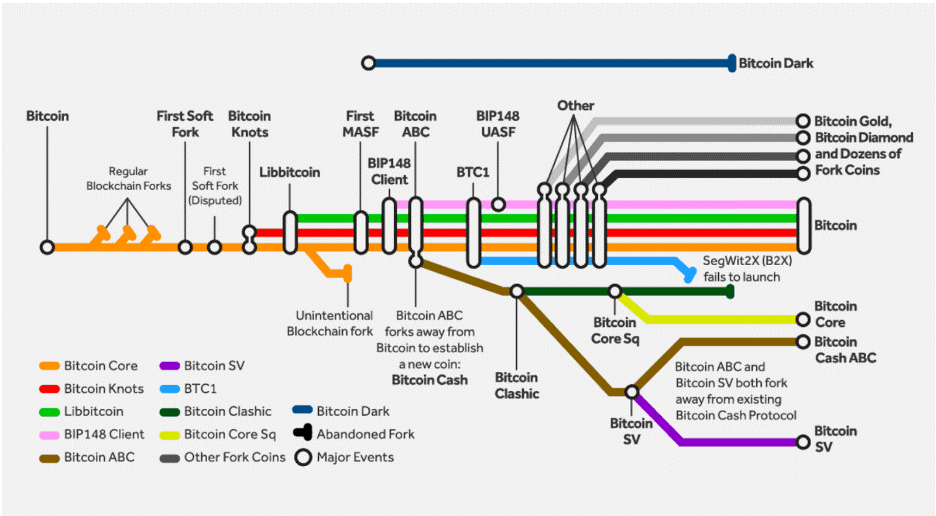

In addition, Bitcoin has played a crucial role in the formation of a range of other cryptoassets — known as “forks” — which either have been inspired by Bitcoin’s technical infrastructure (see Fig. 4) or have borrowed heavily from the software that makes Bitcoin work. This allows for innovation from Bitcoin to spread to the rest of the industry and is a key factor behind the cryptoasset industry’s high level of innovation.

Figure 4: History of Bitcoin forks

Source: Bitcoin Magazine

Valuing Bitcoin

Figure 5: Asset Superclasses

Source: 21Shares

As mentioned previously, Bitcoin relies on a computationally and energy-intensive lottery called mining to verify, settle transactions, and secure the network. The native asset of a PoW network like Bitcoin is not one of the inputs of production but the mere output of it. Hence, we refer to PoW cryptoassets as “crypto-commodities.” In addition, due to its programmed scarcity, Bitcoin has consolidated as an emerging store-of-value asset. Thus, similar to gold, Bitcoin is both a consumable and store-of-value asset in the asset superclass classification.

Market Sizing

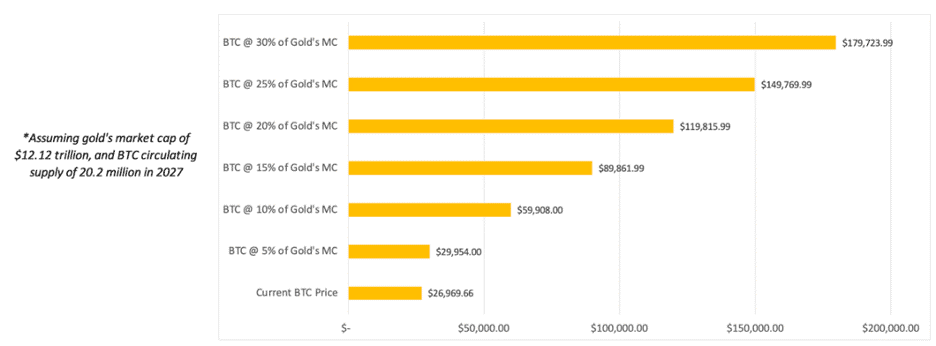

Bitcoin’s primary value proposition comes from its ability to act as a Store of Value. Therefore, the most accurate way to understand Bitcoin’s potential value in the long term is by doing a market sizing analysis. Thus, we can utilize a simple market sizing approach to estimate a target price. The methodology involves establishing a Total Addressable Market (TAM) and a percent share the asset in question could take — Market Penetration. For instance, an investor could price Bitcoin by setting a proportion it could capture of the market value of gold, the seminal store-of-value asset.

As of September 30, the price of BTC is $26,970, with an implied circulating market cap of ~$526 billion. On the other hand, the market cap of gold sits at around $12.12 trillion. Thus, we can use the market sizing methodology described above to estimate the hypothetical price of BTC if it were to capture a given percent share of gold’s market cap. For instance, Figure 4 shows that if BTC were to capture 10%, it would be priced at $59,908. In the most optimistic scenario contemplated, if BTC penetrates 30% of gold’s market cap, the price of one BTC would be $179,724.

Figure 6: BTC market sizing analysis

Source: 21Shares, Data as of September 30, 2023

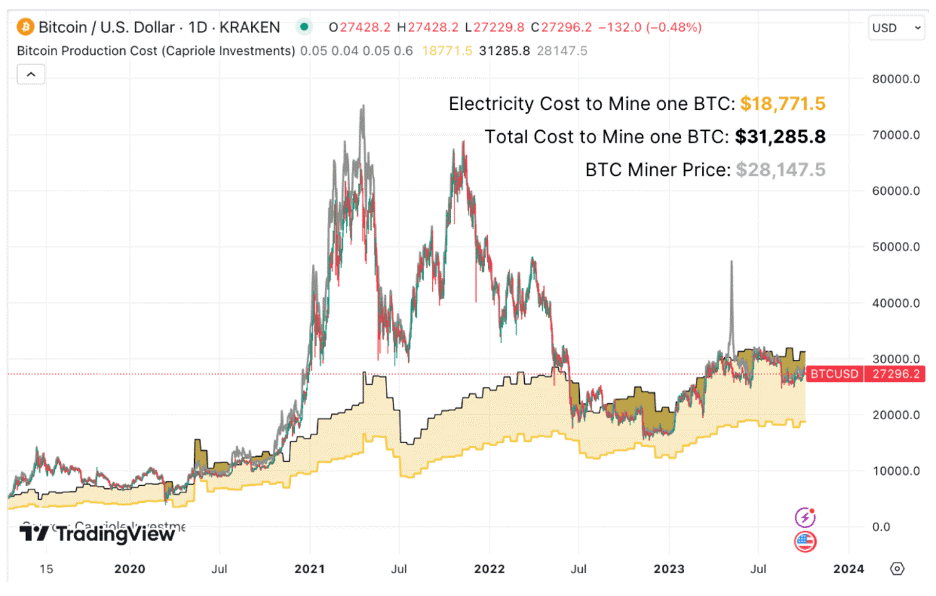

Cost of Production (Bitcoin’s intrinsic value)

When it comes to crypto-commodities, the marginal cost of production is vital as it sets the price floor at which producers (miners) are willing to sell. From the outset, it is crucial to emphasize that we are not suggesting that the price of BTC should be determined by its marginal cost of production. To do so would be to adopt a labor theory of value, which is ostensibly false. Instead, the marginal cost of production is a tool that can help investors estimate a lower bound price level for BTC and other crypto-commodities.

In 2019, Charles Edwards proposed a methodology to estimate the global average US dollar cost of producing one BTC. The first component of the method is the Cambridge Bitcoin Electricity Consumption Index (CBECI), which provides an up-to-date estimate of the Bitcoin network’s daily electricity load. Edwards estimates the cost of production per BTC by:

- Calculating the number of BTC Mined Per Day (based on miner rewards)

- Calculating the daily electricity cost to mine one BTC (Daily Electrical Cost)

- Estimating the global average “Elec-to-Total Cost Ratio” = (Bitcoin Electrical Cost) / (Daily Cost of running a Bitcoin Mining Business)

An investor can then compute Bitcoin Production Cost as (Daily Electrical Cost) / (Elec-to-Total Cost Ratio). Finally, the Bitcoin Production Cost is compared to the “Bitcoin Miner Price,” which attempts to capture the revenue one BTC provides to miners. Bitcoin Miner Price is calculated as follows: BTC Price + (Daily Transaction Fees) / (Daily BTC mined). When the BTC price is below the total cost of mining one BTC, it signals that Bitcoin miners may be struggling and potentially taking short-term losses.

Figure 7: Bitcoin mining cost of production

Source: 21Shares, data as of September 30, 2023.

As of September 30, 2023, the estimated global average electricity cost to mine one BTC is $18,771.5, while the estimated global average total cost to mine one BTC is $31,285.8. To reiterate, investors shouldn’t interpret this range as the fundamental value of Bitcoin, which is subjective, but rather as an estimate of its price floor based on miner profitability and subsequent behavior patterns.

If you’re interested in delving deeper into the world of Bitcoin within a portfolio context and exploring optimal portfolio allocation strategies, we invite you to explore the latest iteration of our comprehensive Portfolio Allocation Primer: Link

Risks

Economic Risk

Bitcoin halvings and reduced block rewards can be considered a double-edged sword. While it usually creates a supply shock leading to new all-time highs post-halving, it also is one of the most significant risks to Bitcoin’s long-term success. Bitcoin miners generate revenue through transaction fees and newly-issued Bitcoin (i.e., the block reward). However, as this block reward decreases over time, miners will be compensated only via transaction fees eventually. Some research shows potential issues with a regime in which block rewards for miners are continually halved. For example, the amount miners receive in transaction fees alone may not be enough, or variability in transaction fees could lead to perverse incentives for miners, such as an increased probability of attempts to reverse transactions through “51% attacks.” Both scenarios could harm Bitcoin’s economic security. However, new innovations emerging on top of Bitcoin, as discussed in this paper, could potentially create sustainable incentives for miners and ensure the longevity of the network’s security. In conclusion, Bitcoin’s block reward halving is a long-term threat to the network’s security, although there are several viable ways to solve the problem going forward.

Environmental Risk

Proof of Work mining is an extremely energy-intensive process that can require miners to be willing to pay up to the current price of Bitcoin in marginal costs to mine a single Bitcoin. The University of Cambridge Centre for Alternative Finance estimates that Bitcoin currently consumes 55.33 Terawatt Hours of energy per year and will only increase as the network continues to grow. We agree that the energy consumption of the Bitcoin network is likely to continue to increase as the mining industry continues to professionalize and as the popularity of the Bitcoin network increases. It is unknown precisely what the energy mix of Bitcoin mining is. Still, one can assume that at least some amount of Bitcoin mining is powered by non-renewable energy sources — meaning that Bitcoin mining may contribute to exacerbating current issues associated with the climate crisis. While it is difficult to verify such numbers, there is no doubt that a large amount of Bitcoin mining is powered by renewable energy. Despite this fact, the mainstream perception is that Bitcoin mining is an unnecessarily energy-intensive process. As policy action around the climate crisis intensifies, there remains the possibility that there could be a regulatory crackdown on Bitcoin predicated on a pro-climate agenda. Researchers in the industry can mitigate the risks of such a scenario by making a concerted effort to prove that Bitcoin mining relies heavily on renewable energy and find ways to reduce its reliance on fossil fuels. Moreover, miners must exercise strategic discernment when selecting their operational bases, considering factors such as operational expenses (including electricity and rent) and geographical vulnerability to environmental hazards like hurricanes and power outages.

Geopolitical Risk

Different countries have adopted various stances toward Bitcoin and cryptoassets. Some have embraced them, while others have imposed strict regulations or outright bans. The best example would be China’s ban on crypto mining in 2021. Even though miners migrated abroad, this regulatory uncertainty can create challenges for individuals and businesses involved in the Bitcoin ecosystem, leading to legal and compliance risks. Additionally, Bitcoin’s global nature makes it sensitive to geopolitical tensions and conflicts. Governments may view Bitcoin as a way to circumvent economic sanctions or capital controls, leading to further regulatory crackdowns and attempts to control its use.

Technology Risk

Bitcoin, like any technology, is not immune to vulnerabilities. For example, as technological progress marches forward, there’s a growing concern about the potential risks posed by quantum computing. Quantum computers, if developed sufficiently, could pose a fundamental threat to Bitcoin’s cryptographic security. This risk requires ongoing research and the development of quantum-resistant cryptographic algorithms. Moreover, as any computer code they are susceptible to potential bugs.

A prime illustration of this is CVE-2018-17144, a code vulnerability that was discovered in 2018, that had the potential to permit an attacker to double-spend bitcoins. Although this bug was never exploited on the Bitcoin mainnet, and a substantial majority of full nodes promptly upgraded to Bitcoin Core versions unaffected by it, it underscores the importance of acknowledging and addressing such risks. Furthermore, in October 2023, the Bitcoin Lightning Network encountered a novel vulnerability, which could potentially empower an attacker to steal funds from Lightning Network channels by exploiting Hash Time Lock Contracts. These contracts serve as a crucial foundation facilitating payment exchanges between counterparties without necessitating trust. Subsequently, a series of interim patches has been introduced to rectify this issue.

To mitigate these technological risks, the Bitcoin community relies on continuous development, peer review of code changes, and a commitment to maintaining the network’s decentralization and security. Participants in the Bitcoin ecosystem, including miners, developers, and users, must stay informed and adapt to evolving technological challenges to ensure the network’s robustness and resilience.

Disclaimer

All content provided by 21Shares is intended for informational and educational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Investments associated with crypto assets, such as cryptocurrencies and crypto tokens, involve risk. These assets are considered highly speculative due to their limited history and new technological nature. Future regulatory actions may impact the usability and tradability of crypto assets. The price of crypto assets can be influenced by a small number of holders and may decline in popularity or acceptance, affecting their value.

For full disclosures, please visit our Disclaimers and Terms & Conditions pages.