Satellite company in this week’s analysis!

Aksjeanalyser.com has taken a closer look at an exciting company on First North!

GomSpace Group

(ticker on First North Sweden: GOMX)

GomSpace develops and manufactures micro and nano satellites, satellite components and turnkey solutions for satellite programs for customers in the science, academic, government and commercial sectors. For more information about the company visit their website here.

The GomSpace share more than doubled last week, and today gets a correction down. Aksjeanalyser.com thinks the GomSpace share could be a good buy candidate here around the SEK 6.00 – 6.50 level (the share was highest on Friday 07/03-2025 at SEK 8.98, and is trading today, Monday morning 10/03-2025 around SEK 6.40).

It’s only natural that the share price should take a downward correction after more than doubling last week. It was also reported today that the chairman of the board has sold around 300,000 shares, but still holds around 1.75 million shares in the company directly and indirectly.

Board member in Gomspace sells shares

“A board member of Gomspace sells shares for SEK 2.4 million, news today 10/3 at 10:14 ∙ Finwire Smallcap”.

“Henrik Kølle, board member of GomSpace, sold approximately 300,000 shares out of a total of approximately 2,050,000 shares on March 6-7th. The total sales value amounts to SEK 2,376,211 with an average price of SEK 7.63 per share. This is stated in the Swedish Financial Supervisory Authority’s transparency register.

Kølle had a direct holding of approximately 0.75 million shares and an indirect holding of almost 1.20 million shares through a holding company, according to Gomspace’s website”.

Equipment for the defense industry

GomSpace supplies, among other things, equipment to the defense industry, and shares in this sector are naturally seeing a strong development these days, and now that Europe is going to be very heavily upgraded in defense. In Norway, for example, Kongsberg Gruppen (KOG) and Kitron (KIT) have shown very strong growth recently.

Read more about GomSpace, its products and services within ‘Defense and Security’ here.

Find out more about all GomSpace products and services

Briefly about GomSpace Group

Technical Analysis of GomSpace Group

(ticker on First North Sweden: GOMX)

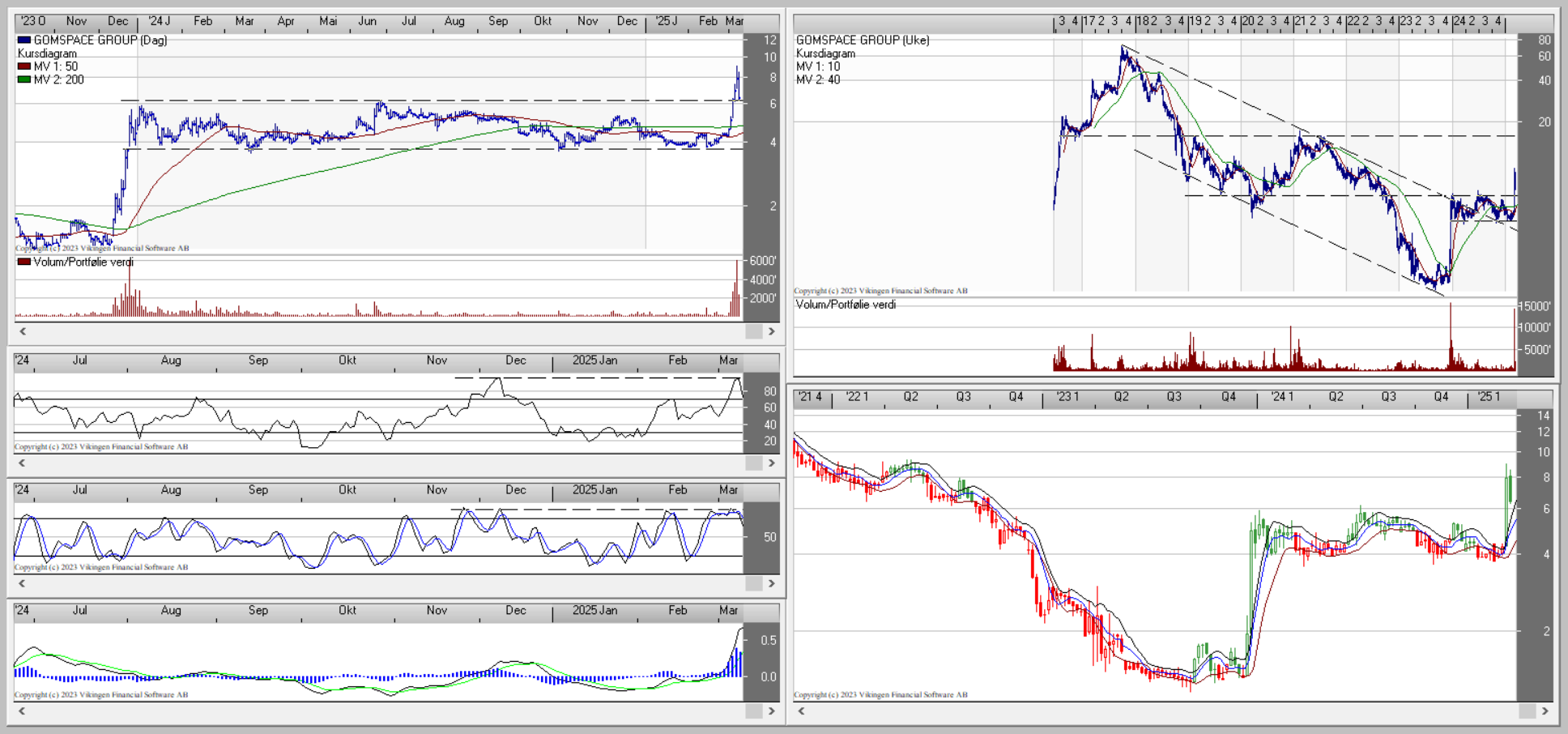

The GomSpace share broke out of a long-term falling trend at the beginning of 2024 (cf. weekly chart), and since then the share has consolidated within a large rectangle consolidation formation, between a technical support level around SEK 3.70 and a resistance level around SEK 6.00.

The GomSpace share broke out of a long-term falling trend at the beginning of 2024 (cf. weekly chart), and since then the share has consolidated within a large rectangle consolidation formation, between a technical support level around SEK 3.70 and a resistance level around SEK 6.00.

Then the share rose sharply and doubled last week from around SEK 4.25 to a high of SEK 8.98 on Friday.

The stock then triggered a strong technical buy signal last week when it broke up from this one-year long consolidation formation, and above the important technical resistance level around SEK 6.00.

Naturally, after doubling in a week, the stock is subject to a downward correction, and it is natural to hedge some of the gains after such a sharp rise.

There should now be significant technical support for the stock around the SEK 6.00 level, and Aksjeanalyser.com thinks the stock seems like a very interesting buy candidate now at this correction down and to the range SEK 6.00 – 6.50.

The overall technical picture for the GomSpace share signals further upside for the share, and Aksjeanalyser.com considers the potential to be up to SEK 15.00 in 3-6 months’ time. The share was highest at the end of 2017 and around the SEK 60.00 level (see weekly chart).

BEST – the model in Vikingen also signals purchase for GomSpace!

The BEST model in Vikingen is also in buy signal now for the GomSpace stock. This popular and effective technical analysis model was developed by Peter Östevik. He finalized the the BEST model around 2019, and after 30 years of experience with technical analysis and Vikingen Financial Software.

What could potentially change the positive technical picture for the share would be if it were to break down below, and establish itself below, what should now be a solid technical support level for the share around the SEK 6.00 level.

That’s the Analysis of the Week for week 11. Don’t forget to follow us on FB, Linkedin and X so you don’t miss anything.

Here you can watch free trainings (in Swedish) about Vikingen Mini, Börs,Trading and Vikingen Maxi programs.

And here you will find Vikingens four basic programs so you can keep track of your favorite stocks around the world. You can find all Vikingens add-ons here.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Sincerely yours