This week’s Analysis – A global Electric Car Company!

Aksjeanalyser.com has taken a closer look at Tesla Inc!

(ticker on Nasdaq: TSLA)

The Tesla share has shown a very weak development since its peak at USD 488.54 on December 18, 2024.

The share ended yesterday, Tuesday April 22nd, 2025, at USD 237.97, but then rose in after-hours trading by 6.33% to USD 253.04. Tesla Inc. released its Q1 2025 results yesterday after the stock exchange closed.

The technical picture for the stock now indicates that the Tesla stock may be at a favorable level to buy at now around the current price level. Read more about this below under the technical analysis of Tesla Inc (ticker on Nasdaq: TSLA).

About the company Tesla Inc

Tesla, Inc. designs, develops, manufactures, sells, and leases high-performance all-electric vehicles and energy generation and storage systems, and provides services related to its products. Its segments include automotive and energy generation and storage.

The automotive segment includes the design, development, manufacture, sale and leasing of high-performance all-electric vehicles, and the sale of regulatory credits for the automotive industry. It also includes sales of used vehicles, maintenance services and collisions without warranty, parts sales, paid supercharging, revenues from insurance services and sales of goods at retail.

The energy generation and storage segment includes the design, manufacture, installation, sale and leasing of solar power generation and energy storage products and related services and the sale of solar power system incentives. The consumer vehicles include Model 3, Y, S, X and Cybertruck. Lithium-ion battery energy storage products include Powerwall and Megapack.

For more information about the company, visit their website here

Technical Analysis of Tesla Inc

Technical Analysis of Tesla Inc

(ticker on Nasdaq: TSLA)

Tesla shares have fallen sharply from a peak around USD 488.00 on December 18, 2024 and to a low around USD 214.00 on April 07, 2025. The stock seems to find solid technical support towards the USD 200.00 – 220.00 level, and the stock is also at the support level at the lower trend line in a long-term rising trend.

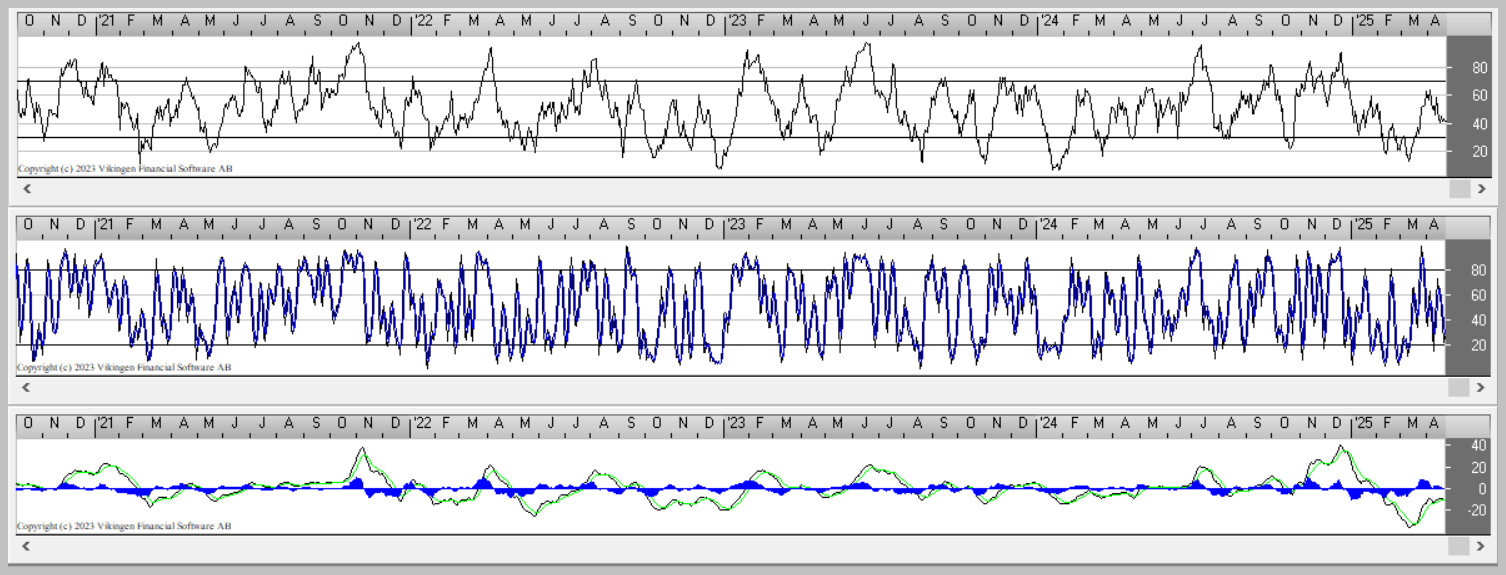

Various momentum indicators such as RSI, Stochastics and MACD signal that the stock may be about to turn upwards in the short term. The overall technical picture for the stock indicates that a test of the resistance level up to the 50-day and 200-day moving averages is likely in the short term. These are currently around USD 270.00 and USD 292.00 respectively.

Various momentum indicators such as RSI, Stochastics and MACD signal that the stock may be about to turn upwards in the short term. The overall technical picture for the stock indicates that a test of the resistance level up to the 50-day and 200-day moving averages is likely in the short term. These are currently around USD 270.00 and USD 292.00 respectively.

An established break above the USD 300.00 level would trigger a strong technical buy signal for the Tesla share.

Based on the overall technical picture that the Tesla share is showing, Aksjeanalyser.com considers the share to be an exciting and interesting stock to buy around the current price level. As mentioned, Tesla delivered its results for Q1 2025 yesterday after the stock exchange had closed, and the stock rose just over six percent in after-hours trading to just over USD 250.00.

But let us hope Elon Musk stops all this nonsense with DOGE, and gets all the focus back on Tesla Inc!

Vikingen Top 10 buy signals!

Have you already taken a look at this week’s Top 10 buy signals? If you haven’t, here are the signals for week 17. Welcome!

And here you can watch free trainings (in Swedish) about Vikingen Mini, Börs, Trading and Vikingen Maxi programs.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours