Aksjeanalyser.com reviews an exciting biotech company!

Aksjeanalyser.com looks at the interesting Norwegian company: Lytix Biopharma ASA

(ticker on Oslo Stock Exchange: LYTIX).

Both Aksjeanalyser.com and the Swedish firm Redeye.se see potential for a doubling and maybe even tripling of the stock price.

Briefly about Lytix Biopharma ASA

(ticker on Oslo Stock Exchange: LYTIX)

Lytix Biopharma is a clinical-stage biotechnology company developing cancer immunotherapies. The company’s technology is based on research in antimicrobial peptides, a defense against pathogens. Lytix Biopharma’s lead product, LTX-315, is an oncolytic peptide with the purpose of personalizing immunotherapy. The company conducts its research and operations in Oslo.

Lytix Biopharma is working with a new technology platform that uses host defense peptide-derived molecules to kill cancer cells and trigger the immune system. The molecules can work in many different cancer indications and treatment settings, both as mono- and combination therapy. Lytix Biopharma’s molecules overcome this challenge by killing the cancer cells, including resistant cells, and exposing their internal components to the immune system. This results in uptake of tumor antigens and activation of tumor antigen-presenting cells, thereby creating a strong, broad and long-lasting systemic T-cell response that overcomes tumor heterogeneity.

“With the potential to overcome major challenges in cancer treatment, we aim to improve outcomes for cancer patients. The majority of cancer patients do not respond to immunotherapy, due to differences between cancer cells in a tumor (heterogeneity) and the lack of a broad and tumor-specific immune response.”

The company was listed on Euronext Growth in Oslo in June 2021 (Euronext Growth Oslo: LYTIX). For more information about the company, visit their website here.

Technical Analysis of Lytix Biopharma ASA

Technical Analysis of Lytix Biopharma ASA

(ticker on Oslo Børs: LYTIX)

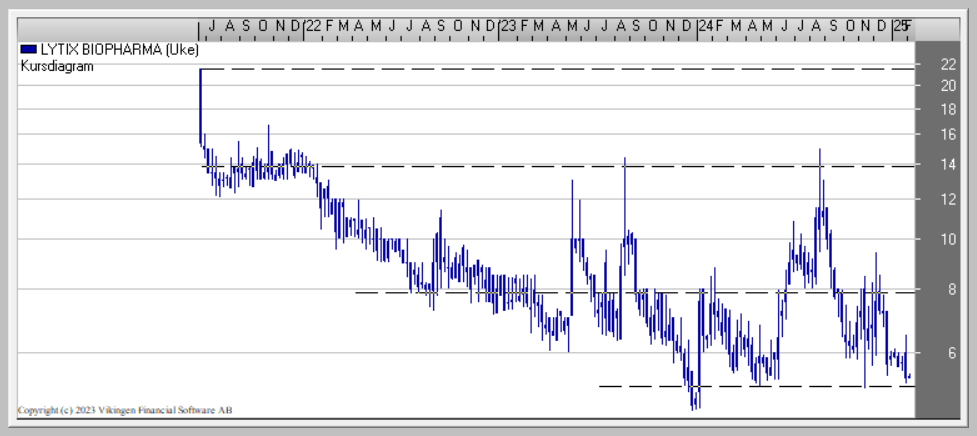

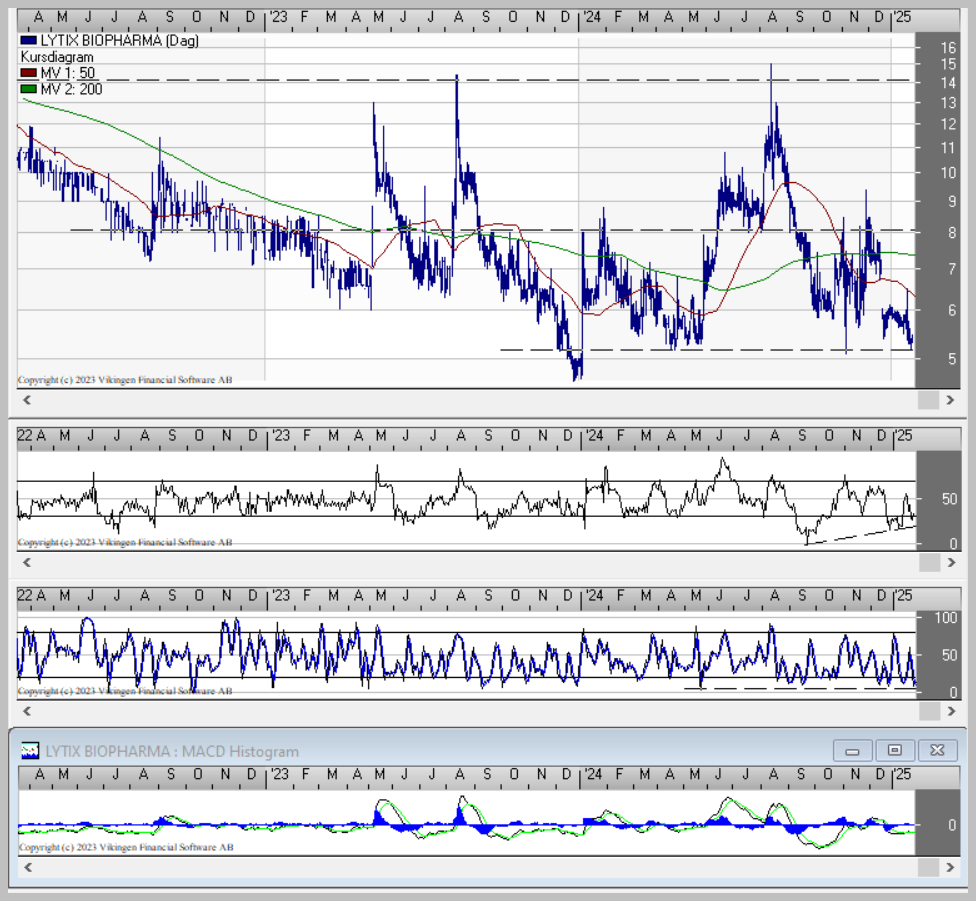

The Lytix share was launched on the stock exchange on June 14, 2021 at a price of around NOK 21.50. As is often the case with biotech companies, the share has shown a weak and volatile development in recent years. Now there are indications that the share may be at a very favorable buying level. This is the view of both Aksjeanalyser.com and the Swedish research firm Redeye.se (who has a Base case price target for LYTIX at NOK 14.00 and a Bull case price target for the share at NOK 22.00).

The Lytix share is now around the all-time low, at the current price level, and is also heavily oversold according to various momentum indicators such as RSI and Stochastics. The MACD momentum indicator has also triggered a buy signal for Lytix, and it is also worth noting a positive divergence in the RSI chart compared to the price chart.

Reversal for Lytix might be near!

Reversal for Lytix might be near!

Such positive divergences between the development of the momentum indicator RSI and the price chart often give very good signals that an upward turn for the stock is imminent. Based on the overall technical picture that the Lytix share now shows, Aksjeanalyser.com considers the share to be a very interesting and exciting buy candidate around the current price level.

Aksjeanalyser.com sees a short-term potential for the share at around NOK 8.00 (1-3 months), and at around NOK 12.00-14.00 in 3-6 months, and then up to around NOK 20.00-22.00 in 12 months. Finally, it should be mentioned that the undersigned, Bjørn Inge Pettersen, owns shares in Lytix Biopharma ASA (ticker on the Oslo Stock Exchange: LYTIX), and with an entry price around the current price level.

Redeye also sees potential for Lytix!

Aksjeanalyser.com is not alone in seeing great potential for the LYTIX share. Swedish Redeye.se also sees opportunities for a multiple increase for the share and has a Base case price target for the share at NOK 14.00 and a Bull case price target for the share at NOK 22.00. Read more here!

You find more news about Lytix via the links below:

Lytix: CEO Øystein Rekdal presents at Redeye Fight Cancer Event – January 22nd, 2025

Lytix Biopharma: Directed Share Issue Sign of Strength

Redeye comments on the successful directed share issue of NOK100m and EUR1m primary bid offering. Here is an excerpt from Redeye.se’s comment in connection with the issue: “On 16-17 December, Lytix carried out a combined directed share issue and primary bid offering bringing in NOK100m and EUR1m before transaction costs at a subscription price of NOK 6. This is a rather moderate discount to the previous day’s closing of NOK 7. The number of shares increases from 50m to 68m.

The main subscriber in the directed issue is Saturn Invest AS with NOK 20m, followed by Jakob Hatteland Holding AS and TAJ Holding AS, both with NOK 10m. We had assumed less money would be raised (NOK50m) with more discount. We think the ability to raise NOK 100m plus an additional EUR1m in the current tough market for biotech is a sign of strength, certainly supported by Verrica’s excellent phase II results with LTX-315 in basal cell carcinoma now heading towards a phase III program. Lytix already had NOK44m in cash as of Q3, so this capital will fund Lytix for a significant time ahead (into H2 2026 with current spending and longer with less spending).

A phase I study of LTX-401 is possible with the new funds. The cash injection de-risks the share in the medium term, so now is probably a good entry point for any presumptive investors.”

LYTIX shares are currently trading at around NOK 5.46, valuing the company at around NOK 365 million. Considering what Lytix is currently priced at around NOK 365 million, it is worth noting that in its global license agreement with Verrica Pharmaceuticals Inc (VERRICA), Lytix can receive total payments of more than USD 110 million and upon achievement of certain clinical, regulatory and sales milestones. More information.

Below you find news about the company, Lytix Biopharma ASA (LYTIX) recently published

LYTIX: RESULTS STRENGTHEN POTENTIAL OF LTX-315 22 Jan. 08:27 ∙ TDN Finance Oslo (Infront TDN Direkt): Lytix Biopharma’s license partner, Verrica Pharmaceuticals, has presented clinical data on Lytix’s drug candidate LTX-315 at the 2025 Winter Clinical Dermatology Conference, held January 17-19 in Miami, Florida. The results support a potential shift in the treatment paradigm for patients with basal cell carcinoma.

“We are very pleased with Verrica’s presentation of the LTX-315 data at the Winter Clinical Dermatology Conference. These positive results reinforce the potential of LTX-315 to transform the treatment paradigm for basal cell carcinoma and underscore the strength of our oncolytic peptide technology,” said Øystein Rekdal, CEO of Lytix Biopharma.

Verrica Pharmaceuticals Announces Presentation of Three Posters Featuring Positive Preliminary Topline Results of VP-315 for the Treatment of Basal Cell Carcinoma at the 2025 Winter Clinical Dermatology Conference.

To refresh your knowledge about Vikingen and technical analysis you are welcome to watch these training videos for free (only in Swedish) Vikingen Mini, Börs,Trading and Vikingen Maxi programs.

This video was recorded with Peter Östevik on 19/11 2024 when he provided many valuable tips and insights on how to invest successfully and how to best use Vikingens Models.

Vikingen Financial Software reminds you that past positive results do not always indicate future profits and that all trading is at your own risk.

Yours sincerely